gjghghj

Recently I received a call from a young person who started a job at a company that provides a company 401(k). He was unsure how to proceed in making plan elections and didn’t want unforced errors at the beginning of his plan that could cause problems in the future. Unfortunately, he’s far from being alone.

401(k) plans are a great retirement-saving vehicle and can be very valuable if properly understood and utilized. (The problem is 401(k) plans can be intimidating and confusing. Especially if the employee is young and not well-versed financially.)

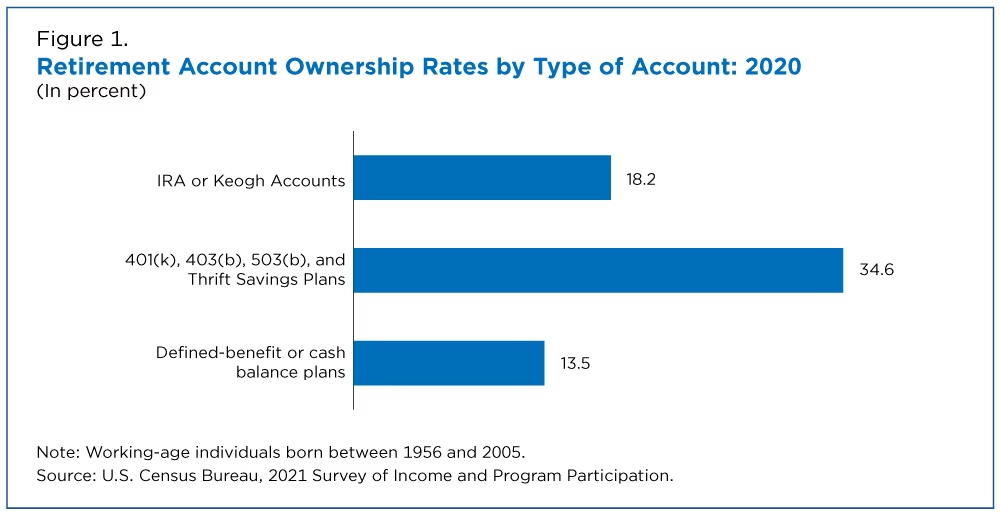

401(k) plans belong to the group termed Defined Contribution plans. Defined Contribution plans, as a group, have essentially replaced Defined Benefit plans (Pension Plans) as the employer plan of choice, with only 13.5% of retirement plans being in the Defined Benefit category in 2020. For a general overview of the Retirement Plan landscape see RETIREMENT PLANS- GETTING STARTED EARLY.

jhfhfhfhfhfhf

Let’s see if we can simplify the mighty 401(k)!

What is a 401(k) Plan?

According to Investopedia: A 401(k) plan is a retirement savings plan offered by many American employers that has tax advantages for the saver. It is named after a section of the U.S. Internal Revenue Code (IRC). The employee who signs up for a 401(k) agrees to have a percentage of each paycheck paid directly into an investment account. The employer may match part or all of that contribution. The employee gets to choose among a number of investment options, usually mutual funds. There are two basic types of 401(k)s—traditional and Roth—which differ primarily in how they’re taxed.

jfjfjjfhjfhffh

401(k) Plan Types

As stated above, there are two types of 401(k) plans. An employer may provide both types of 401(k) plans (Traditional and Roth), but the majority of employer plans cover traditional 401(k) plans.

From Investopedia:

Traditional 401(k)– With a traditional 401(k), employee contributions are deducted from gross income. This means the money comes from your paycheck before income taxes have been deducted. As a result, your taxable income is reduced by the total amount of contributions for the year and can be reported as a tax deduction for that tax year. No taxes are due on either the money contributed or the investment earnings until you withdraw the money, usually in retirement.

Roth 401(k)– With a Roth 401(k), contributions are deducted from your after-tax income. This means contributions come from your pay after income taxes have been deducted. As a result, there is no tax deduction in the year of the contribution. When you withdraw the money during retirement, though, you don’t have to pay any additional taxes on your contribution or on the investment earnings. However, not all employers offer the option of a Roth account. If the Roth is offered, you can choose between a traditional and Roth 401(k). Or you can contribute to both up to the annual contribution limit.

If their employer offers both types of 401(k) plans, an employee can split their contributions, putting some money into a traditional 401(k) and some into a Roth 401(k).

However, their total contribution to the two types of accounts can’t exceed the limit for one account (equalling $20,500 for those under age 50 in 2022 or $22,500 in 2023).

kfjfjfhjfhfhf

How Much to Contribute?

My young investor’s first question was relatively easy. He wanted to know how much he should be contributing to the company 401(k). The quick answer is that he should contribute as much as possible, or at least enough to receive the maximum company-sponsored match. Most 401(k)s are set up to match a certain percentage of employee contributions. With many options, unfamiliar terms, stipulations, and rules, 401(k)s can be hard to understand and decipher.

Contributions from each paycheck should be large enough to take advantage of any match that your employer offers. Otherwise, you are losing out on part of the compensation provided by your employer, and missing out on the 50% instant return, or 3% of the maximum 6% contribution. The employer match is equal to half of the employee contributions up to the 6% maximum contribution limit. This means that for every dollar invested the employer will provide a fifty-cent matching contribution. The employer will continue this process until the contributions reach 3% of the employee’s compensation. If the employee contributes the maximum of 6% of compensation, then he will receive an immediate 50% ROI (return on investment.)

jhfhfhfghgfhf

How Much is this in Actual Dollars?

The most common partial match provided by employers is 50% of contributions up to 6% of your salary. In other words, your employer matches half of whatever you contribute up to 3% of your salary total. To get the maximum amount of match, you have to put in 6% of your salary.

You may also be able to make non-tax-deductible contributions to traditional 401(k)s above the employee contribution limit. About a fifth of 401(k) plans allow employees to make these kinds of contributions. The combined contributions of an employee and an employer to a 401(k) account in 2023 are $66,000 or 100% of the employee’s compensation, whichever is less, ($73,500 when you include catch-up contributions for workers 50 or older). This means that together, you and your employer can contribute up to $66,000 to your 401(k).

There are two separate components to a 401(k) contribution: the employee contribution and the employer match (if applicable). For the tax year 2023, the employee contribution limit equals $22,500, which is up $2,000 from 2022. This limit does not include employer-match contributions.

hhghghghhg

The second question required more thought. He wanted to know how to invest the contributed funds. He had the option to self-direct management of his funds or place funds in a Target Date Fund.

Contributions made to a 401(k) account are invested according to the selection your employer provides. Options include stock and bond mutual funds and target-date funds (which are designed to reduce risk as the employee moves closer to retirement.) Contribution amounts, company matches, asset location and allocation, annual returns, and the number of years until retirement all contribute to the final account balance. A properly funded and managed 401(k) account be a very large piece of a future retirement plan.

That’s great but still doesn’t answer the question of where to invest. For me, the answer would be to self-direct my funds. But my investing career spans approximately fifty years and my CRPC™ charter has provided additional information and education.

My recommendation to my young friend and all uninitiated in investing is to use a Target Date Fund, where funds are institutionally invested and managed. This is the “Easy Button” for most employees. (Target Date Funds automatically reduce risk as the employee ages to protect portfolio balances and gains. Target Date Funds have a higher degree of risk when a person is young and has a long investing horizon. As a person ages the risk decreases as the investing time horizon decreases.)

gjgjgjg

How Do Funds Grow?

In a Traditional 401(k) all employee contributions and employer matches grow tax-deferred and are not taxed until distributed in retirement (provided that there are no non-qualified distributions before retirement.) Roth accounts grow tax free and all qualified distributions are distributed tax-free as they are funded with after-tax dollars. Both traditional and Roth 401(k) owners must be at least age 59½- or meet other criteria spelled out by the IRS when making withdrawals to avoid a penalty when taking distributions.

gjghjgjgjgjg

What about MRDs ( Minimum Required Distributions)?

Traditional 401(k) plans– Beginning on January 1, 2023, account owners who have retired must start taking MRDs from their traditional 401(k) plans no later than age 73. The dollar amount of the MRD calculated is based on your life expectancy at age 73 and the percentage increases each year.

Roth 401(k) plans– To make a qualified withdrawal from a Roth 401(k) account contributions must be at least five years old and the account holder must be at least 59½ years old. Qualified withdrawals before age 59 1/2 can be made if the account holder becomes disabled or passes away. The terms of Roth 401(k) accounts also stipulate that required minimum distributions (RMDs) must begin by age 73, or age 70½ if you reached that age by January 1, 2020. However, under the SECURE 2.0 Act of 2022, RMDs are eliminated for Roth plans starting in 2024 if not already taking distributions.

(There are different situations where funds can be distributed penalty free from both traditional and Roth accounts before retirement. These situations can be complicated and are beyond the scope of this blog.)

So to restate: My advice was to contribute as much as allowable, or at least contribute to the maximum employer matching amount, and to place these funds in a Target Date Fund managed on your behalf (if you are not well versed financially.) The earlier the contributions begin, the longer the funds can grow and compound. See: INVESTMENTS AND COMPOUND INTEREST.

jgjgjhgjgjg

Final Thoughts

- The 401(k) is one type of Defined Contribution plan that allows employees to save in a tax-deferred or tax free vehicle while also gaining matching funds from the employer.

- Most plans are constructed in a manner that allows employers to provide a 50% match of contributions up to 6% of employees’ salaries.

- For the tax year 2023, the employee contribution limit equals $22,500, which is up $2,000 from 2022. This limit does not include employer-match contributions.

- All funds (both contributions and matching funds) grow tax-deferred in traditional 401(k) accounts and tax-free in Roth 401(k) accounts.

- Both Traditional and Roth 401(k) accounts are subject to multiple rules and regulations in both the contribution and distribution phases.

- The 401(k) account is an integral part of current Defined Contribution plans and a central piece of most employees’ retirement plans.

ghghbhhghhjg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS