“An old joke states that if you get five economists in a room you’ll get seven different opinions.”

According to Wikipedia: In the United States, a Recession is defined as “a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

How does a Recession Affect Housing?

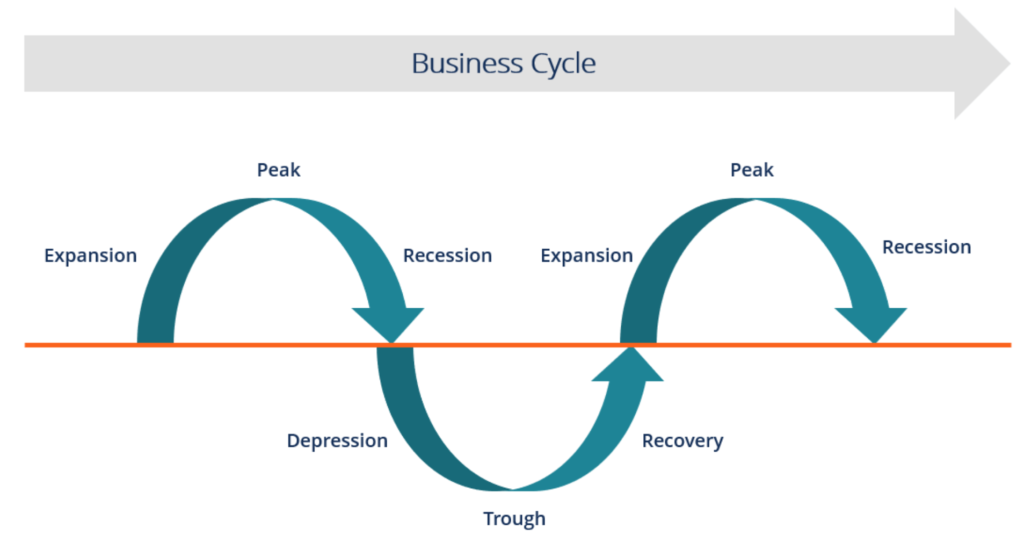

A business cycle is similar to a human life cycle. In a Life Cycle, a person is born and progresses through infancy, childhood, adolescence, adulthood, and old age. This is similar to the manner in which each year progresses through Spring, Summer, Fall, and Winter to complete one annual cycle.

A business cycle follows a six-stage pattern of expansion, peak, recession, depression, trough, and recovery.

fdhdhhdghdghhgd

Source: CFI™

Source: CFI™

1. Expansion

The first stage in the business cycle is expansion. In this stage, there is an increase in positive economic indicators such as employment, income, output, wages, profits, demand, and supply of goods and services. Debtors are generally paying their debts on time, the velocity of the money supply is high, and investment is high. This process continues as long as economic conditions are favorable for expansion.

2. Peak

The economy then reaches a saturation point, or peak, which is the second stage of the business cycle. The maximum limit of growth is attained. The economic indicators do not grow further and are at their highest. Prices are at their peak. This stage marks the reversal point in the trend of economic growth. Consumers tend to restructure their budgets at this point.

3. Recession

The recession is the stage that follows the peak phase. The demand for goods and services starts declining rapidly and steadily in this phase. Producers do not notice the decrease in demand instantly and go on producing, which creates a situation of excess supply in the market. Prices tend to fall. All positive economic indicators such as income, output, wages, etc., consequently start to fall.

4. Depression

There is a commensurate rise in unemployment. The growth in the economy continues to decline, and as this falls below the steady growth line, the stage is called depression.

5. Trough

In the depression stage, the economy’s growth rate becomes negative. There is further decline until the prices of factors, as well as the demand and supply of goods and services, contract to reach their lowest point. The economy eventually reaches the trough. It is the negative saturation point for an economy. There is extensive depletion of national income and expenditure.

6. Recovery

After the trough, the economy moves to the stage of recovery. In this phase, there is a turnaround in the economy, and it begins to recover from the negative growth rate. Demand starts to pick up due to low prices and, consequently, supply begins to increase. The population develops a positive attitude towards investment and employment and production starts increasing.

Employment begins to rise and, due to accumulated cash balances with the bankers, lending also shows positive signals. In this phase, depreciated capital is replaced, leading to new investments in the production process. Recovery continues until the economy returns to steady growth levels.

djhdjhdjhdjdj

This completes one full business cycle of boom and contraction. The extreme points are the peak and the trough.

Recession follows the peak of expansion (when growth reaches a peak, prices peak, and economic markets become saturated.) Prices are at their highest and inventories are higher due to increased consumer demand. During a recession, consumers decide that prices are too high and reduce spending. Because of previous increased demand, inventories are at their highest. The decrease in spending and consumption causes excess inventory. The combined effect of decreased spending and decreased consumption causes a significant drop in prices. Economic indicators such as income, output, wages, etc., consequently start to fall as a result of the spending and consumption decreases.

Even though a recession affects all consumers and all areas of the economy, this discussion will focus on how a recession affects housing. In the same fashion that the effects of a recession are different for different consumers, a housing recession has different effects on consumers, but some more than others.

jjfjfjfhfhhfjf

Instead of categorizing housing recessions Ωby age of those affected, this discussion will divide the effects of housing recessions into three categories based on the magnitude of the effects of a housing recession irregardless of age: highly affected, marginally affected, and unaffected.

Highly Affected:

- Some homeowners during a recession will lose their jobs– Homeowners unable to find replacement work will be severely affected financially. Loss of income means homeowners may be unable to afford house notes (in addition to all other household expenses.) unpaid house notes can lead to eventual delinquency of the mortgage, and repossession of the home.

- Anyone with direct connections to housing or the housing industry– Realtors, carpenters, housing contractors, construction workers, housing lenders, construction-related vendors, appliance and furniture manufacturers and retail sellers, etc. will all suffer from decreased activity in the housing market.

- Younger workers and those entering the job market– Recessions normally increase unemployment. This creates a larger worker pool, depresses wages and salary increases, and makes it harder for young workers and recent graduates to find meaningful work.

Marginally Affected:

- Homeowners selling homes– Softening demand means house prices fall. Falling prices can be a significant problem for a homeowner that needs maximum value from a home sale. (But falling home prices mean that new homes will be less expensive.)

- Home buyers– Both first-time owners and buyers selling one home to buy another are affected. Recessions are usually preceded by inflation and increasing costs. Interest and mortgage rates for new loans (and mortgages) can cause increased financial strain on potential homebuyers. Current homeowners can face Sticker Shock when facing higher interest rates than their current mortgage rate.

- Reverse mortgages– reverse mortgages are still available. In a Recession, the mortgage amount is based on a lower appraised value. Therefore, the dollar amount of a reverse mortgage may be less during a housing recession.

Unaffected:

- Homeowners without a mortgage– Homeowners with no mortgage are unaffected by increasing mortgage rates.

- Current homeowners with fixed mortgages- Current homeowners with fixed mortgages are unaffected by rising mortgage rates.

fhgfhghghg

Effect on Retirees and Pre-retirees

Inflation and recession will affect retirees and pre-retirees in areas other than housing. In most cases, wisdom dictates that retirees and pre-retirees are best served by staying calm and not making hasty or emotional decisions based on media hype, especially in housing.

As noted in the notes above, retirees and pre-retirees are unaffected by a housing recession if remaining in their current homes. (I similarly think about this as owning a bond. Bond prices go up and down over time, but the face value of the bond is unaffected.) Homeowners don’t lose money in a recession if they are not selling. Only the sale of a home generates a gain or loss.

A retiree or pre-retiree who sells a home may generate gains or losses. Gains or losses will depend on the length of ownership and how much appreciation has occurred.

There is also a situation called Geographic Arbitrage. Homeowners may benefit in a housing recession by selling in an area less affected by the recession and subsequently purchasing a home in areas where home prices have declined more severely.

jfgjfjfjjkfjfjjfg

Final Thoughts

- A Business Cycle follows a predetermined pattern of expansion, peak, recession, depression, trough, and recovery stages.

- The effects of a housing recession on consumers range from highly affected to unaffected.

- Retirees and pre-retirees are unaffected by a housing recession if remaining in their current homes.

- With a strategy called Geographic Arbitrage, homeowners benefit in a housing recession by selling in an area less affected by the recession and subsequently purchasing a home in areas where home prices have declined more severely.

- Retirees and pre-retirees are best served by staying calm and not making hasty or emotional decisions based on media hype, especially with housing.

fjhfhfhfhfnhf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS