Approaching retirement can be an uncomfortable and stressful period. A person has worked hard, sweated, saved, and invested successfully. Retirement approaches with a Retirement Plan in place and the Plan of Record being followed. There are adequate retirement funds; and finances, mindset, and purpose in retirement have been addressed.

EVERYTHING IS IN THE GREEN ZONE! LIFE IS GREAT!

Then…….someone explains something called Sequence-of-Returns Risk.

That’s when you find out that twenty, thirty, or even forty years of consistent investing could be destroyed by a few years of negative returns early in retirement. It doesn’t make sense because negative returns during accumulation help long-term investing results (investments are purchased for less, which boosts long-term returns.)

But, the same type of negative returns early in retirement poses the greatest threat to retirement (running out of money) and sequence risk is not within someone’s control.

Sequence-of-returns risk is the silent killer that can destroy your retirement!

HUH?

Wait a minute!

I’ve paid my dues and I’m ready for the retirement that I’ve prepared for and earned. I’m financially healthy. Nothing’s going to stop me!

Not true! (Like heart disease in humans, sequence risk is the silent killer of retirement plans.)

What is sequence-of-returns risk and what does it mean for you and your retirement?

Investopedia defines Sequence Risk as: The danger that the timing of withdrawals from a retirement account will have a negative impact on the overall rate of return available to the investor. This can have a significant impact on a retiree who depends on the income from a lifetime of investing and is no longer contributing new capital that could offset losses. Sequence risk is also called sequence-of-returns risk.

Sequence risk in retirement is a series of negative portfolio returns early in retirement which creates early portfolio depletion.

And……….Poor sequence risk can’t be controlled.

Baird Private Wealth Management Products and Services published two charts that are immensely helpful in understanding sequences of returns, and what happens with a poor sequence of returns.

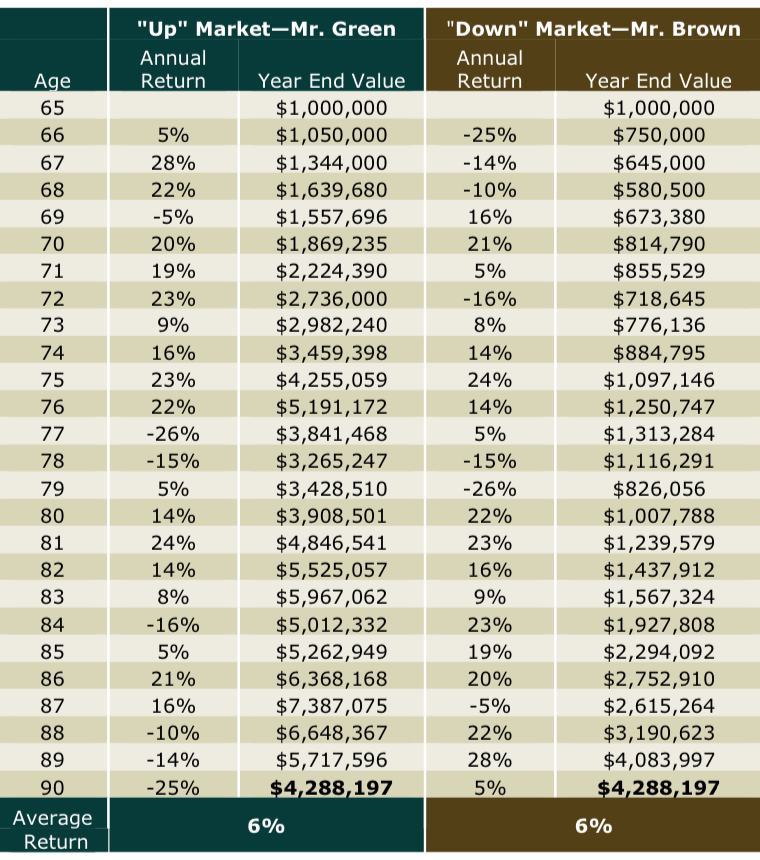

Consider the following hypothetical investment scenarios for Mr. Green and Mr. Brown:

Mr. Green and Mr. Brown both started with a $1 million investment portfolio at age 65. Both averaged a 6% annual return that grows to the same value after 25 years, but they experience their annual returns in inverse order from each other. See the chart below demonstrating their different paths to their ending values.

In this case, the sequence of investment returns had no bearing on portfolio values because the average annual rate of return was the same and no distributions were taken from the account.

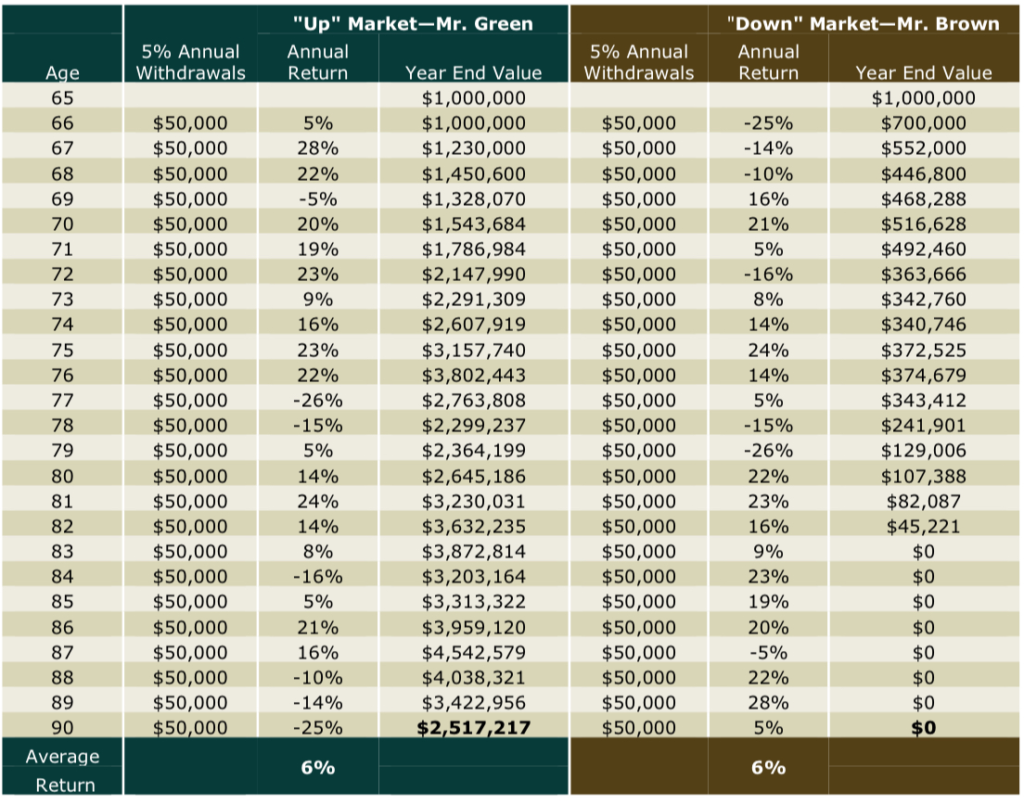

Now let’s look at how the sequence of returns can impact a portfolio when taking distributions:

Mr. Green and Mr. Brown still start with an initial $1 million investment portfolio. But in this example, they start taking 5% withdrawals (of the initial value) beginning immediately at age 65. Mr. Green begins taking withdrawals in an upmarket, giving him the optimal environment to maintain his portfolio value long-term. Unfortunately for Mr. Brown, he starts taking income in a down market and depletes his entire portfolio before reaching age 83.

The sequence of investment returns can significantly impact your investment portfolio when taking distributions.

In each example, the returns were reversed from first to last. In the first example with no distributions, the sequence of returns has no bearing on final results with both portfolio balances ending elevated and equal at age 90.

In the second example, 5% annual distributions have significant effects on portfolio longevity and balances when compared to early retirement up (gaining) market situations and early retirement market down (losing) market situations.

In an up market with a 5% distribution rate, and early positive portfolio returns the ending balance surpasses the initial balance even after factoring in withdrawals.

In a down market early in retirement the combined effect of withdrawals and portfolio decline creates an untenable situation and portfolio failure with a zero balance in year eighteen at age 83. NOT A GOOD SITUATION IF YOU ARE THIS PERSON!

So how do you stop something you can’t control?

You don’t!– You mediate Sequence Risk by proper advanced planning!

When planning for a long trip it is understood that at some point during the trip it will probably rain. You’re not sure when it’s going to rain, and you can’t control the weather. What do you do? You can bring adequate rain gear, carry an umbrella, or make alternate plans for those days. There are several alternatives for anyone who has planned for bad weather.

Just like rainfall, investment returns can’t be controlled. But, adverse investment returns can be mediated by advanced planning.

Mediating Sequence Risk

- Anticipate and plan for a worst-case scenario.

- Work longer– Consider working longer to contribute more to your retirement account, particularly in your peak earning years.

- Continue investing– Save and invest even after you retire.

- Diversify your portfolio– Different investments react differently. Diversifying means that normally some investments are gaining when others are losing. This allows most investors to avoid selling assets when they are depressed.

- Buy safety– High-quality corporate and government bonds, CDs, and Treasurys all have a high degree of safety and lower risk. Having these investments in your portfolio means that you have assets to sell in a down market.

- Reduce exposure– Reducing exposure to the riskiest assets when approaching retirement means less of a drop in value if the market crashes.

- Annuities– Annuities provide a steady stream of income that is unaffected by market returns and is guaranteed for life.

- Social Security– Social Security is another form of guaranteed income. Social Security also provides Cost of living Adjustments (COLA). Delaying the onset of Social Security payments as long as possible (to a maximum of age seventy) provides the highest stream of lifetime income.

- Reverse Mortgage– Also called a Home Equity Conversion Mortgage (HECM) when issued by the US Government. A Reverse Mortgage can provide a steady stream of income that is unaffected by market returns.

- Cash value life insurance– The cash value portion of life insurance can provide a steady income stream if needed. (Accessing cash value has both tax and insurance implications and should be evaluated before accessing available cash value in insurance policies.)

- Bucketing– Also known as a Time Segmentation strategy. Assets are placed in different tranches or buckets based on when the funds will be needed. Funds needed sooner are placed in cash or cash equivalents while longer-term funds are invested more aggressively to combat inflation risks.

- Using a fixed withdrawal strategy– Multiple strategies are using different guards (or guardrails) to prevent the over-withdrawal of assets.

Like heart disease, the Sequence-of-Returns risk is a silent killer. It can shorten or destroy someone’s retirement lifetime or lifestyle. But, also like heart disease, some things can be done earlier in life to lessen and mediate the long-term effects of sequence-of-returns risk.

Final Thoughts

- Sequence risk is the danger that the timing of withdrawals from a retirement account permanently damages the investor’s ability to maintain adequate funds throughout retirement.

- Account withdrawals during a bear market are more damaging than the same withdrawals in a bull market because retirees don’t have enough time to recover the cumulative effect of losses and withdrawals on portfolio balance and stability.

- A diversified portfolio can protect your savings against sequence risk.

- Timing and luck play a big part in sequence risk. If you retire when the market is rising and returns are positive for several years, it’s because you’re lucky, not smart!

- Proper planning before retirement is your best defense against sequence risk.

- Fixed assets such as CDs and bonds are less affected by bear markets.

fhghghghdjjdjf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS