One of the biggest reasons people continue to work when otherwise able to retire is work-related healthcare coverage. In my blog titled: HEALTH CARE AFTER WORK different healthcare options for early retirees were evaluated.

This blog will discuss different means for modification or reduction of work obligations when approaching retirement.

NEED FOR FLEXIBILITY

According to a 2021 article written by Anna Rappaport for the Society of Actuaries:

For workers at or near retirement age, flexibility is important, and they are much more likely to continue working if flexible arrangements are available. Flexibility can be a win-win for individuals and businesses. For many firms, there is a great value to having some workplace flexibility and the ability to have access to experienced people who know the firm.

Flexible arrangements can help with:

• Scheduling work for organizations such as retail, health care, and food service that can have long hours and varying workloads at different times of the day or week.

• As businesses have become much leaner in their staffing, often the one-time projects that formerly were assigned to regular staff pile up, and there is a need for someone to do them.

Work and the Retirement Journey

• Some organizations need to replace a worker who is gone for a day. For example, a substitute teacher is needed in the classroom when the regular teacher is gone.

• Some businesses are seasonal, such as toys and cosmetics where a large part of the year’s output is needed for Christmas, and tourism, which has a different busy season depending on location. Farming is also seasonal, and it has different types of work at different times of the year. Health care also is influenced by seasonal forces.

• Some businesses may have a temporary increase in workload, in situations where they get a major contract for a limited period. Others may have event-related peaks. After major storms or fires, there is a need for insurance adjustors, utility workers to restore power, people to repair damage, short-term help for people displaced, etc. Fires may also require extra help to fight the fires.

• During COVID-19 or other events that encourage sheltering in place, there is an increased demand for delivery people and for those who do grocery and other shopping through shopping services.

• Retaining people who have personal or caregiving obligations that require a reduced schedule, often on a temporary basis.

• All businesses need to have a way to temporarily replace the employee who is gone for several weeks or months but who will return.

Managing Flexibility

Note that some needs are predictable well in advance, and others are not. A replacement will be needed on very short notice for the teacher or nurse who calls in sick. Seasonal needs can usually be predicted in advance, but a farmer will not know exactly when it is the right time to plant or harvest since conditions can change.

Flexible arrangements can be available to all employees, they can be limited to certain job classes, or they can be on a discretionary basis only. Some flexible arrangements are available only with individual approval. The people strategies should include the approval process defining who can sign off on specific arrangements and whether they must follow pre-approved designs, or whether they can be individually negotiated.

Flexibility may apply to the amount of work, place of work and scheduling of work. Types of flexible work arrangements include part-time work, telecommuting, contracting, rehire of retirees, flexible hours, use of retiree pools, and use of people to work on limited projects. The individuals doing the flexible work may be employees, contractors, or work through a temp agency or consulting firm. Ms. Rappaport also stated that some examples of retiree pools encountered during many years of research on these topics include:

- Informal pool– human resources keeps a box of index cards on retirees interested in temporary work.

- Formalized pool- the company maintains a formalized pool for temp assignments, with retirees encouraged to participate.

- Formal specialized pools such as substitute teacher pools, claim examiner pools, utility worker pools, nursing pools;

- Organizations specializing in matching caregivers to those who need care and managing them. Pools can be limited to one employer only, or to a group of employers, or to anyone who wants to access them. They can be managed in-house or management can be outsourced.

Work and the Retirement Journey. Copyright © 2021 by the Society of Actuaries

dhdhdhdhdhhdhdhdh

The flexible work arrangements that work well for phased retirees may work well at all ages. However, there may be some different issues when working with experienced employees.

WANTED: FEWER WORKING HOURS

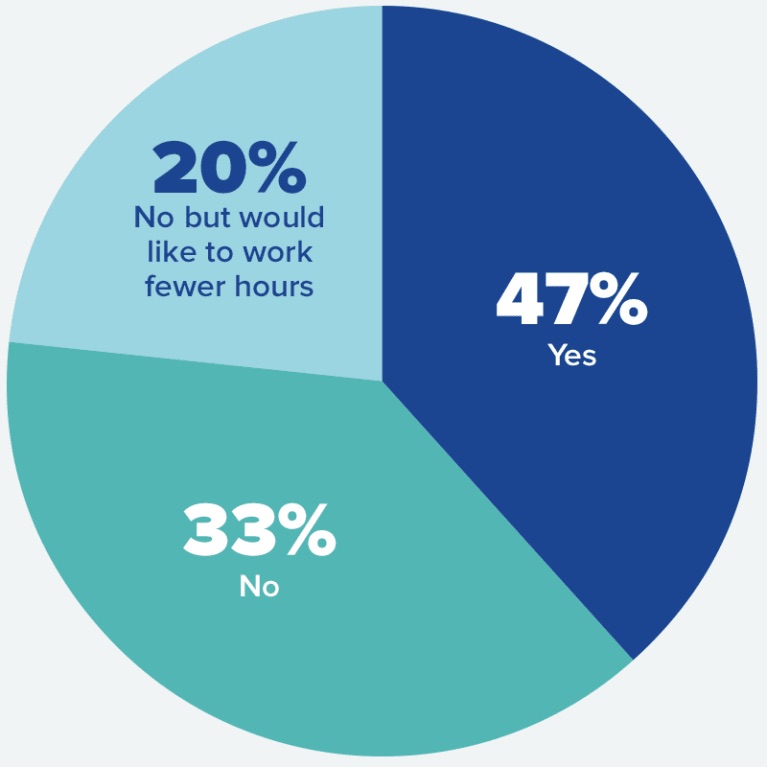

A survey asked 1,032 working seniors ages 65 to 85 (with an average age of 67) if they’d like to retire.

More than 60 percent said the decision to keep working was based on finances, while 38 percent said staying at work was a personal decision, for instance because they enjoy working or want to avoid boredom.

Source: Provision Living poll conducted in August 2019.

PRE-RETIREMENT WORK OPTIONS

The following list of pre-retirement job options is not to be considered exhaustive, but used as a pathway to thoughtful consideration of possible late-career job transitions:

- Quitting work- Some people decide they’ve had enough of work and just choose to quit altogether. This is likely the path of least resistance and requires only one work decision. The biggest decision that has been expressed is how and when to give notice of retirement. Other decisions expressed were the creation of a retirement income stream, and health care before Medicare coverage.

- Work sabbatical- Employees may choose to receive time off in the form of a sabbatical. (A sabbatical is a period of paid leave granted to a university teacher or other worker for study or travel, traditionally one year for every seven years worked.) This is a longer period of leave provided to a worker that may or may not be paid and provides time for a worker to recharge and re-assess their career options. A sabbatical gives workers time to decide whether to continue working or retire. A sabbatical also gives someone the chance to give retirement a trial run without giving up employment.

- Remote work- workers have quickly come to love remote work (commonly referred to as working from home.) With the advent of the Internet and advanced communication technology workers can work away from the traditional office setting while still in constant communication. But, the greatest benefit of remote work would be the ability to work from any site. The worker is not limited to their home but has the option to travel and work from remote sites away from their homes. This allows some workers to combine meaningful travel while fulfilling work obligations simultaneously.

- Hybrid work- as a byproduct of the coronavirus epidemic, workers are exploring the option of continuing to work part-time at home, while re-instituting part-time work at their place of employment. This hybrid style of work has gained popularity with employees more than employers who are encouraging workers to return to the job site on a full-time basis. The ability to work a hybrid work style may eventually become a thing of the past as employers now encourage more traditional work models.

- Phased retirement- Phased Retirement is a method of work reduction that is much sought after presently. However, according to an article written by Stephen Miller, CEBS for the Society of Human Resource Management in 2019: For many workers, easing into retirement is an expectation that is never realized. Among workers in the U.S. ages 61 to 66, roughly 29 percent said they had planned to reduce their work hours as they transitioned to retirement, but fewer than 15 percent subsequently reported that they were partially retired or were gradually retiring from their jobs, according to a 2017 report by the U.S. Government Accountability Office. The agency relied on the University of Michigan’s biennial Health and Retirement Study of Americans over age 50, which had more than 12,000 respondents. An August 2019 survey by Provision Living, a provider of senior living communities, found that among 1,032 working seniors ages 65 and older, 20 percent wanted to stay employed but cut back their hours. The availability of phased retirement is increasing—albeit slowly and often only for the most-valued employees. Among employers that responded to the Society for Human Resource Management’s 2019 Employee Benefits survey, the share of organizations offering some employees the option to phase into retirement through an informal program has risen steadily in recent years, reaching 15 percent. The prevalence of formal, phased retirement programs broadly available to workers, meanwhile, has stalled at around 6 percent, according to the survey, which was conducted earlier this year and drew responses from 2,763 HR professionals. Employers, the data suggest, prefer to limit phased retirement opportunities to high-performers and those with in-demand skills—which they can more easily do ad hoc. Among these large corporations, the survey revealed, “14 percent frequently and 41 percent sometimes have employees phase into retirement on an informal or case-by-case basis,” said Lauren Hoeck, senior director of retirement consulting at Willis Towers Watson. “The types of employees targeted by these approaches included those in professional, technical and manager positions more often than those in routine and manual positions.” LIMRA’s survey found that women are more likely to phase into retirement than men, including those in formal and informal programs. Twenty-five percent of female recent retirees phased into retirement versus 16 percent of male recent retirees, LIMRA found. “Men may be less likely to phase into retirement because it is more difficult to do so with their pre-retirement job functions,” the researchers noted. For instance, 23 percent of men worked in managerial jobs before retirement, compared with 13 percent of women.

- Same job/ different location- workers may seek a change of location while keeping similar work obligations. A change of location not only provides different scenery, but can also provide different hours, new co-workers, and renewed work energy.

- Different job/ same location- many companies allow workers to modify or change job descriptions rather than lose the worker’s skill and knowledge base altogether. An example would be companies that allow workers to move from managerial, or upper-level positions, to non-managerial, or lower-level positions. Another example would be workers who are allowed to mentor or tutor co-workers that will ultimately replace them in their current position.

- Different jobs/ different locations- although it is less common, some companies may allow workers to change job descriptions and job locations in an effort to retain skilled and in-demand workers.

- Different company/part-time- some workers may find it advantageous to discontinue work with one company and begin working on a part-time basis with a different company in the same or different work capacity. Workers in this position can negotiate hours, compensation, and benefits that would have been unavailable at their previous job. (Examples of in-demand jobs for seniors include: real estate sales, administrative assistants, sales jobs, driving jobs such as Uber, chauffeur, taxi and bus driving, providing child care, management consulting, financial managers, freelance writing, and people with musical skills can work as part-time musicians or singers.)

- Independent contractor/ consultant (same company)- Another viable option is to quit work with a company, then contract to the same company as an independent contractor, or independent consultant. The independent contractor in many cases will have the same or a very similar job description. The biggest difference is the contractor is no longer employed by the company but is now self-employed. With Independent contracting, the independent contractor can set hours, compensation, and duration of employment. The downside of contracting is independent contractors are normally responsible for health insurance, retirement benefits, liability insurance, and malpractice or “errors and omissions” types of insurance.

- Independent contractor/consultant (different company)- The same options are available for workers or owners who decide to quit working at one company and become a general independent contractor working for different companies. This type of contracting allows more flexibility with a greater variety of job descriptions and different work locations.

Note: Becoming an Independent Contractor after forming my own independent Contracting company is the career path that I chose. As the owner of an independent dental practice, I was able to transfer ownership of that practice to a younger practitioner and become an independent contractor after the practice sale. Since I was already operating as a Limited Liability Company (LLC) there was no additional legal work required. In the past eight years, I have done “Locum Tenens” dental contracting. (Merriam-Webster defines locum tenens as “one filling an office for a time or temporarily taking the place of another.”) Operating as an independent dental contractor I set hours and compensation. The dental practices provide office settings, staff, supplies, and patients. I provide malpractice insurance and guarantee that treatment will be personally provided. Over the last eight years, I have provided treatment in sixteen dental offices for periods varying from very short time frames to several years in duration. This has allowed me to continue practicing dentistry on a limited basis while helping dental offices in need.

As explained above, my late career occupation is a non-traditional career path in Dentistry. Innovative thinking and planning allowed me to continue providing dentistry in a non-traditional manner.

In the same vein, I have provided the list above to provoke thoughtful consideration. There are many different ways to reduce or modify work obligations while still retaining relevancy and work skills for anyone interested in late career work options.

Websites: You may also consider using websites to search for a job or a career that will let you ease into retirement. Here are a few to take a look at:

hdhhfhfhfhfhfj

Final Thoughts

- For many workers, easing into retirement is an expectation that is never realized.

- Twenty-nine percent of American workers said they had planned to reduce their work hours as they transitioned to retirement, but fewer than 15 percent subsequently reported that they were partially retired or were gradually retiring from their jobs, according to a 2017 report by the U.S. Government Accountability Office.

- In many cases phased retirement is limited to highly skilled or highly compensated employees.

- Options for part-time are limited only by imagination and flexibility.

hfjghhghghgh

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS