Recently my daughter asked about the best places to park money for a short period of time. (Normally a holding period of two years or less is considered short-term.)

Because of the question that inspired this post and all the help I received to get to this point, I’m dedicating this Blog and Podcast posting to my daughter and her husband who have both been instrumental in the inception of the RWE Website, Blog, and the RWE Podcast.

My daughter’s concern with short-term investment vehicles (Short-Term Parking) was losing the higher returns generated by longer-term investments.

Why would someone consider placing money in an account earning a nominal return when other accounts generate much higher average returns? The problem here lies with the word “average.” If you add: (2)+(-2)+(-2)+(-2)+(-2)+(10)+(10)+(10)= 24

Then divide twenty-four by eight (24 divided by 8 = 3), you end up with an answer of three.

If each of the numbers in this eight-number sequence represents an annual return percentage, then the average annual return is 3% even though the majority of annual returns are a negative two percent. Four of the eight returns represent a negative annual return. So, in four of the eight years of investing the return was negative even though the average return is 3%.

Let’s return to the problem of the short-term placement of money. When seeking higher returns for short-term funds the concern is the sequence of short-term returns.

In the previous example, three of the annual returns were 10%, and four of the annual returns were -2%. So in a two-year period the sequence of returns could potentially be a positive 20% or a negative 4%. The future sequence of returns on any investment is unknown and that presents a problem for short-term investing.

The primary concern with short-term investments is not the return on investments, but the return of investments. When you need a certain amount of money in a short period the greatest concern is not gaining the highest return, but the return of all needed capital. (Making a gain of 20% would be wonderful, but losing 4% of the needed money would be less wonderful!)

This represents the NO PARKING zone. The worst thing that can happen is losing money that you’ll need shortly because of a negative short-term return sequence.

When positioning short-term funds preservation of capital is the highest priority, with higher investment returns occupying a distant second place.

The bottom line is that monies needed soon should be placed in the safest vehicle possible, with a lesser emphasis placed on return.

For investment options of one year or less, the main considerations should be safety and utility.

jfjfjfjfjfjfjffj

The following list is based on the safety and utility of funds needed in one year or less:

*Bank Checking Account- a bank checking account is normally the easiest and simplest place to park short-term funds. Most people have a checking account and adding to or withdrawing from this account is quick and easy. Checking accounts are FDIC insured with very low risk. Checking accounts may or may not have an interest rate feature. In either case, the interest earned is normally very low, but the account has a high degree of safety.

*High-yield savings accounts – a high-yield savings account is a good alternative to a bank checking account, which typically pays little or no interest. Savings accounts are normally insured by the FDIC (Federal Deposit Insurance Corporation) at banks and by the NCUA (National Credit Union Administration) at credit unions. These accounts provide a higher return than checking accounts, are easier to use and are insured.

*Money market accounts – money market accounts are offered by banks as an additional kind of bank deposit. Money market accounts are usually, but not always FDIC insured, so it is important to verify insurance before investing in a money market account. Funds in money market accounts provide easy access and offer a higher rate of interest than checking accounts offer. Some money market accounts impose restrictions on withdrawals.

*Cash management accounts – cash management accounts are usually offered by online brokerage companies. It is another type of liquid cash account that allows easy and quick access to funds. Cash management accounts also pay interest on funds invested. Usually, cash management accounts provide insurance on funds deposited, however not all cash management accounts are FDIC insured.

*Money market mutual funds – money market mutual funds differ from money market accounts. Money market mutual funds invest in short-term securities, and since it is a mutual fund there are expenses that the mutual fund company deducts from the interest received on the account. Money market accounts are generally very safe, but are not FDIC insured, and could potentially lose money in extreme market conditions. There may also be limitations on withdrawals.

*Treasurys– treasurys come in three varieties: T-Bills, T-Bonds, and T-Notes, and are backed by the US federal government. Treasurys are a type of bond, with risks and rewards differing by bond. Treasurys are not FDIC insured, but are backed by the US federal government and are considered safe. Treasurys are less liquid than other short-term investments. However, they can be bought and sold on any day the market is open.

*No-penalty certificates of deposit- certificates of deposit are time deposits in which a depositor agrees to hold money in the account for a specified period ranging from weeks to years. Funds can be withdrawn without penalty before the CD matures. CDs are FDIC-insured. CDs are also typically less liquid, but No Penalty CDs allow you to withdraw funds early and this eliminates most of the illiquidity.

*Short-term US government bond funds – Short-term US government bond funds provide a diversified portfolio of bonds and are considered low risk. Bonds issued by the federal government and it’s agencies are not FDIC insured, but by the government’s promise to repay the money. Because US government bonds are backed by the full faith and credit of the United States these bonds are considered very safe. US bonds will pay a reasonable rate of interest, but not as much as corporate bonds. US bonds are highly liquid and can be bought and sold any day the stock market is open.

*Short-term corporate bond funds – Short-term corporate bond funds are comprised of bonds issued by major corporations to fund their investments. Corporate bond funds are considered safe and normally pay interest quarterly or semi-annually. Corporate bond funds are not insured by the government and can lose money. Corporate bond funds are diversified, which mitigates much of the risk incurred by investing in individual bonds, and can be bought and sold on any day the financial markets are open.

When evaluating the options listed above it will be noted that there are several short-term options, but the ease of use, safety, liquidity, and ease of access to funds should be the highest considerations. Most short-term investors would benefit by placing funds in Bank checking accounts, Bank savings accounts, and Bank money market accounts. (Although treasurys, bond funds, and CDs are listed, these may be more appropriate for a two or three-year investment horizon.)

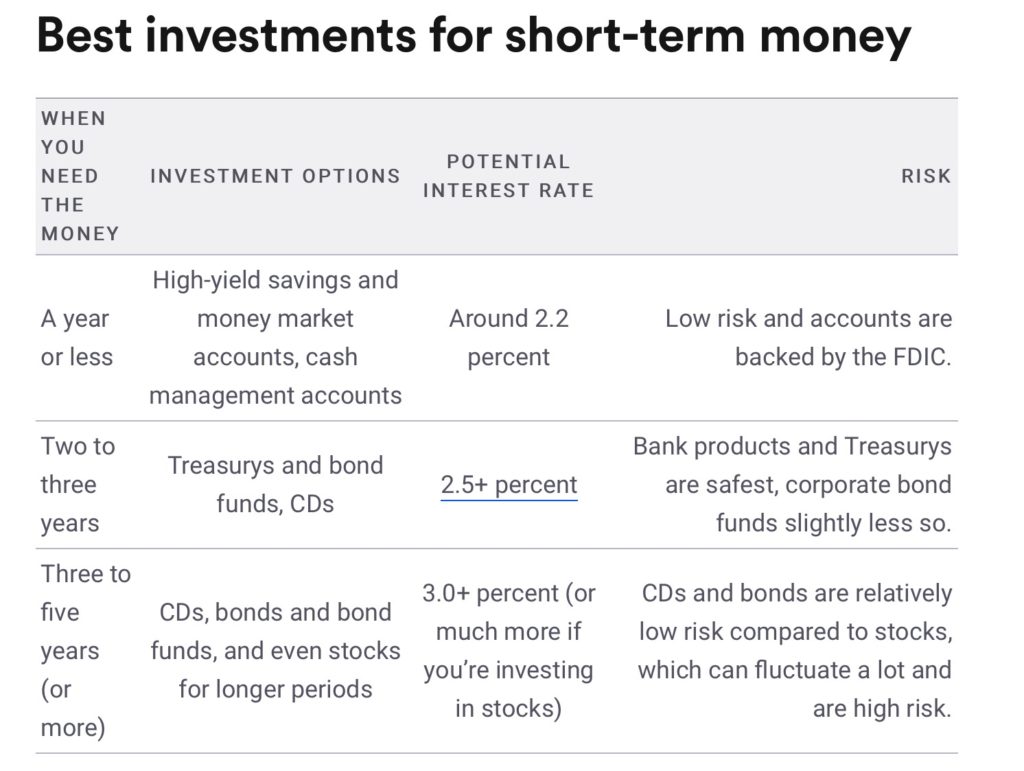

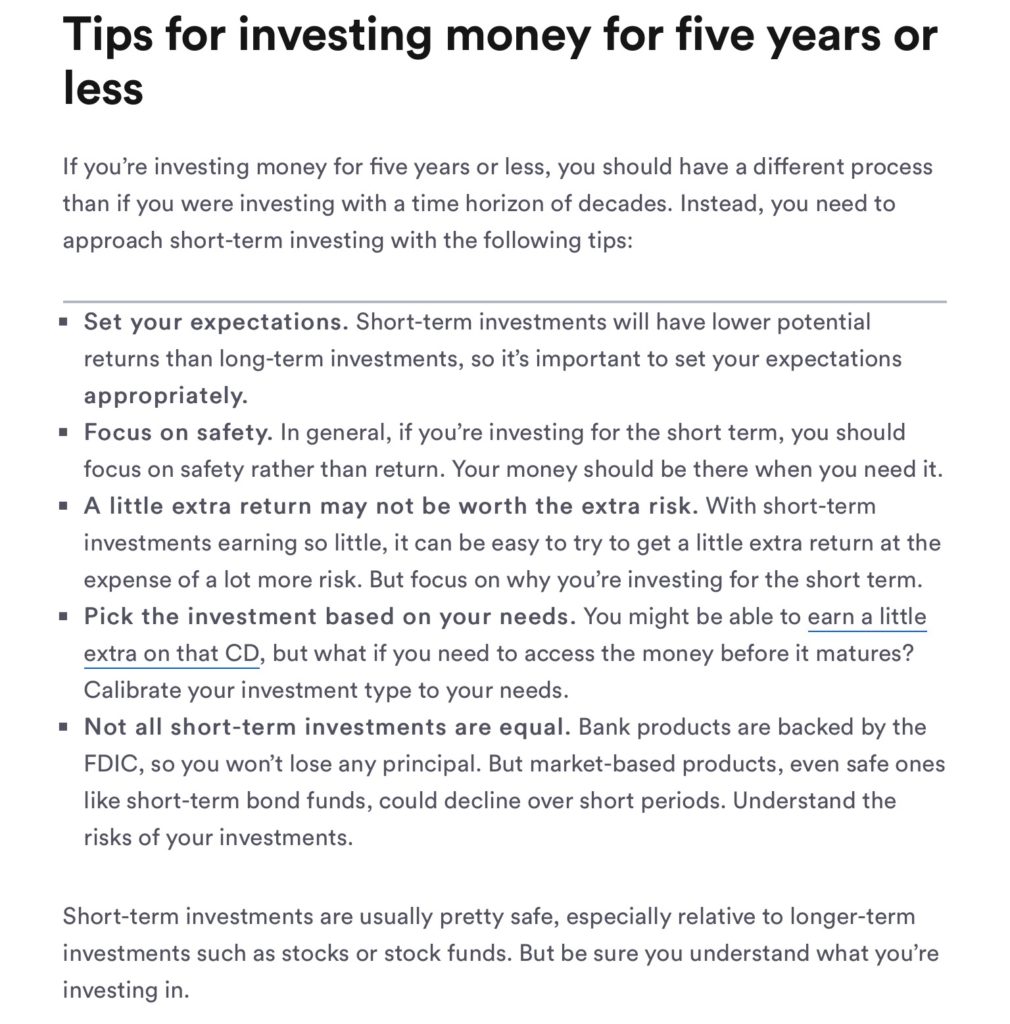

Included below are two tables provided by bankrate.com which summarize the information provided above:

Thanks for reading this post.

My next post will discuss retirement travel.

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS