GFHGHHGHGH

“A lot of people when they get negative on the market put 50% in cash, but unfortunately, a lot of times when you get to that position it’s just about when the market’s about to rally.” -Peter Lynch

“Being very early and being wrong look exactly the same 99% of the time.” -Seth Klarman

“In the stock market, the most important organ is the stomach. It’s not the brain.” -Peter Lynch

jfjfh

A reader recently begged me to agree with him that his best option was to sell all of his stock holdings and move to a cash position. He had read current stock market information, listened to stock market pundits, and followed stock market podcasts and was convinced that the Market was overvalued and was due for a major correction. He didn’t want a Market drawdown to wipe out all of his hard-earned portfolio gains.

He felt that his best option was to sell all his stocks, move to cash, and wait for the beginning of the next bull market. He felt this strategy would protect his profits and best position him for the beginning of the next bull market.

I felt that it was time to remind him of one stock market adage: “The stock market is the only market where things go on sale and all the customers run out of the store….”. -Cullen Roche

jfhhfhgfhf

Was He Correct, and Should I Agree With Him?

fhfhhfhhfh

Technically, my listener is correct! By selling all of his stocks he would indeed capture and protect all of his current stock market gains.

But, the next question becomes “What are you going to do now with your cash?”

jfhfgfggf

Are There Benefits to Holding Cash?

jfhhhfhf

The benefits of holding cash are:

- If the market continues to fall, holding cash helps to prevent further loss in value by remaining invested in stocks.

- Holding cash feels good mentally, and may confer peace of mind.

- When the whole market is in a drawdown situation, holding cash avoids systematic risk (the risk in the Market as a whole.)

- Cash helps to avoid short-term market volatility.

- A build-up of cash creates a reservoir of money for new stock purchases.

- Selling a bad investment to prevent further losses.

- Selling an appreciated asset to provide cash for new opportunities.

- Cash creates a cushion for unanticipated emergencies.

- For investors nearing retirement, selling and moving to cash provides an opportunity to de-risk a portfolio to avoid steep losses close to retirement.

- Selling and moving to cash could create an opportunity for tax loss or tax gain harvesting.

- Selling and moving into cash with small losses may prevent emotional panic selling and generating bigger losses if the stock market declines increase.

But, honestly, I’m not a fan of selling stocks when you think the market is due for a correction or when you’re nervous. There are numerous risks associated with selling stocks to avoid a potential stock drawdown.

FHGHHGGHHG

What Are the Risks of Selling Stocks and Moving to a Cash Position?

JFHJHFHFHHF

The risks of selling stocks and moving to cash are:

- As a general rule, cash normally doesn’t grow in value. Cash invested in money market accounts does not keep pace with inflation.

- Interest earned in cash accounts is taxable and further erodes the purchasing power of cash residing in savings and money market accounts.

- Stock market wisdom states that you sell when market valuations are high. Panic selling, when the Market has dropped, violates this principle because you sell when market valuations are low.

- Selling stocks and going to a cash position when approaching retirement means a portfolio might not have enough exposure in stocks to fight the effects of inflation. Retirees need stock exposure during retirement to combat the effects of inflation.

- Rebalancing a portfolio instead of strictly selling stocks means that in a stock drawdown stocks will usually be bought instead of sold. Rebalancing a portfolio involves selling assets that are outperforming and using the proceeds to purchase assets that are underperforming. This brings the overall portfolio allocation back into balance.

- Selling stocks and moving to a cash position to wait for better market conditions means that you have to be right twice. You must sell at the peak of the market rise, and then buy at the market trough. Peaks and troughs are easy to identify in hindsight, but extremely difficult to isolate and profit from in real-time.

- In a market, drawdown portfolios experience paper losses. When an investor sells assets that have lost value this generates actual losses.

- Historically, the stock market outperforms all other asset classes over long periods. Selling stocks and moving into cash has an opportunity cost associated with that move. Opportunity cost means that you compare the growth of your cash portfolio, which will lose purchasing power over time due to inflation against the potential gains in the stock market which protect against the effects of inflation.

- Selling stocks and moving to a cash position means that an investor misses out on all the eventual gains when the stock market recovers.

hfhghfhgghf

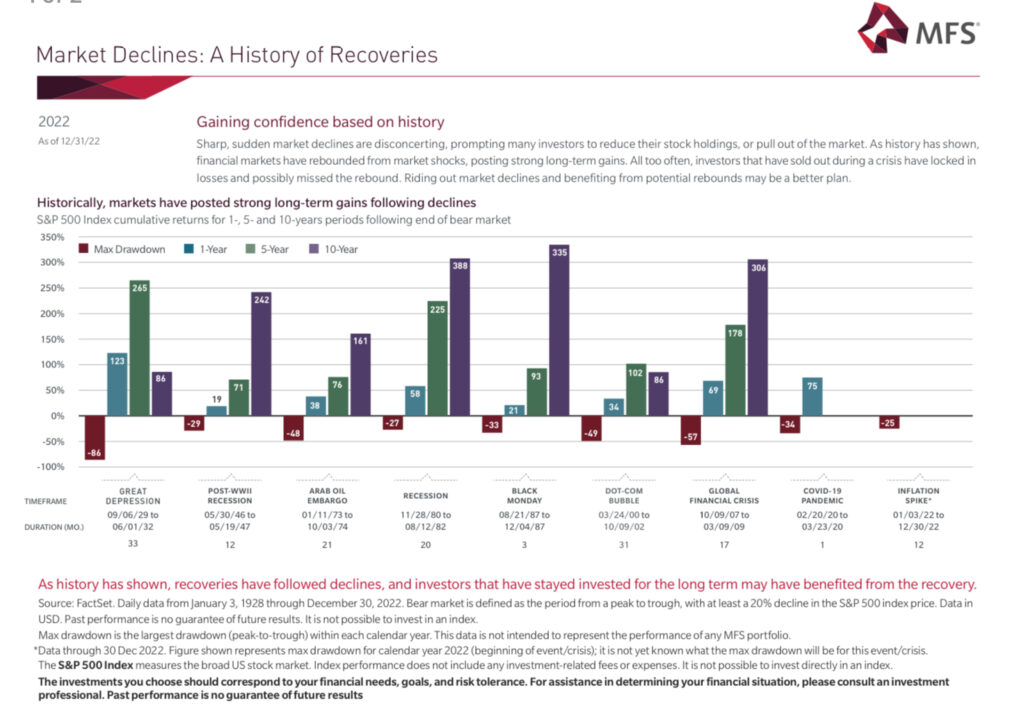

My investing career began approximately 50 years ago in 1970. Over that period I have experienced multiple drawdowns and recessions. The following chart by MFS shows major market declines and recoveries since 1929:

fhhfhhf

Since 1970 alone there have been seven major stock market declines!

hjfhghgfhhf

That means that since 1970 I have had at least seven opportunities to panic and sell stocks when the market declines and miss out on the eventual gains that occur with the recovery. The average duration of these seven market declines is fifteen months, with the longest being 31 months, and the average gain over the twelve months following the recovery is 73%!

fhghhgh

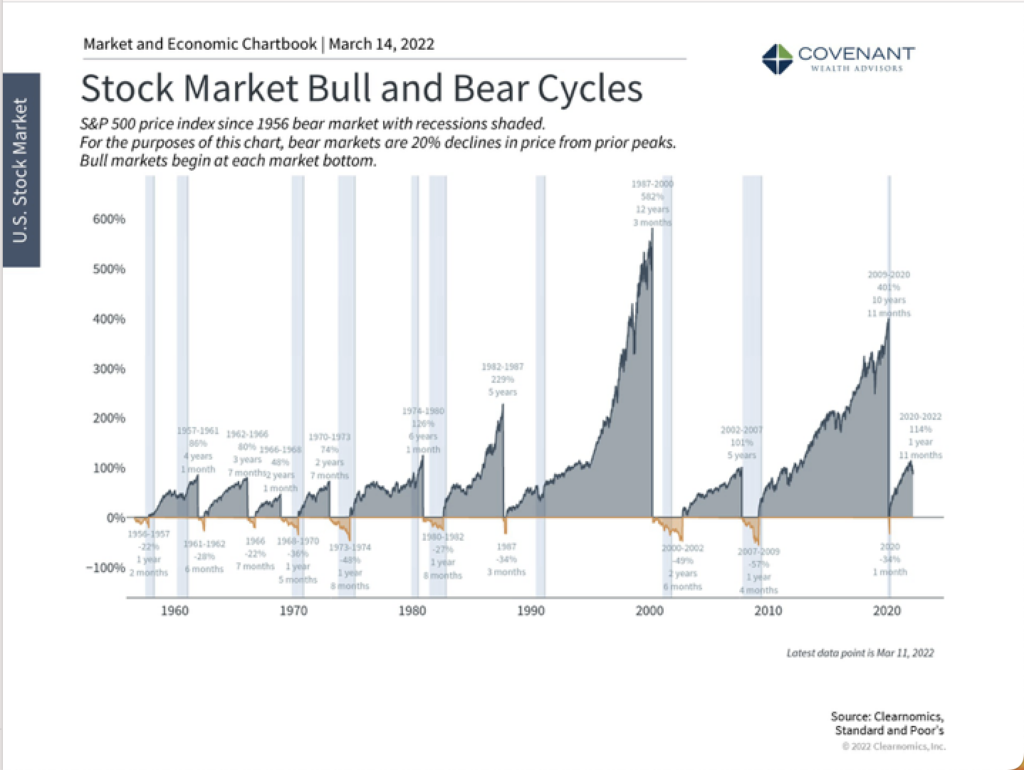

A second chart by Covenant Wealth Advisors shows the magnitude of recoveries versus bear market drawdowns:

Compare the size of the orange-shaded regions, which show bear markets, and the size of the gray-shaded areas, which represent market recoveries. The market recoveries dwarf the crashes both in terms of severity and duration.

hfgggf

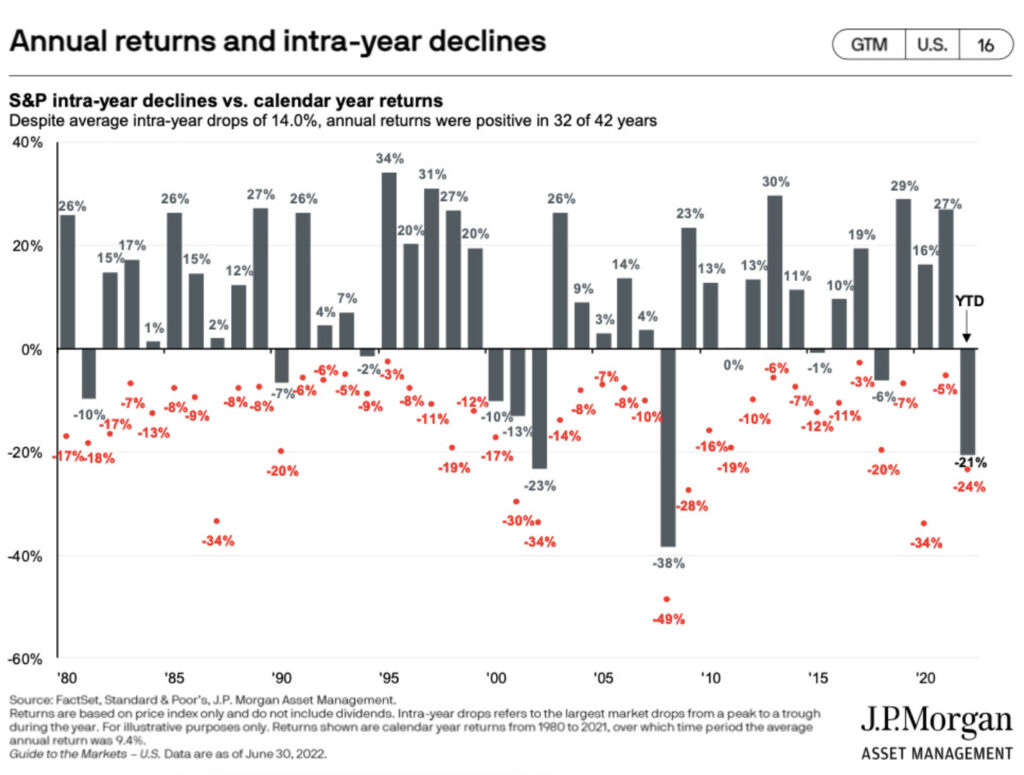

A third chart by J.P. Morgan Asset Management shows that I don’t have to wait for major corrections to get scared and sell. This chart shows annual returns and intraday-year declines:

Since 1980 the average intra-year decline has been -14%. Despite that fact, returns were positive in 32 of 42 years or approximately 75% of the time!

gjghgh

What’s the Point?

jfhhfhfh

The point I’m making is investing in the stock market will always involve risk.

It is a well-known investing principle that the greater the risk, the greater the return. There will always be declines in the stock market, and these declines can be severe, even in the short term.

Investors need to understand risk tolerance! It’s easy to be invested in the stock market when the market is rising. It’s much harder to stay invested in the market when the market is declining.

This has a lot to do with behavioral psychology. The emotional response to market losses is more intense than the emotional response to profits. This disparity between happiness with the stock market gains and sadness with stock market losses causes investors to sell when the stock market is declining.

Investors with a lower risk tolerance want to reduce the emotional pain they are suffering when the stock market declines.

In the final analysis, there are valid reasons to maintain a cash position. However, these valid reasons do not include selling stocks when the market is declining to avoid pain, or with the idea of timing the market.

Because markets eventually recover, a much better long-term strategy is to purchase stocks while they are on sale or to re-balance portfolios during the decline, which will effectively have the same result as purchasing stocks while they are out of favor.

Final Thoughts

- In the stock market, the most important organ is the stomach. It’s not the brain.

- It’s important to remember that the stock market is the only market where everybody runs out the door when everything‘s on sale!

- Cash does normally not grow in value, and is subject to inflation and taxation.

- Stock markets will always rise and fall. The ability to tolerate market volatility is directly related to each individual’s risk tolerance.

- Rebalancing portfolios during market declines is a good strategy, as rebalancing purchases stocks when they are on sale. Rebalancing also gives investors the feeling they are doing something proactive to combat the effects of market declines.

GNHGHGH

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS