JHFHFHFHF

The man who moves a mountain begins by carrying away small stones -Confucius

fjfhjfhf

I always felt like I would enjoy hitting a “big winner” by investing in a micro-cap stock that blows up and makes millions or even winning the Mega Millions lottery. Most people daydream of that one quick event that makes them multi-millionaires.

I’ve been known to invest a few dollars in the Mega Millions lottery. The thought of winning hundreds of millions of dollars with a wager of a few dollars is very seductive.

But, understanding the odds are critical. Too many people believe that their investment in lottery tickets or Casino games makes sense. How does this make sense when the odds of winning the Mega Millions Lottery are 1 in 302 million.

People are confused about what’s considered gambling versus what’s considered investing. The biggest difference between investing and gambling is that with investing there is an expectation of profit (return), whereas with gambling there is a hope of profit.

Sorry, but statistically speaking, no one reading this blog is going to win the Mega Millions lottery. Steven Diaz is a mathematics professor at Syracuse University’s College of Arts and Sciences. He has calculated that the odds of winning the Mega Millions lottery are 1 out of 302,575,350. The odds of getting struck by lightning in a given year are about one in one million. So, the average person is 300 times more likely to be struck by lightning than win the Mega Millions jackpot with one ticket.

So, since we’re not going to win the lottery, let’s find out what all of us non-winners can do about saving for retirement.

ghhghhg

Where Does That Leave All Non-Lottery Winners?

What becomes your investment plan if you are one of the 302,575,349 people who don’t win the Mega Millions lottery? The hope of winning the lottery is not a valid Retirement Plan!

Since we won’t be “get rich quick” instant multimillionaires, this leaves the rest of us non-lottery winners scrambling to develop a Retirement Plan.

It also means that the Plan developed will be implemented and followed for a long period. This is where Perseverance takes center stage!

nfhhgfhfh

Why Does it Take so Long to Create Wealth?

The “get rich quick” mentality is the direct opposite of the fundamentals of long-term investing. When hope ceases to be an option, then continuous investing of small amounts over a long period becomes the recipe for retirement planning success.

Is this as much fun as winning the Mega Millions lottery? No, it’s not! But, since the “winning the lottery” plan probably won’t work, then it’s best to develop a plan that will work.

I’ve made my share of “get rich quick” mistakes in the past. At one point I aggressively invested in stock options. Then, there was the period of chasing last year’s best mutual fund performers. Other embarrassing schemes won’t be enumerated. Needless to say, I remained well below millionaire status at the end of my “running with risk” period. The good news is that this period of risky investing occurred early in my career. Even though the money lost was large relative to my net worth, in the long scheme those early mistakes were not extremely costly. But, losing those small amounts early still impeded my later success because I lost the effect of compounding on those dollars not wisely invested.

For the majority of people, successful retirement planning involves Investing a certain percentage of income regularly for long periods, usually 30 to 40 years or more.

ejjjfdjjd

How Long is Long, and What Percentage is Enough?

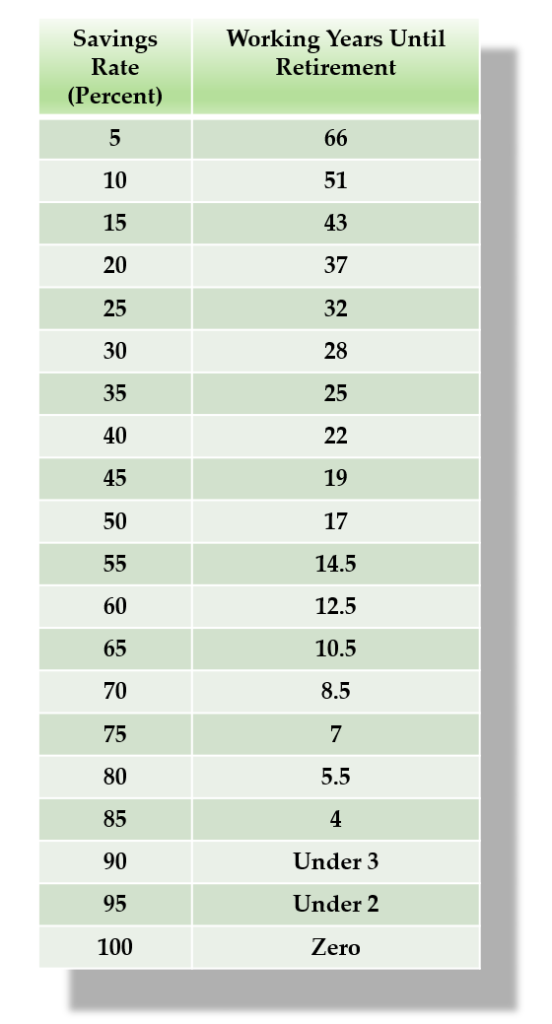

Mr. Money Mustache, a famous member of the F.I.R.E. Community (Financial Independence, Retire Early), created a graph that speaks volumes. In his graph he compares the percentage of income saved each year versus how many years it will take to become financially independent :

Mr. Money Mustache’s assumptions:

- You can earn 5% investment returns after inflation during your saving years

- You’ll live off of the “4% safe withdrawal rate” after retirement, with some flexibility in your spending during recessions.

- You want your ‘Stash to last forever, you’ll only be touching the gains, since this income may be sustaining you for seventy years or so. Just think of this assumption as a nice generous Safety Margin.

- As soon as this income is enough to pay for your living expenses while leaving enough of the gains invested each year to keep up with inflation, you are ready to retire.

Here’s how many years you will have to work for a range of possible savings rates, starting from a net worth of zero:

Most people try to save between 10% and 15% of their annual income. Using the chart above means that people will need between 43 years and 51 years to become financially independent. Saving 20% of annual income drops that number to 37 years.

Two things quickly become obvious. The first is that true wealth is created over long periods for most retirement investors. The second point is that even with an annual savings rate of 20% that it will take about 40 years to become financially independent.

For most families, a savings rate approaching 20% is almost untenable. Even double-income families struggle to dedicate the required dollars to retirement investment accounts.

fjfjghghghg

What Do Retirement Savers Need to Do?

- Retirement savers need to realize that Retirement Planning requires playing the long game. Wealth is normally created over an investing lifetime. Very, very few investors become wealthy at an early age.

- Automate contributions whenever possible. Not having to consciously decide to make a monthly contribution is much easier to perpetuate.

- Pay yourself first. My Profit Sharing Plan contribution was deducted first before monthly living expenses were factored into income. (When contributions are deducted first, you live on the remaining income and you tend to not miss the income used for contributions because you never have access to it.)

- Target saving at least 15% of your income, and give yourself bonuses whenever possible. (The more saved, the quicker it will add up.)

- Persevere. Saving for retirement should be boring. Put your money to work in a diversified portfolio, add money periodically, rebalance it as needed, and let it grow and compound.

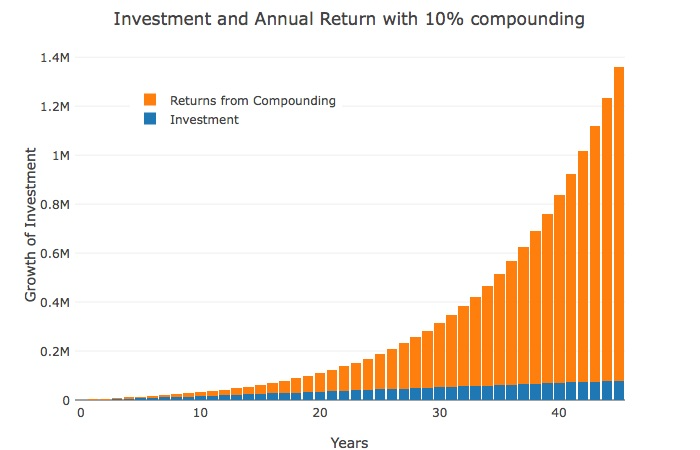

- Remember, time is your friend. Compounding needs long periods to be most effective. This is dramatically illustrated in the following chart from Exploring Finance:

ngnghghghgh

kvgkjgjgjg

The effects of compounding are almost negligible in the first ten years. Then, compounding takes off exponentially!

Almost everyone has read or heard of someone who made a big score and became a multimillionaire overnight. For the rest of us non-overnight millionaires, a well-thought-out and well-implemented Retirement Plan can still get us to multimillionaire status over time. Perseverance and periodic investing are necessary and integral ingredients for retirement success.

hfhfhfhfhf

Final Thoughts

- Most people dream of the one event that will make them multimillionaires, but statistically very few people in life are afforded that luxury.

- For the majority of people, successful retirement planning involves investing a certain percentage of income regularly for long periods, usually 30 to 40 years or more.

- True wealth is created over long periods for most retirement investors, and even with an annual savings rate of 20%, it will take about 40 years to become financially independent.

- Perseverance is important because wealth is created over long periods by periodic sustained investing.

- For compounding to be most effective a long time is needed.

- The formula of sustained and periodic investing has been integral to my successful investment plan for over 35 years, and is still ongoing!

jfjfqjhfhffh

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS