hjghghgh

A recent article decried the use of the Roth IRA versus the Traditional IRA. I will not disclose the article’s title, nor the author’s name, because I strongly disagree with much of the information provided.

Instead, I will attempt to provide alternative views and information to allow readers to make their own decisions. Many of the statements are quoted directly from the article and will be designated as from the author. I will take statements made in the article and attempt to provide contrasting information based on factual research.

Let’s start by defining the terms Traditional IRA and Roth IRA, and continue with an explanation of their basic differences.

Traditional IRA accounts (commonly known as Individual Retirement Accounts, but are technically termed Individual Retirement Arrangements) were first established in 1974 to provide a vehicle for workers to save money in a tax-sheltered account with before-tax dollars. Money invested in a traditional IRA grows tax deferred. No taxes are paid on either the principal or the earnings in a Traditional IRA account until funds are distributed.

Roth IRA accounts were created by the Taxpayer Relief Act of 1997. Roth IRAs are funded with after-tax dollars. This means money used to fund Roth IRA accounts has already been taxed. Neither principal nor earnings in a Roth IRA account is taxed at distribution with proper compliance with Roth IRA distribution rules. This effectively means that once money is placed in a Roth IRA account, it is never subject to taxation again!

The attraction of never paying taxes again on principal or earnings in a Roth IRA is the biggest draw to Roth IRA accounts. It is also the biggest point of contention of the author in the article referenced. In his article, the author states that only 9% of investors actually benefit from funding Roth IRA accounts, and this number is inflated. He went on to state that Roth IRAs are only beneficial to 0.2% of workers.

fhhgfhhg

Who should put their money into a Roth IRA?

Author’s statement: If you’re early in your earning years, contribute heavily into retirement, and plan to withdraw far more in retirement each year than you earn today—you should likely contribute to a Roth IRA.

This author’s response: The group above represents the author’s 0.2% of workers who would benefit from funding a Roth IRA. My first point of contention comes from a further statement: “This is precisely what the Roth IRA does. It forces you to pay taxes today and at a likely higher rate than you would in retirement.” The author’s argument is that the government is happy to have workers pay more and higher taxes now than paying fewer taxes at a lower rate in retirement when earned income declines.

The statements the author makes are highly suspect because:

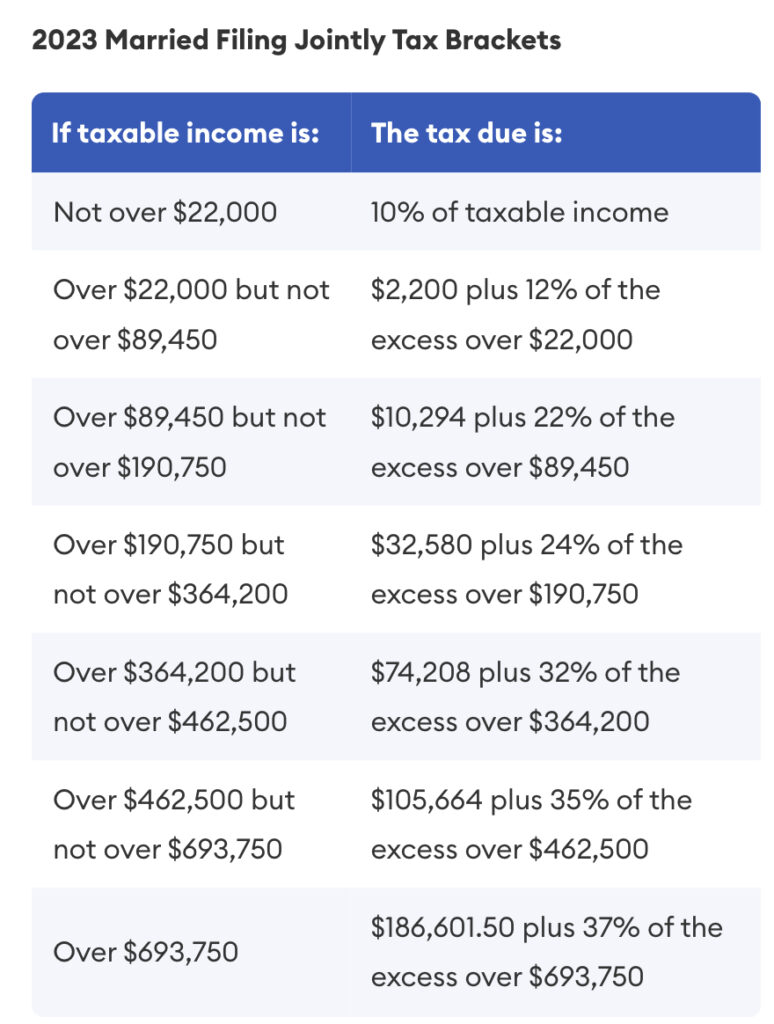

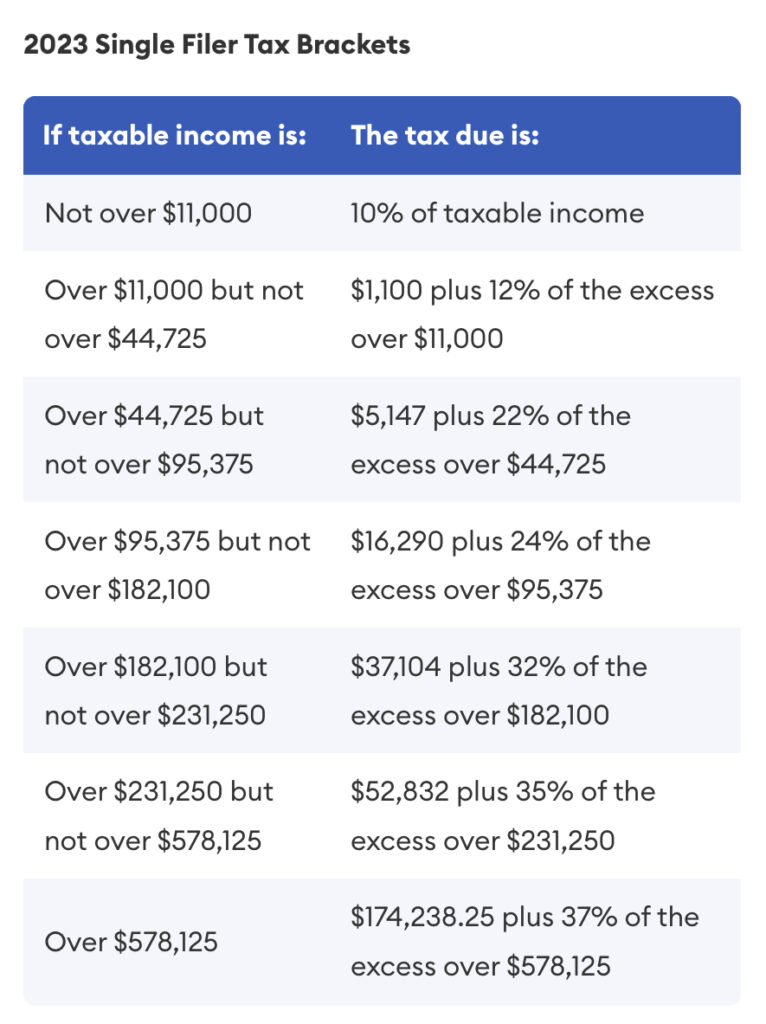

Young workers can actually make significant Roth IRA contributions with very little, or no tax implications. The following charts from Forbes detail 2023 Federal tax rates for taxpayers who are single and taxpayers who are married and filing jointly.

A 20-year-old, single taxpayer with a salary between $44,725 and $95,375 can make a Roth contribution in the amount of $6,500 and pay a maximum tax rate of 22% (a tax increase of $1,430.) I don’t know about you, but I don’t know many 20-year-olds, making more than $95,000 per year; and a 22% marginal tax rate is not egregious.

Let’s assume this same 20 year old instead, makes an annual traditional IRA contribution of $6,500 while in the same 22% bracket. Instead of paying an additional $1,430, he will save $1,430 in tax payments. The same $6,500 annual investment in a Traditional IRA receives an 8% average return (This is a conservative estimate as the average return of the S&P 500 has been approximately 10.53% over the last 50 years.) Over the next 55 years would have a terminal value of almost $6,000,000! The taxpayer’s MRD (minimum required distribution) for the first year at age 75 would be approximately $244,000. Using current tax brackets in order to compare apples-to-apples results in a terminal 35% tax bracket. This tax bracket only includes the $244,000 from the MRD of the Traditional IRA. Other earned income, investment income, pension income, rental income, or up to 85% of Social Security income would be taxed at ordinary rates and would also be subject to a 35% tax hit.

As you see per the example above, at age 75 this same single worker would actually be subjected to higher taxes, not lower taxes. This example does not factor in any earned income, or other investment income, which would only make things worse, and also assumes that tax rates will remain at their current levels.

With The current level of the National Debt (currently over $32 trillion) and the expiration of the Tax Cuts and Jobs Act of 2017 in 2025, it’s hard to imagine tax rates declining in the foreseeable future. Both the other author and I make certain assumptions. But, it’s hard to dispute the double whammy of higher potential tax rates and forced income increases through MRDs. High MRDs and higher tax rates would mean more future tax pain and tax payments, not less!

hghghghhg

So would the government want you to defer your taxes and pay them later?

The author stated: Of course not. They’d like their money today, and they’d like to see more money rather than less. This is precisely what the Roth IRA does. It forces you to pay taxes today and at a likely higher rate than you would in retirement. What a great deal for the government and a horrendous deal for you, the taxpayer.

This author’s response: Contributions to IRAs, either Traditional or Roth, are not a tax avoidance strategy. You, as a taxpayer, will pay taxes either now or later. The government gives you the choice to pay taxes now with contributions into a Roth IRA or pay taxes later with contributions into Traditional IRAs as funds are taxed later in life when distributed. No one is “forced to pay taxes today and at a higher rate higher rate than you would in retirement.” Taxpayers who choose to contribute to either Roth IRAs or Traditional IRAs are under no pressure to initiate or use either account. Using the statement that tax rates will be lower in the future during Retirement is disingenuous, as that information is currently unknowable. Tax rates could be lower or higher in the future. Funds contributed to Roth IRA accounts are taxed at current rates, and future tax rates become irrelevant as Roth accounts pay no future taxes on principal or earnings. Many taxpayers would rather pay a known tax rate now versus unknown tax rates at some point in the future. The illustration above showed that income from MRDs may actually increase retirement income instead of decreasing retirement income, which would also adversely affect taxes.

hghghhghhhg

What are the disadvantages of a Roth IRA?

Author statement: Most people will earn less in retirement than they do today.

This author’s response: The author’s statement is true in the fact that once a person retires their earned income declines. But, as shown above, that doesn’t mean total income declines. Many people find that total income in retirement increases due to the combined effects of outside investment income, Social Security income, pension income, rental income, or MRDs.

jghghghjhjghj

You’ll be paying a higher tax rate now than you will in retirement.

Author’s statement: If you earn $122,000/year now and make the same amount in retirement, you’re effectively paying 22% tax today to invest in the Roth to save 9.8% in retirement.

This author’s response: The above statement has been effectively debunked and explained above.

jhjhghghhg

Many retirees today pay nearly nothing in taxes.

Author’s statement: According to the Census Bureau Population Reports, the median income for households aged 65 and older is $47,620. The effective tax that the average retiree pays is 4.2%.

This author’s response: based on the Census Bureau Reports, 50% of the population has an income of $47,620 or less. This means that 50% of the population has an annual income of $47,621 or more. The higher the income, The higher the marginal tax rate becomes. And, at least 50% of the population have incomes higher than $47,620.

gjjgjjg

Survey methodology.

Author’s statement: The author based his survey results on a survey of 635 individuals. He stated: “We received responses from 167 Gen Zers, 288 millennials, 94 Gen Xers, and 86 boomers. Of the 635 respondents, 370 were men, 264 were women, and one declined to answer.”

This author’s response: Sorry! A survey based on a sample that represents 0.000189% of the American population does not instill confidence in the results of the survey.

hghhghhg

What does all this mean?

jgjjhghhhhg

- Disclaimer- I am a believer in the tax benefits of Roth accounts, and have done significant Roth conversions over the years. I still maintain a traditional IRA account and believe that there is a fundamental role for both account types in a well-constructed retirement plan.

- Like most things related to retirement, the relevance and utility of the information presented will vary by individual.

- Roth IRAs eliminate forced RMDs that are associated with traditional IRA accounts. They are or no RMDs at any age associated with Roth accounts. (The Secure Act 2.0 has eliminated RMDs associated with Roth 401(k) accounts.)

- Roth IRAs can be a very effective tax and estate planning tool.

- Because Roth IRAs can be passed to heirs without tax implications, they are a very effective legacy strategy. Does inheriting a Traditional IRA with its associated distribution rules and tax implications benefit heirs, or does it primarily create tax headaches?

jgjjjgjjgjg

Next year I will begin MRD distributions from my Traditional IRA Account. Since I did extensive Roth conversions earlier in my retirement, my future MRDs will be very moderate. Without Roth conversions, my financial picture would be totally different.

The combined effects of Social Security payments, earned income, investment income, and MRDs (if not converted to Roth accounts) would create huge financial and tax implications going forward.

Because I completed these early Roth conversions, I now have much more control over my financial future and tax situation. Delaying Social Security payments until age 70 means that I now receive approximately 32% more in benefits each month, but also means that I have more potential taxable income.

Each Individual must decide what will provide the best outcome for their particular Retirement needs. Contrasting information was provided to help people in deciding whether Roth conversions make sense for their needs.

jfhhhfhhfhf

Final Thoughts

ghjfhfghghghf

- Weighing the pros and cons of Roth IRAs versus traditional IRAs is an ongoing discussion.

- There is no one-size-fits-all rule applicable to every person or every situation.

- Neither principal nor earnings in a Roth IRA account is taxed at distribution. This effectively means that once money is placed in a Roth IRA account, it is never subject to taxation again!

- Contributions to IRAs, either Traditional or Roth, are not a tax avoidance strategy. You, as a taxpayer, will pay taxes either now or later. The government gives you the choice to pay taxes now with contributions into a Roth IRA or pay taxes later with contributions into Traditional IRAs as funds are taxed later in life when distributed.

- Many taxpayers would rather pay a current known tax rate and place funds in Roth accounts versus unknown tax rates at some point in the future when funds placed in Traditional IRA accounts are distributed.

- My personal situation has dictated that conversions into Roth accounts have been very beneficial financially. Each person must decide if Roth accounts will provide the same benefits.

hfhghfh

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS