There’s an old joke about a pastor who is awakened at 3 o’clock in the morning. On the phone is one of his flock. He tells the pastor that he can’t sleep. The pastor responds that he understands his concern, but it’s 3 AM and he’s not sure what he can do to resolve the problem. The man on the phone responds: I’ve done everything else that I could think of to make me sleep and nothing works. Is it possible for you to preach to me for a few minutes?

The two topics discussed today could have the same affect on readers. I also have a warning and disclaimer: this post will include formulas and I am not responsible for anyone falling asleep. But, don’t quit reading yet because this is not going to be a geeky discussion based on formulas.

Why even talk about this?

If you keep reading you will find out that these two concepts affect everyone, with that effect being more common than expected. But more importantly, knowing and understanding Opportunity Cost and the Time Value of Money will make a huge difference in how you approach future opportunities, both financial and non-financial.

Opportunity Cost and Time Value of Money are two separate but connected ideas. View them like two siblings who are closely related but have individual personalities.

According to Investopedia:

Opportunity Cost represents the potential benefit that an individual, investor, or business misses out on when choosing one alternative over another. Because opportunity costs are unseen by definition, they can be easily overlooked. Understanding the potential missed opportunities when a business or individual chooses one investment over another allows for better decision making.

Here comes formula number one:

Opportunity Cost = return on best foregone option (FO) – return on chosen option (CO)

Business Opportunity Costs represent the comparative cost between two options. The classic example concerns a company that makes a business decision to build a facility that will generate a 4% return for the company versus a second unused option to build in a different location that would generate a 7% return. In this example the opportunity cost would be 3% when choosing the first option instead of the second. Opportunity Cost is the benefit or profit lost by the the choice of one option over a second option that would have been better or more profitable.

Personal Opportunity Costs present the same types of choices on a personal level. An example would be someone who buys a new car, but could have saved 10% buying a used car. The Opportunity Cost here is 10%. A similar example would be someone who finances that new car through a dealership with an 8% interest loan, but could have used bank financing and secured a 5% interest loan. Here the Opportunity Cost is 3%.

Opportunity Cost is represented by the potential returns not earned in the future on an investment because the capital was invested elsewhere.

Is Opportunity Cost the same as Risk?

Opportunity Cost differs from risk because risk compares the actual performance of an investment against the projected performance of the same investment, while opportunity cost compares the actual performance of an investment against the actual performance of another investment.

Why is understanding Opportunity Cost valuable on a personal level?

Understanding Opportunity Cost leads to better and more profitable personal decisions. In the previous example of an auto sale or automobile financing the understanding of Opportunity Cost, and better evaluation of available options, could generate hundreds or thousands of dollars in savings. These are real dollars that would flow into your pocket because you’ve educated yourself and are making better decisions. (Knowledge is power, and in this case knowledge translates into more dollars in your pocket.)

For a moment let’s shift our attention to Opportunity Cost’s sibling called Time Value of Money.

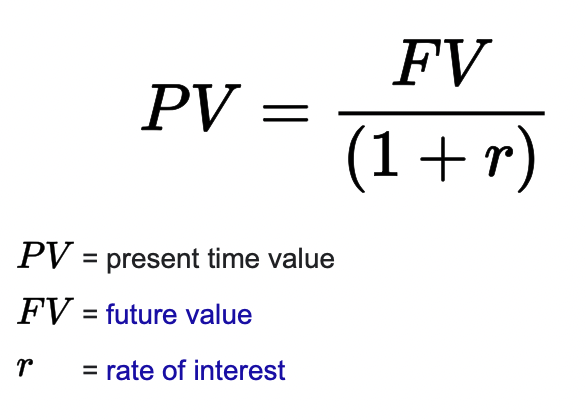

Warning! Here comes formula number two:

According to Investopedia:

The Time Value of Money is a financial principle that states the value of a dollar today is worth more than the value of a dollar in the future. This philosophy holds true because money today can be invested and potentially grow into a larger amount in the future. (When a discussion begins using terms like present value, future value, and number of investing periods most people’s eyes glaze over. Examples of Time Value calculations normally use questions such as: Would you rather receive $10 today or $15 dollars in one year?)

The calculation to derive the correct answer using the formula above is not difficult, but it requires estimates of interest rate and number of investment periods. So there is at least a moderate amount of finesse in doing calculations.

So let’s think about Time Value of Money in a different way. First of all, given a choice it is always better to receive the same amount of money now versus some future date. Time and inflation erode the value of money. One dollar received now will buy more than one dollar received in five years. (In mathematical terms the dollar received now has a greater Present Value than the future dollar.) This is because one dollar received now can be invested and will have a greater value than the same dollar received five years from now. Using the formula above will also give the value at a future point of money invested now. But it’s important to remember that money received now is worth more than an equal amount of money received in the future.

Why is understanding the Time Value of Money important on a personal level?

When money is received by working, gift, inheritance, or winning the lottery the recipient has two choices: spend money now or spend it later. (Someone who understands Time Value of Money knows that money invested grows, compounds, and creates wealth.)

Bringing the two siblings (Opportunity Cost and Time Value of Money) back together we can now understand how their union can be harmful or beneficial. Looking at our examples with a better understanding shows that skillfully using this knowledge can create opportunities for wealth building.

In the first example, by purchasing a less expensive car a person foregoes the Opportunity Cost of the newer or more expensive auto. This means that the person now has a car and also has extra cash!

In a society where consumer spending is rampant and keeping up with the Joneses is common, it’s hard to forgo the Opportunity Cost. Most people want a big luxury car and a big house with a pool. Most people also want nice clothes and multiple opportunities to travel. For most consumers the focus is not on Opportunity Cost or saving.

If you read my blog titled: QUITTING WORK- WHAT’S YOUR NUMBER ?you will find that most Americans don’t know how much they need to retire, and those Americans that have some savings are woefully lacking in retirement funds.

So, understanding Opportunity Cost provides the opportunity to free up present dollars. It’s hard to give up present luxuries, but it’s not impossible. Buying at a discount, purchasing sale items, promotions, vouchers, or buying used are all ways to avoid Opportunity Cost and free up money that would otherwise have been spent.

Using knowledge gained by understanding Time Value of Money we can take these extra dollars and invest them to create future wealth. A dollar spent today is gone forever and has no power to grow and create future wealth. Saving and investing these extra dollars creates the foundation for future wealth.

It’s not easy to do! I’ve seen many professional friends graduate from Medical, Dental, and Law schools and immediately purchase big cars and big houses, setting themselves up for a lifetime of debt and diminished chances of financial independence. Most of these professionals eventually generate above average incomes, but can’t seem to find dollars to invest. The dollars they spend today are dollars that are unavailable for investing and future wealth creation.

Many would argue that since dollars are worth more today and inflation will erode future purchasing power, why not spend the dollars today at their greatest value? Since both of those facts are true, it is a valid argument. But, spending dollars today means that no dollars are available to invest for the future. Dollars invested over time will overcome the effects of inflation, and will benefit from the effects of compounding. (Investopedia states that Compounding is the process in which an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment will generate earnings from both its initial principal and the accumulated earnings from preceding periods.) It’s the process where both the money you invest and the money you earn grow exponentially over longer periods. Compound growth is a very powerful weapon in the fight for financial independence.

Time Value of Money and Opportunity Cost can be your best friends, or your worst enemies. You get to decide!

In a recent article the author stated that when you are in debt you must go out every day and work for the dollars you need for food, clothing, housing, and debt service. In the same article the author stated that when you have money invested that these invested dollars go to work each day making more dollars for you. It’s your choice to work for your dollars each day, or to have your dollars work for you!

So, if you’re still awake you are now aware that there are ways to generate dollars though intelligent use of Opportunity Cost, and that these dollars can then be invested and benefit from Time Value of Money principles.

Small amounts of money invested periodically over long periods of time have the potential to create great wealth and financial independence. Conspicuous consumption often leads to increased debt and financial unhappiness.

If you position your finances where your dollars work for you each day, then eventually there will be no need for you to work because your working dollars provide all your wants and needs. When you no longer need to work you become financially independent!

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS