In a recent episode of the television series Ted Lasso, Coach Lasso recommended to one of his players who made a mistake that he, “Be a goldfish“ because goldfish have such a short attention span.

Recent studies indicate that goldfish now have longer attention spans than humans.

In light of this information, here are two quotes worth considering:

“When you let your attention slide a bit, don’t think you will get back a grip on whatever you wish— instead, bear in mind that because of today’s mistake everything that follows will be necessarily worse…….. is it possible to be free of error? Not by any means, but it is possible to be a person always stretching to avoid error. For we must be content to at least escape a few mistakes by never letting our attention slide.” —-Epictetus, Discourses, 4.12.1; 19

“[What information consumes is] the attention of its recipients. Hence a wealth of information creates a poverty of attention.” —-Herbert Simon Nobel winner, Economics (1978)

But can I still concentrate?

When I began studies for my CRPC™ (Chartered Retirement Planning Counselor) designation I set an ambitious goal of three hours of concentrated study each day for six days each week until the successful completion of the designation course.

After successfully graduating from high school, college, and four years of postgraduate dental school, I felt confident in my ability to maintain focus for prolonged periods. I was self-assured that my attention span was excellent.

But, I was moderately concerned that I had not engaged in an extended period of focused study for over 40 years. My concerns were quickly realized by the end of my second study day when I realized I was retaining very little of the study material.

After a period of self-doubt, self-reflection, and a serious pep-talk I resumed my studies. I didn’t want to fail. Neither did I want to spend a considerable amount of time and money in an aborted attempt to become a Chartered Retirement Planning Counselor™.

It was then that I realized that my ability to focus was not lost, but that my study skills had been underutilized for many years. My brain and focus were unpracticed for this type of endeavor and would need to be re-trained.

The story does have a happy ending in the fact that I completed the coursework for the CRPC™ designation and passed the final exam with an excellent test score.

My recent studies for the CRPC™ exam prompted research on attention span and focus. Initial Internet searches revealed the following information:

A recent study by Microsoft concluded that the human attention span has dropped to eight seconds – shrinking nearly 25% in just a few years.

The study stated that the current average human attention span is less than the average attention span of a goldfish.

I know from experience that it’s hard to outstare a goldfish.

But, are attention spans truly declining?

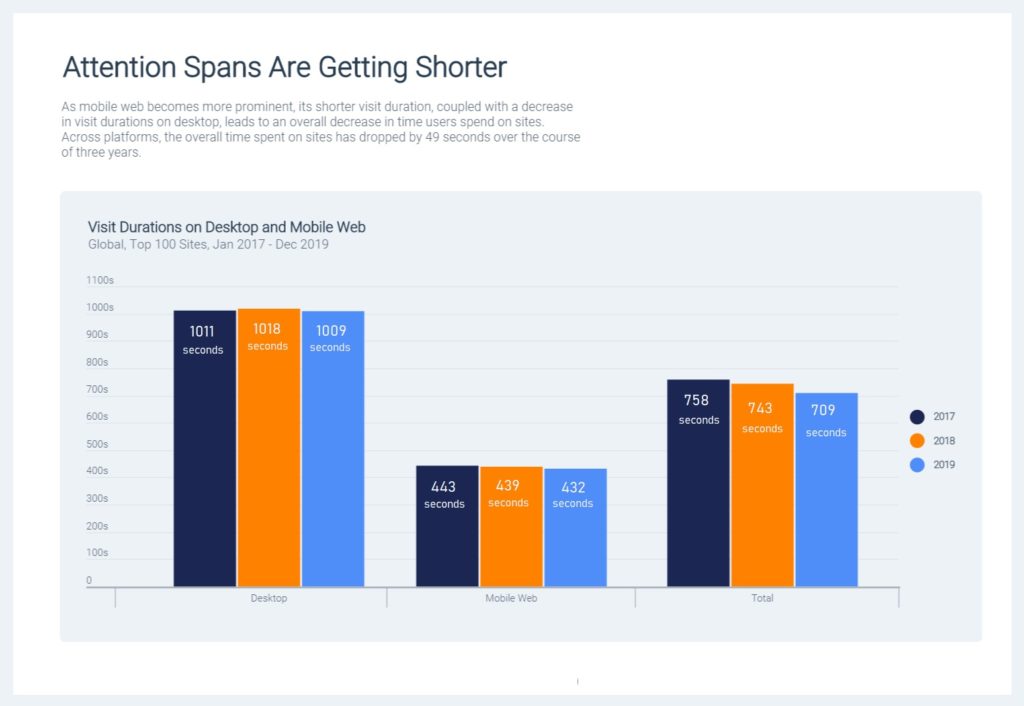

A recent article by SimilarWeb for Digital Information World seems to confirm this finding:

The data suggests that the average amount of time spent on websites before navigating away for all devices has gone down by 49 seconds which is a pretty huge reduction all things considered. This is important data because this will have a large impact on the kind of content that is being produced, and it will also incentivize websites to start adapting their designs and user interfaces to capitalize on what they now know. It’s important to note that desktop browsing is still going strong, it’s just mobile browsing times that are dropping which is causing a change in the statistics.

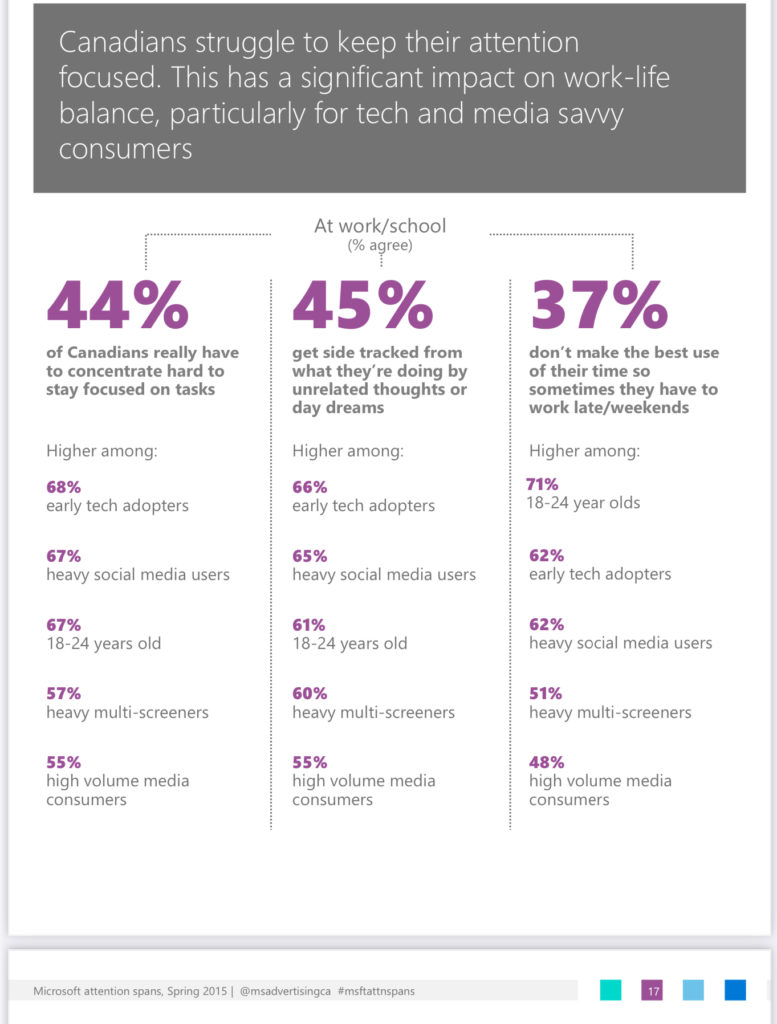

There are dozens of articles on the web that repeat the same information about decreased attention span and lack of focus. All of these articles are based on a 2014 Microsoft study of 2000 Canadians:

Gameified online quantitative survey | 2,000 Canadian respondents | fielded Q4 2014. The survey and games were designed to assess consumers’ attention capacities. They also included a range of metrics on digital lifestyles that academic evidence suggests could have an impact on attention and broader cognitive functioning.

Below are some of the findings:

But the bottom line is that this was a study and not the result of a verified empirical double-blind scientific research project.

So, things may not be quite that bad!

How does this affect Retirement Planning?

The results of the information presented are concerning because preparation for a successful retirement involves years of concentrated effort and planning. (This post will consider only the financial aspects of long-term planning and focus while leaving mindset and purpose considerations for another post.)

In previous posts SAVING FOR RETIREMENT- OPPORTUNITY COST & TIME VALUE OF MONEY and INVESTMENTS AND COMPOUND INTEREST the value of time and focus on planning were discussed. Investments that are focused, maintained and monitored over extended periods perform best.

hhgfhghghghghjghj

Common investing errors concerned with short attention spans:

- Selling investments when the market is low, and buying when the market is high, Instead of the opposite- Even though it is counter-intuitive, the best time to buy stocks is when the market is in a downtrend. (When a portfolio is rebalanced better performing investments are sold and the poorer-performing investments are bought.)

- Excessive trading- Jumping in and out of the market, excessive trading of investments, or moving positions is normally counterproductive. Research indicates that buy-and-hold investors have better returns than investors who try to “Time the Market” (Buying stocks when they think the market is low and selling when they think the market is high.)

- Going all-cash and waiting for an upturn in the market cycle- One of the best ways to lose ground in the market is by abandoning positions and moving investments into cash while waiting for better market conditions. No one truly knows when there is a market bottom or market peak. The best strategy is to remain invested and allow the market to work for you over long periods. Investors who stay invested for long periods are rewarded with better market returns.

- Lack of clear and precise investment goals- The blog HAVING A “PLAN” discussed the importance of having clear and precise one-year, three-year, five-year, ten-year, and twenty-year goals. (You can’t get to your destination if you don’t know where you’re going.)

- Focusing on the wrong performance- purchasing the wrong kinds of investments, purchasing at the wrong time, and purchasing in the wrong amounts will all have adverse long-term effects on returns. (Most long-term investors have the best results with periodic investing in index mutual funds or EFTs.)

- Unrealistic expectations- Like compound interest, investments are most productive when allowed to grow for extended periods. Investors who expect continual above-average returns will be disappointed. Short-term returns are subject to large swings from very high to very low returns. It is only after 10-year or greater periods that returns even out and provide investors with the best return.

- Not controlling emotions- lack of focus on controlling emotions usually results in making the worst investment decisions at the worst time. (One of the best functions of financial advisors is preventing investor clients from making poor choices during periods of stressful market conditions.)

- Not focusing on inflation- investors need to always be aware of the difference between real return and nominal return. What matters to investors is the real (or true) return. Annual inflation eats away at total returns generated from investments. Return evaluations and projections should consider investment returns that are adjusted for inflation.

- Not starting an investment program early- probably the worst offender is procrastination or not starting an investment program, closely followed by not starting an investment program early in life which allows the greatest effects of compounding.

A precise and well-thought-out investment plan that is started early in life, funded periodically, rebalanced, maintained, and allowed to grow without excessive portfolio changes and trading is the cornerstone of a successful financial retirement plan. Properly implemented, an investor will retire with a large and well-funded retirement account.

Final Thoughts

- Successful investing for retirement requires dedication and sustained attention for a long period of years.

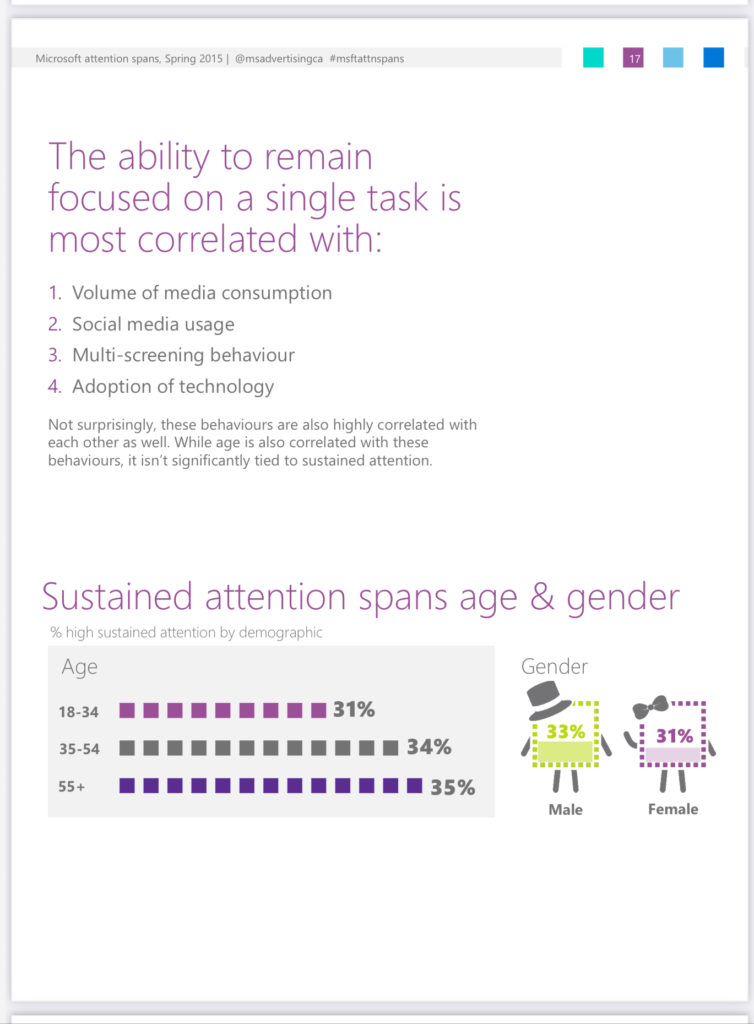

- Sustained attention span actually increases with age.

- A successful retirement plan must be well thought out, implemented early in life, and monitored throughout the investing period.

jrhfhfhfhghghfhhf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS