GHGHGHGH

Think ahead, don’t let day-to-day operations drive out planning ⁓ Donald Rumsfeld (Former U.S. Secretary of Defense)

jghghhghg

Being a financial advisor one would think my answer to the question of whether everyone needs a financial advisor would be a resounding “Yes.”

Because I don’t view my CRPC™ designation as a source of income, and I’m not relying on advisor income for living expenses, I can be much more honest in my responses! And, my responses may surprise you!

I did a multi-part series on Financial Advisors and questions to ask your potential advisor before engagement (See: ENGAGING ADVISORS- ALPHABET SOUP- PT 1, ENGAGING ADVISORS- ALPHABET SOUP- PT 2, ENGAGING ADVISORS- TWENTY QUESTIONS.) In these blogs, I was both complimentary and critical of Financial Advisors. (Most [but not all] Financial Advisors are hard-working honest individuals.) But, human nature dictates that Financial Advisors may not always act in the client’s best interest (especially when the client’s best interest conflicts with the Advisor’s best interests.) These blogs also discussed the difference between the Fiduciary Standard and the Suitability Standard. Also mentioned was the fact that the same Advisor may act as either a Fiduciary or a Non-Fiduciary advisor in different situations. For most consumers, this is a very confusing and frustrating situation and these frustrations are expressed in the low- confidence and low-trust grades the advisor industry currently experiences.

fhfhfhhff

Financial Advisor versus Financial Planner

Financial Advisors and Financial Planners are actually two separate entities. Financial Planners are concerned primarily with helping clients reach their financial goals while the term Financial Advisor encompasses planners as well as stockbrokers, insurance agents, estate planners, bankers, and accountants.

So the title of my blog is a bit of a trick question because almost every person contracts a financial advisor at some point to help with insurance, banking, or stock investing needs. The insurance agent that provides your life insurance is usually considered to be a financial advisor and may also provide annuities or other insurance products. Bankers provide savings and insurance vehicles also.

But let’s zero in on the Financial Advisor space occupied by Financial and Retirement Planners.

jgugujgjgjg

What Value Does a Financial Planner Provide?

- Specialized knowledge– probably the greatest asset financial planners possess is specialized knowledge in areas unfamiliar to most people. People are usually not well versed in the details of financial planning such as portfolio construction, retirement planning, asset location, allocation, etc.

- Time– not only the implementation of the actual Financial Plan, but also the process of initiating, formulating, finalizing, and funding a Financial Plan can be very time intensive. Having a knowledgeable Financial Planner contracted can save many frustrating hours spent on do-it-yourself plans.

- Emotional Barriers– the greatest threat to most investors is not the sequence of returns risk, recessions, or market volatility. The greatest threat to most investors is the investors themselves! Even long-term investors who have extensive experience with market cycles may exit the market at exactly the wrong time. This can be a costly mistake that cannot be corrected. The reason that many older investors exit the market at the worst time is due to fear of being older and closer to retirement. These older investors are fearful of losing a lifetime of savings in a downturn close to retirement. So, they sell near a market bottom and miss the eventual recovery. This behavior is especially harmful because advancing age limits their ability to recover from mistakes. Their investing lifetime becomes shorter each year.

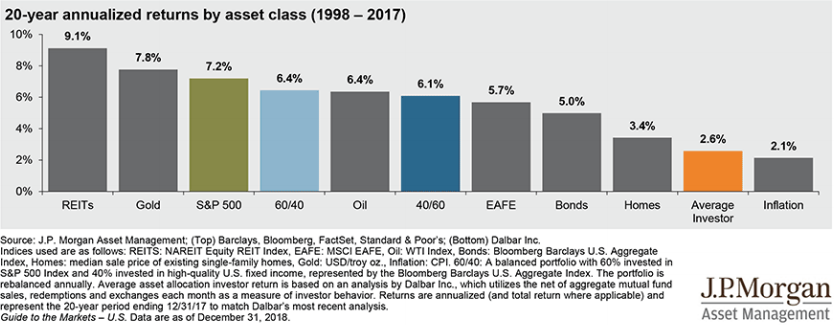

- Maximize Opportunities and Mitigate Losses– planners have the necessary background and knowledge because they keep abreast of the latest laws and market conditions. They use this background to recognize financial opportunities that will benefit their clients. Unlike fearful investors, planners provide the benefit of not allowing current market conditions to force the abandonment of a well-thought-out investment strategy. The chart below is a pictorial representation of the poor returns most average investors generate:

hghghghg

fhfhfhfgh

Over the last 20 years, the average investor returned an annualized return of 2.6% when the S&P 500 returned 7.2%. The 4.6% difference between the S&P 500 and the average investor is the result of poor stock picking and market timing. As a result, they miss out on the returns they would have received by staying invested.

- Portfolio Construction and Maintenance– there are many benefits provided by proper asset location and allocation, rebalancing, strategic cash flow management, and tax planning. Most of these techniques and strategies are unknown or unfamiliar to the common investor.

- Emotional Benefits– shifting the burden of planning and implementing a Retirement Strategy to a professional can provide immense emotional benefits. The pressure of being successful in retirement planning can be a heavy burden for a non-professional consumer trying to plan for retirement. Most people will sleep better at night knowing they are not responsible for their financial well-being after retirement. Most planners can provide benefits and guidance to investors who wish to tilt their investments based on moral or social guidelines. There are many ESG (environmental, social, and governance) funds that specifically invest in stocks that are of interest to certain groups of investors.

- Accountability– a financial planner can act like a personal trainer or a life coach. Instead of providing information about exercise, food, or proper sleep habits, a financial planner can provide information on proper financial well-being. And, just like a life coach or personal trainer, a good financial planner will monitor each client’s financial behavior and inform them when they are moving away from proper guidelines.

gjjghjghjgjhg

What are the Disadvantages of Engaging a Financial Planner?

- Peace of Mind– transferring management of retirement assets to a Financial Planner also means transferring control. The client must trust the wisdom and judgment of the portfolio manager and financial planner. Since portfolio updates are usually provided semi-annually or annually, decreased awareness of portfolio balances on a continuous basis can become a source of apprehension, instead of a source of comfort.

- Conflict of Interest– a planner may not be a fiduciary advisor and may only be held to the Suitability Standard (The Suitability Standard dictates that an investment only be suitable, but not necessarily in the best interest of the client.) This can create conflicts of interest where two or more different “suitable” investments provide differing levels of financial gain for the advisor. The temptation for the advisor is to recommend the “suitable” investment that provides the best financial incentive or commission to the advisor, not necessarily the most appropriate investment for the client.

- Costs and Fees– advisor fee structure may not be clear or apparent, so in many cases, it’s hard to know exactly how much is being charged for advisory services. Advisors tend to charge a higher percentage for smaller dollar amounts under management. So, smaller account holders tend to pay a higher percentage of portfolio balances for management at the time when their need to be fully invested is greatest. The question account holders must evaluate is: do the fees charged create value in excess of portfolios that are self-managed?

fjbfjfjfjfj

The best and final assessment is whether potential retirees and retirees feel comfortable managing assets that will be needed in retirement or feel better delegating asset management to a financial planner.

After a lifetime of self-education, and over 50 years of investing experience I am comfortable managing my own portfolio. But, not everyone desires to dedicate the time and effort needed to educate themselves about investing and financial literacy. Many people may not be comfortable self-directing retirement assets during retirement, or may not even want to dedicate the time needed to prepare a comprehensive Plan and manage it in retirement.

Retirement should be a time of joy and happiness. You made it!

You’ve crossed the finish line and won the race. Why burden yourself with unnecessary problems if you don’t have to?

There is a corollary that can be made between mowing your own grass and managing your own finances. Someone may understand the technical aspects of mowing their own grass, but doesn’t own a lawnmower. Another person may own a lawnmower, but not know how to start it. People may have a basic understanding of finance, and even possess an understanding of some basic tools like portfolio construction, but don’t have mastery of the process. They may have a financial lawn mower, but can’t mow their financial grass. They need the help of a financial lawn service, what we call a Financial Planner.

I understand how a house is constructed. I worked at a building materials company in my youth and spent a lot of time around construction sites and speaking with Builders. But does that mean that I understand how to build a house, or would I want to manage all the details that are incorporated in building a home? Are my knowledge base and skills comparable to or equal to a certified building contractor?

jfjjjfjhtf

Retirement and cognitive decline

One of the biggest problems facing investors during retirement is the problem of cognitive decline. According to the American Association of Individual Investors (AAII) cognitive impairment affects approximately half of all 80-year-olds. Retirees who engage a financial planner have someone to manage accounts and make appropriate funding and distribution decisions. Large fund companies, like Vanguard, Fidelity, and Schwab have already placed some basic firewalls and safeguards on accounts to protect their clients from the effects of cognitive decline on account balances. Requests for password reset and repeated errors in account manipulation will raise red flags.

It’s safe to say that these same companies do not assume responsibility for poor decisions and mistakes due to cognitive decline, but these safeguards are better than nothing, and at least they are a starting point for this process.

Cognitive decline is difficult to diagnose in the early stages and for most people is a gradual process that may not be obvious until later stages when mistakes and decline become more evident.

jfhjfhfhhfhf

Am I saying that everyone needs a financial planner?

No!

What I’m saying is every person or family approaching retirement needs to prepare in the best way possible for retirement. Everyone gets one life, and one chance to make that life the best one possible. I can’t tell you what will be the best decision for your circumstances.

Personally, I will continue to self-direct my portfolio as long as I am comfortable that the correct decisions are being made. But, I have already taken preliminary steps to insure that accounts will be properly managed if I am unable to continue managing my accounts competently.

I have developed a relationship with a CFP and at some point in the near future will allow him to manage a portion of my portfolio. I have also taken steps to familiarize my wife with our total financial picture. (She is a passive investment partner who prefers that I handle financial matters.) But, I have taken steps to insure that she is comfortable with and aware of all account types and locations.

This is critically important for the non-investing partner because at some point total management (or control of accounts) may be left to her singularly. At some point I may be subject to cognitive decline or even worse, I may no longer be alive. Empirical data indicates that I will precede her in death, so I don’t want to leave her uninformed and unprepared.

These are the realities of life and leaving loved ones prepared for these eventualities beforehand is one of the best forms of love.

jgjgjhhjgg

Final Thoughts

- Financial advisors may or may not act in clients’ best interests depending on whether they are acting in a Fiduciary capacity or operating under the Suitability Standard.

- Financial advisors encompass a large field that includes insurance agents, bankers, certified financial planners, and CPAs.

- Good financial planners can create value for their clients in a number of ways. One of the most valuable functions of good financial planners is protecting clients from making bad financial decisions during periods of emotional stress.

- There are several disadvantages to engaging a financial planner. Probably the biggest disadvantage is a planner may not always function in a fiduciary capacity and may not operate in the best interest of the client.

- The question of engaging a financial advisor or self-managing Investments ultimately becomes a question of what will make the client most comfortable in retirement.

- Cognitive decline is a real problem for retirees as they advance in age. Having an honest and reputable financial planner can mediate the negative effects of the financial decline on investment portfolios.

hghghghghgh

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS