The Oxford Language dictionary defines a portfolio as a range of investments held by a person or organization.

Merriam-Webster dictionary defines a portfolio as securities held by an investor.

Combing the two meanings above: An investment portfolio is the set of securities or investments held by a person or organization.

jfjfjfjfjfjjfjfj

What are the Common Portfolio Types?

- The Aggressive Portfolio– seeks greater returns through higher-risk investments.

- The Defensive Portfolio– Also called a conservative or a capital preservation portfolio.

- The Income Portfolio– Concentrates on distributions and dividends to create a steady stream of income.

- The Speculative Portfolio– Uses the highest risk, uncommon and non-traditional investments.

- The Hybrid Portfolio– Diversifies across asset classes.

- ESG Portfolio (Environmental, Social, and Governance)– An investment’s ESG score measures the sustainability of investment in those specific categories.

What are Asset Classes?

Investopedia states an asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations. Asset classes are thus made up of instruments that often behave similarly to one another in the marketplace.

The main asset classes used by investors are:

- Cash

- Domestic Equities

- Global Equities

- Bonds

- Real Estate

- Commodities

- Futures

- Derivatives

- Cryptocurrencies

Investopedia continues: Asset classes help investors diversify their portfolios to maximize returns. Investing in several different asset classes ensures a certain amount of diversity in investment selections. Each asset class is expected to reflect different risk and return investment characteristics and perform differently in any given market environment. (Investors interested in maximizing return often do so by reducing portfolio risk through asset class diversification.)

Asset classes and asset class categories are often mixed together. There is usually very little correlation and in some cases a negative correlation, between different asset classes. This characteristic is integral to the field of investing.

Each portfolio is defined by the assets within the portfolio. Combining assets from different asset classes that have different cash flow streams and varying degrees of risk are used to create a diversified portfolio. Investing in several different asset classes ensures a certain amount of diversity in investment selections. Diversification reduces risk and increases your probability of making a positive return.

Portfolio Creation

Creating a portfolio is very unique and personal. Every portfolio should reflect the individual goals, risk tolerance, and time horizon of the investor.

But, how does someone create a portfolio? A good portfolio begins with a plan and appropriate goals. Why is the portfolio being created? Is the goal to save for retirement, a new car, a luxury vacation, or to leave a legacy for children and grandchildren?

What is the investor’s appetite for risk? How willing is someone to suffer short-term losses for long-term gains? Can an investor stomach a 30% portfolio decline? How about a 40% or 50% decline? How long can these losses be tolerated? These questions must be answered prior to portfolio creation.

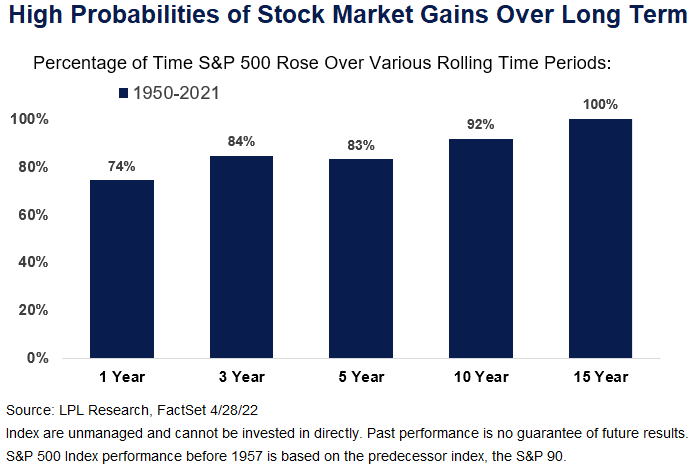

How long will the assets be invested? A longer time horizon means the portfolio composition can be more aggressive. (The following chart by LPL Research shows that stock market investments in the S&P 500 Index rose 100% of the time if continually invested for fifteen years or longer.)

If your investing goal and time horizon are years away your portfolio might be tilted toward growth assets, such as stocks. If you need to provide income from your portfolio sooner, or you desire less volatility, a portfolio might be tilted toward defensive assets, including cash, cash investments, and short-term U.S treasuries (which are normally less volatile than stocks and long-term bonds.)

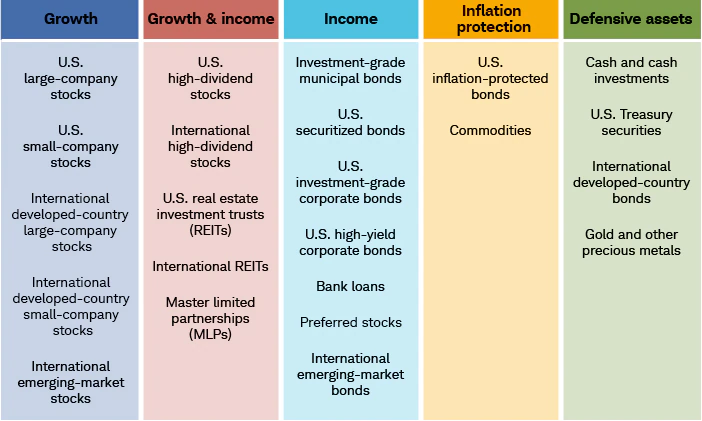

Below is an overview of major asset classes provided by Charles Schwab, and what they can bring to your portfolio. (Although grouped based on how they’re commonly used—for growth, defense, income, or inflation protection—keep in mind that most can fill multiple roles in a portfolio. They are also ranked according to their relative volatility as part of a broader portfolio, from the relatively riskier growth assets to defensive assets aimed at helping manage risk.)

Source: Schwab Center for Financial Research. For illustrative purposes only.

JDDJDJDJDJDJDJD

Growth

Investors typically depend on stocks for growth potential over the longer term. Historically, equities have delivered the highest returns—but with a correspondingly higher risk of volatility and losses.

- U.S. large-company (or “large-cap”) stocks are publicly traded shares issued by U.S.-based companies with a market capitalization value of more than $20 billion. They tend to be relatively stable and liquid compared with other types of stocks.

- U.S. small-company (or “small-cap”) stocks are shares issued by U.S.-based companies that have a relatively small market capitalization value; companies with a market cap of $2 billion or less are often considered small-caps. Small-cap stocks provide more potential room for growth than large caps, but with commensurately higher volatility.

- International developed large-company (or “international developed large-cap”) stocks are issued by large-cap companies based in countries considered to be highly developed in terms of their economy and capital markets. They typically provide growth potential and diversification.

- International developed small-company (or “international developed small-cap”) stocks are issued by small-cap companies in developed markets. They offer greater potential for growth than their large-cap counterparts. They also provide diversification in a portfolio that includes U.S. stocks, because the revenues of these companies tend to be tightly tied to their home countries.

- International emerging-market stocks offer higher growth potential than developed markets, because corporate revenues have the potential to grow faster when economic growth is higher. They also offer diversification, as international emerging markets can perform differently than developed markets.

Growth and Income

High-dividend-paying stocks and yield-oriented securities can provide both growth and income, given their potential for both high returns and yield. However, they have various levels of risk, and some may experience significant price declines. Also, as noted above, international investments are subject to factors including currency fluctuations and political instability.

- U.S. high-dividend stocks are shares of U.S. companies that tend to distribute higher-than-average dividends to shareholders. They can provide both income and growth potential to a portfolio.

- International high-dividend stocks can provide income, growth, and diversification to a portfolio.

- U.S. real estate investment trusts (REITs) are publicly traded real-estate related securities. REITs typically invest in commercial properties, such as shopping centers and office buildings. They are required by the IRS to pay out at least 90% of their taxable income to unit holders each year, money that is often exempt from corporate income taxes. REITs can provide income potential, inflation protection, and diversification.

- International REITs are REITs in countries outside the U.S. They can provide inflation protection, income potential, and diversification.

- Master limited partnerships (MLPs) are publicly traded securities of partnerships that generate at least 90% of their income from activities related to real estate or the production of oil, natural gas, coal, and other commodities. MLPs offer a tax advantage to investors, as cash flows are not taxed at the company level. MLPs can provide income and growth potential.

Income

A broad array of fixed-income investments can provide income. Having a steady stream of income in a portfolio—the kind that fixed-rate coupon payments can provide—can help stabilize a portfolio during a stock market downturn. However, income-oriented investments offer various levels of risk and aren’t immune to sharp price declines. We’ve ranked them in order of relative level of income and potential volatility:

- Investment-grade municipal bonds are issued by cities, states, counties, and public-purpose entities like hospitals and airports. They generally have relatively high credit ratings and provide income that is typically exempt from federal taxes, making them particularly attractive to investors in high tax brackets who are investing in taxable accounts.

- U.S. securitized bonds include asset-backed securities (ABS), mortgage-backed securities (MBS), and commercial MBS. They are typically backed by hard assets or loans.

- U.S. investment-grade corporate bonds are debt securities issued by U.S. companies with relatively high credit ratings. They tend to offer higher yields than comparable-maturity U.S. Treasury bonds.

- U.S. high-yield corporate bonds, sometimes known as “junk” bonds, are issued by companies with lower credit ratings. Because these bonds are riskier, they typically offer higher yields than comparable investment-grade bonds.

- Bank loans are loans that banks make to commercial borrowers, which are then sold to investment vehicles like mutual funds and exchange-traded funds (ETFs). They typically pay a floating rate based on a short-term interest rate benchmark. Although many investors buy them for income, because of their floating rate they can also be used as a hedge against interest rate changes.

- Preferred stocks have characteristics of both stocks and bonds. They generally offer relatively high yields, which can add income potential to a portfolio.

- International emerging-market bonds are issued by governments and companies in emerging-market countries. They typically offer higher yields to compensate for risk factors such as political instability and currency fluctuations. They can be a source of income and diversification, and offer the potential for capital appreciation.

Inflation

Inflation protection can minimize the corrosive impact of inflation on the value of your investment, though it’s probably best to think of such investments as offering diversification against inflation, and not a guarantee to keep pace or to beat inflation over time. Inflation-protected bonds and commodities are two such investments. However, keep in mind that inflation-protected bonds could lose value if deflation were to occur, that commodity prices are often volatile, and that futures trading is risky and not suitable for all investors.

- U.S. inflation-protected bonds—called Treasury Inflation-Protected Securities, or TIPS—are used to protect against rising inflation. At maturity, TIPS pay either the inflation-adjusted principal or the original principal, whichever is higher.

- Commodities—such as energy, agriculture, industrial metals, and livestock—can provide both diversification and inflation protection to a portfolio. Investors typically don’t purchase the actual commodity but invest in mutual funds or ETFs that buy and sell futures contracts, which are agreements to purchase a certain amount of a commodity at an agreed-upon price and date in the future.

Defensive assets

Defensive assets generally have low correlations—that is, they don’t move in tandem—with stocks. This means they tend to perform relatively well when the stock market is under pressure—but they may underperform when the stock market is rising. Note that while defensive assets can lessen the impact of volatility on a portfolio, the portfolio may still lose value. Also, international investments and commodities such as gold may be affected by currency fluctuations, geopolitical events, and other factors.

- Cash and cash investments can offer a high level of stability, as well as liquidity and flexibility when needed. Nominal returns also generally rise if interest rates and inflation increase. Cash includes money in bank checking accounts, savings accounts, and certificates of deposit (CDs), which are all insured by the Federal Deposit Insurance Corporation (FDIC). Cash also includes money in brokerage accounts, which is protected by the Securities Investor Protection Corporation (SIPC), and money in a purchased money fund, which isn’t insured, but may offer relatively higher yields than the other cash investments.

- U.S. Treasury securities including Treasury notes and bonds are considered a relatively safe, defensive asset class. Their timely payment of principal and interest is backed by the full faith and credit of the U.S. government, making them among the highest-credit-quality investments available. U.S. Treasuries with shorter maturities can be a useful investment for money that could be needed soon, and Treasuries with longer maturities can provide diversification to stock investments.

- International developed-country bonds are often considered a defensive asset class that offers U.S.-based investors geographic and currency diversification benefits along with income potential. They can be more volatile, however, than cash, cash investments, and U.S. Treasuries.

- Gold and other precious metals can be used to help buffer a portfolio against inflation and stock market shocks. Historically, when concern about inflation, geopolitical unrest, or financial system stability is high, investors have tended to buy gold. While gold and precious metals may provide defensive attributes, their prices can be volatile, and we don’t suggest them for money that may be needed soon.

fhjjgjhgjhgjgj

Portfolio Composition

- 1. Pick asset allocation– The traditional rule of thumb is that portfolio equity percentage equals 120 minus the investor’s age. A forty-year-old investor would have eighty percent of portfolio funds in equity investments (120-40= 80.) A seventy-year-old investor would have a fifty percent stake in the stock market (120-70= 50.) This rough percentage of equity investment automatically adjusts for the time horizon. (As a person ages, stock exposure automatically decreases over time.) Aggressive investors may increase this ratio, while conservative investors may have a decreased exposure. (Some investors opt to use a more standard asset allocation that falls within the 70/30 [70% equity/ 30% other] to 30/70 [30% equity/ 70% other] range.)

- 2. Pick asset class ratio– (the number of asset classes and relative percentage of all asset classes compared to equity percentage)- portfolios normally have a mixture of stock or stock funds, bonds or bond funds, real estate, and cash. Portfolio complexity can range from a simple two-fund (for example: A 70% S&P 500 Index/30% Total Bond Index) portfolio to as many as twenty different asset types across domestic and international equity markets, domestic and international bond markets, domestic and international real estate markets, and other assets such as commodities, futures, currency exchanges, cryptocurrencies, precious metals, and derivatives (for example: 30% domestic stock funds, 20% International stock funds, 20% domestic bond funds, 5% International bond funds, 10% domestic real estate funds, 5% International real estate funds, 1% cryptocurrencies, 5% commodities, 2% precious metals, and 2% cash.)

- 3. Pick assets and the number of funds within each allocation based on use– the equity portion of the portfolio can be invested in many ways (for example: growth funds for long-term growth, income funds for income, large cap, mid cap, small cap, or micro cap funds, defensive funds, or ESG funds, to name some.) The bond portion of the portfolio also has multiple investment choices (for example: long-term bond funds, inflation-protected bond funds, total bond funds, short-term Bond funds, international bond funds, and medium-term bond funds.) For example: In a 70% stock/ 30% bond portfolio, the 70% Stock portion may contain a large-cap growth fund, a small-cap value fund, a large-cap balanced fund, and an income fund; while the 30% bond portion may contain a short-term bond fund, a TIP FUND, and a total bond fund.

Examples:

- A 40-year-old may choose a portfolio with an 80%/20% allocation of 80% S&P 500 Index fund and 20% Total Bond Index fund.

- Another 40-year-old may choose a 60%/30%/10% allocation of 40% S&P 500 Index fund, 20% Growth and Income fund, 10% TIP fund, 20% Total Bond Index fund, and 10% REIT Index fund.

- A 60-year-old may choose a 50%/50% portfolio of 25% Value Index fund, 25% Small Cap Index fund, 40% Total Bond fund, and 10% Total International Bond Fund.

- Another 60-year-old may choose an aggressive 80%/20% portfolio with multiple funds.

kfjfjfjfgjgjngng

The choices among portfolios and portfolio types are unlimited. Stocks and stock funds increase risk, but also act as a buffer against inflation.

Portfolio diversification decreases risk. But, increasing the number of assets and asset classes also increases complexity. In a taxable account, this will increase costs and taxes as trades and rebalancing may create taxable events.

Tax-deferred and tax-free accounts with more asset classes and funds may increase complexity, but don’t create taxable events by trading and rebalancing.

jjfjfjfghjfghfghjfhjfhj

Final Thoughts

- Creating an Investment Portfolio is an investment tool commonly used by financial planners to best help clients reach financial goals.

- It’s better to spend adequate time thinking about creating a portfolio before acting. Portfolio compositions are not written in stone, but changing the portfolio’s composition costs both time and money.

- Changes in portfolio ratio and composition may create taxable events.

- Continually switching between different styles and types of portfolios will decrease long-term returns.

- More or less complexity and number of funds is a personal choice.

- Portfolio diversification decreases risk.

- Each asset class reflects different risk and return investment characteristics and performs differently in any given market environment.

- Standard asset allocation usually falls within the 70/30 [70% equity/ 30% other] to 30/70 [30% equity/ 70% other] range.

- A longer time horizon means an investor can tolerate increased risk.

- The scope of portfolio types, asset classes, and portfolio compositions is unlimited.

- Portfolios can be broadly classified by portfolio type and asset class composition.

- A portfolio is generally defined by the assets within the portfolio.

jkgjgjgjgjgjghjg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS