fhfhhhfhhf

hfhhfhjhfjjf

In a recent Blog and Podcast I wrote and spoke about the merits of Dollar-Cost Averaging. See: INVESTING IN REGULAR INCREMENTS.

Another popular investing strategy is called Lump-Sum Investing. Both lump-sum investing and dollar-cost averaging are valid investment approaches. But, is one approach better than the other?

dhdghdhgdhgd

Is Dollar-Cost Averaging Better Than Lump-Sum Investing?

What do these two terms mean and what’s the difference?

Lump-Sum Investing puts all available money into the market at once, while Dollar-Cost Averaging spreads investments out over a period in regular installments.

In an ideal world with a rising stock market, research indicates that lump-sum investing will outperform dollar cost averaging. Since the stock market averages rise three out of four years, lump-sum investing seems like the clear winner.

End of blog and podcast!

fgfgfgggf

Shortest Blog and Podcast Ever?

I guess this would be my shortest blog and podcast ever if we lived in an ideal world where the stock market rose every year.

But, we don’t live in an ideal world, and the stock market doesn’t rise every year. Like most other investing principles, there is much subtlety and nuance in determining which approach is better in a particular situation.

fhfhhhfhhf

I’ll start the discussion with a personal situation. I did my final Roth conversion in December 2019. Before this conversion, I sold all remaining positions and went to an all-cash position. (It is possible to do an in-kind Roth conversion without selling securities, but in this particular situation, being in cash would make allocating funds in the Roth IRA easier).

I started the 2020 calendar year with a large cash position and an important decision to make. Would I invest this large cash position in a lump sum, or would I make several smaller investments?

Ultimately, I decided to make 12 equal investments into the stock market.

Why?

The stock market was at a high point in a bull market and I feared a market downturn!

I would also be paying taxes on every dollar of the Roth conversion. I hated the idea that my portfolio value could potentially decrease in addition to paying taxes on the Roth conversion.

What do I mean?

The amount of the Roth conversion added to other income meant that at least 30% of the converted amount would be lost to taxes. Taxes for the Roth conversion were paid from an after-tax brokerage account. Taxes were a big factor, especially if taxes due were added to a market decline.

For example, if the converted amount is $400,000 and the tax rate is 30%, then $120K in value would be lost to taxes. A stock market decline of 20% means that the $400K converted amount would drop in value from $400K to $200K (considering both taxes and market decline.) OUCH!!!

In January I made the first allocation of the Roth conversion cash into the stock market. This was January of 2020. The next month COVID started and everyone quickly thought the world was coming to an end!

In early February I made another cash allocation in the stock market. I wasn’t aware at the time that stock market valuations were near their peak in mid January.

The 2020 bear market, triggered by the COVID-19 pandemic, started around February 19, 2020, with the S&P 500 peaking, and officially hit bear territory (a 20% drop) by March 12, 2020, bottoming out on March 23, 2020, marking one of the fastest market slides ever, with the S&P 500 losing approximately 33.9% of its value in just over a month.

In mid-March with the market decline over 30%, I invested the remaining 80+% of available cash into the bear market. The market recovered all losses by August of 2020, and I was up over 30% in approximately five months.

By employing a combination of dollar-cost averaging and lump-sum investing, I was able to minimize regret and maximize return on investment in my Roth IRA.

dhhgfh

This brings me back to my original statement! We don’t live in an ideal world, and the market doesn’t always go up.

fggfggfg

A lump sum investment in January would have recovered lost value by August and would have been better off in several years. This would be a correct statement.

The psychological damage from investing such a large sum of money, having to pay taxes on that amount, and then watching it drop by approximately 34% in two months would have been devastating and most likely permanent!

In this example, I experienced a 30% profit in five months and felt like a lottery winner!

Research indicates that lump-sum investing is a better strategy when the stock market is rising. On average, the stock market rises approximately three out of every four years making lump-sum investing appear to be the clear winner!

However, lump-sum investing does not consider the behavioral and psychological costs of investing in a declining or bear market. Declining market conditions are where dollar cost averaging shines.

fbgfgggf

Research indicates that dollar-cost averaging produces better results and more investment shares in a declining or bear market.

fgfghhhf

Let’s look at the following example while evaluating Warren Buffett’s thoughts:

“Warren Buffett Called Dollar-Cost Averaging ‘the Dumbest Thing in the World.'”. This sentiment typically applies to investors with large lump sums of cash who invest all at once. Historical data suggests lump-sum investing can sometimes yield slightly higher returns because markets rise more often than they fall. However, even Buffett advocates DCA for most average investors who invest a set amount from each paycheck.

From Hartford Funds:

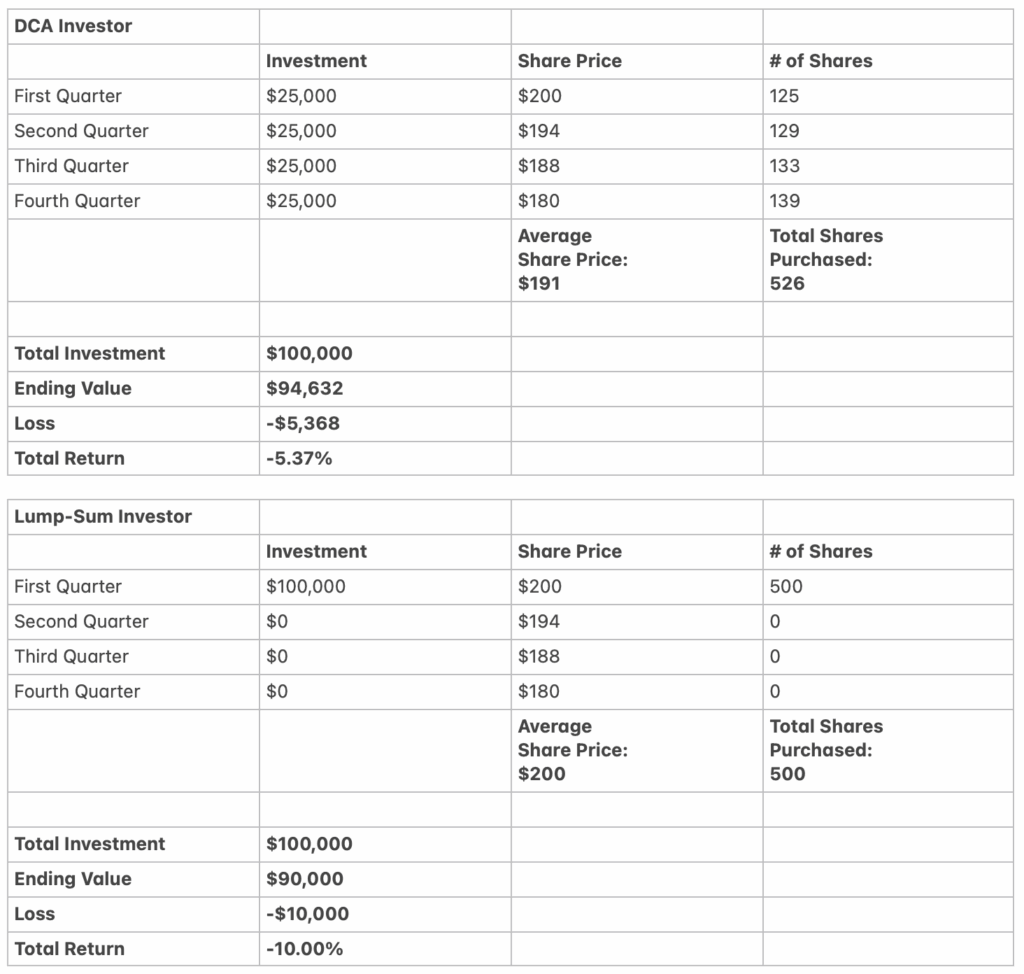

Scenario 1: Market Decreases in Value

The scenario below contrasts investing $100,000 using DCA vs investing a lump sum when share prices are falling over one year.

Past performance does not guarantee future results. Ending values may differ from totals provided due to rounding. The performance shown above is for illustrative purposes only. Source: Hartford Funds, 4/25.

The investor who used DCA fared better because the average share price ($191) was lower than the lump-sum price ($200).

fhfhhfhf

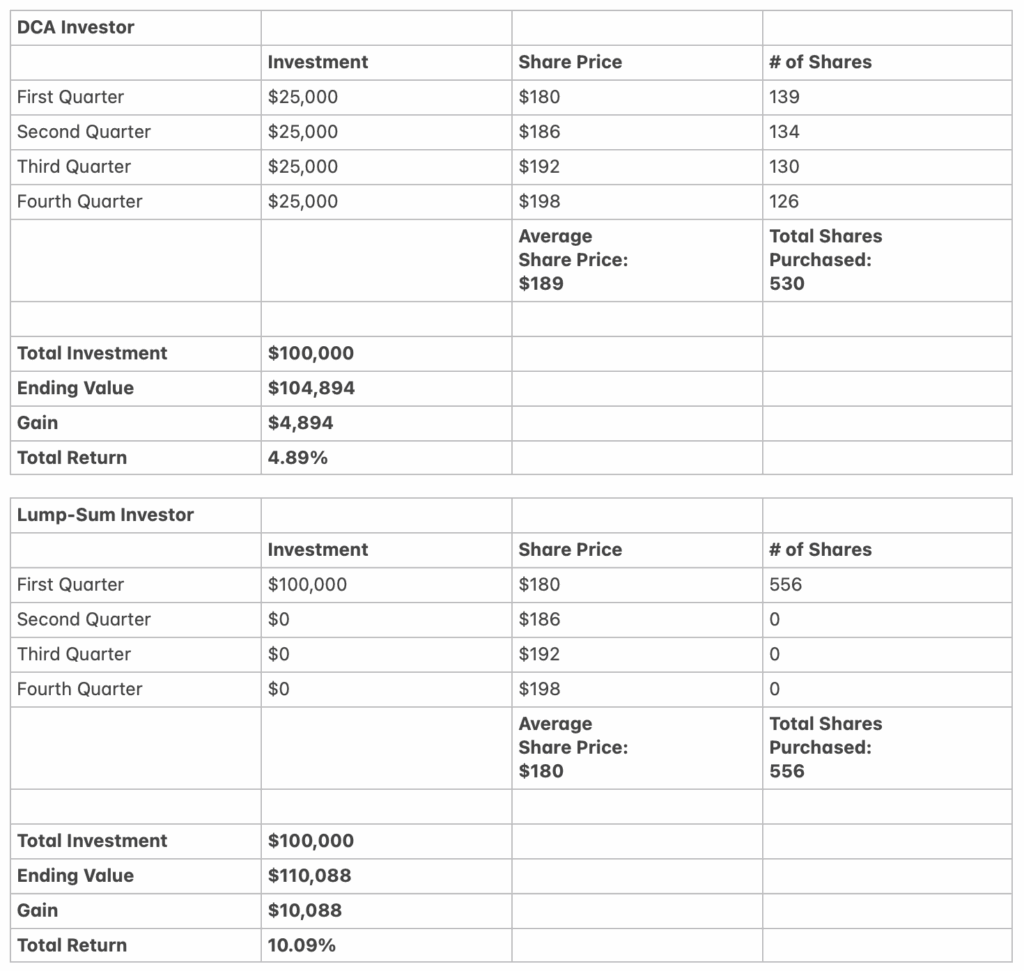

Scenario 2: Market Increases in Value

The scenario below contrasts investing $100,000 using DCA vs investing a lump sum over one year when share prices are rising.

Past performance does not guarantee future results. Ending values may differ from totals provided due to rounding. The performance shown above is for illustrative purposes only. Source: Hartford Funds, 4/25.

The investor who used DCA fared worse. The average share price for DCA was more ($189) than the lump-sum share price ($180), and the total number of shares using DCA was fewer.

dhdhjhd

Empirical proof that shows over one year that lump-sum investing outperforms DCA in a rising market, while DCA outperforms in a falling market.

The two questions that every investor must consider are: how soon is the money needed (what is the time horizon), and how tough are you mentally (What’s your risk tolerance)?

What happens if the market declines initially after making a lump-sum investment? Research indicates that over long periods lump-sum investing will still outperform DCA. An investor’s time horizon must be long enough to overcome initial losses.

A DCA approach has an associated opportunity cost. Cash is held for long periods in lower-earning cash accounts. This holding period decreases returns, and multiple investment periods may increase fees or costs.

An investor’s risk tolerance must be high enough to withstand investing a large amount of money and then watching the value decrease. An investor must be able to resist the temptation to sell after the value of the Investment drops. It has been shown that the pain of loss is much greater than the joy of gains in the stock market.

fhfhhhfhf

So, the answer to the question will depend on the individual investor. I have successfully used both of these approaches and my opinion is based on experience.

For the majority of my practice career, I used a dollar-cost averaging approach. I periodically invested regardless of market conditions and valuations. As stated above, I have used lump-sum investing to maximize a one-time investment.

hyfhyhyfhyf

My risk tolerance has declined because my time horizon has shortened.

Earlier in my investing career, I had no reservations about investing lump sums of money when my time horizon was longer.

fhfhghhfhf

fhhhfhhhf

Final Thoughts

Dollar-cost averaging is a great approach for most investors because it removes emotions from investing, fosters discipline, and is a proven way to grow wealth. Research has also shown that dollar cost averaging works best in a declining market.

Lump-sum investments have outperformed DCA over long periods. The concern with lump-sum investing is that the investor must have a higher risk tolerance to overcome the tendency to sell if valuations decline immediately after making the lump-sum Investment.

Most investors have a lower risk tolerance than they perceive! Unfortunately, most investors don’t realize the limits of their risk tolerance until they face difficult decisions.

In the final analysis, if you are a long-term investor with a high risk tolerance, then lump-sum investing will provide the greatest return.

If you are an investor with a lower risk tolerance who is looking for a consistent approach that removes emotion from investing and will build wealth over time, then dollar-cost averaging is probably the best approach for you.

duduudfufd

fhhfhhf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS