jfhjfhf

Recently, my thoughts returned to my time as a Summer vacation worker during my high school years. It was hard to find Summer work in the late 60s in rural areas, so I felt I was lucky to get a job as a laborer and driver for a retail lumber company.

I had done the math and knew my gross salary for my forty-hour work week was approximately $64 (minimum wage in the late 60s was $1.60 per hour.) My excitement upon receiving my first paycheck was quickly tempered when I realized that I had only received a little over $60, not my salary of $64.

This was my first experience with Social Security and Medicare taxes (approximately 4.8%) which were being withheld from my wages. It was then that I first understood that my wages were going to be reduced by a tax that would most likely not benefit me in any way for another 45+ years.

These taxes paid as a young worker were being set aside for my future retirement and medical needs. Right? Isn’t entitlement to future retirement benefits and medical benefits embedded within the process of paying Social Security and Medicare taxes? Aren’t Social Security and Medicare benefits guaranteed for long-term workers who make long-term contributions to the Social Security and Medicare systems? Wasn’t my right to a future retirement being guaranteed by my paycheck deductions?

hfhghhghg

Let’s Explore Whether Retirement is a Right or a Privilege

fhhfhfghf

Recent World Affairs Have Revived Interest in the Question of Whether Retirement and Retirement Benefits are a Right or a Privilege.

ghhghg

This is not a political blog, So, without taking political sides I will try to present an impartial overview of retirement as a right or a privilege.

The bedrock of most developed countries’ retirement programs is some form of Social Security or Pension program. These programs provide some level of retirement income for the life of retirees or pensioners. Most workers consider Social Security benefits as their right. Workers have worked and contributed to the Social Security program for many years, and feel that SS income is a right granted by their years of labor and contributions to the system.

But, with declining birth rates in most developed countries, governments are experiencing increasing pressure to modify existing retirement programs to insure future viability. These modifications usually appear in the form of increasing taxes, increasing the retirement age, decreasing benefits, or some combination or variation of these plan changes.

This has created an interesting dynamic where governing bodies are aware of internal pressures building that, if left unchecked, will eventually destroy retirement systems. These same governing bodies are generally unwilling to enact legislation to protect the integrity of the retirement systems.

Needed changes to existing retirement systems are politically unpopular and emotionally charged, and no seasoned politician wants to be included in universally unpopular legislation that will increase taxes, increase the retirement age, or decrease retirement benefits to any voter.

dhfhhhgfhfh

Protecting the Social Safety Net

fhfhhgf

France– I’ve watched with great interest the recent events occurring in France. The French president floated a bill to raise the retirement age in France from age 62 to age 64. When the bill would not pass through France’s Parliament, the French President, Emmanuel Macron, used a constitutional power (Article 49.3) in mid-March 2023 to force through the changes without a vote.

According to CNN: For Macron’s cabinet, the simple answer to the government’s commitment to reforms is money. The current system – relying on the working population to pay for a growing age group of retirees – is no longer fit for purpose, the government says.

Labor minister Olivier Dussopt said that without immediate action the pensions deficit will reach more than $13 billion annually by 2027. Referencing opponents of the reforms, Dussopt told CNN affiliate BFMTV: “Do they imagine that if we pause the reforms, we will pause the deficit?”

gjgjjgjjhg

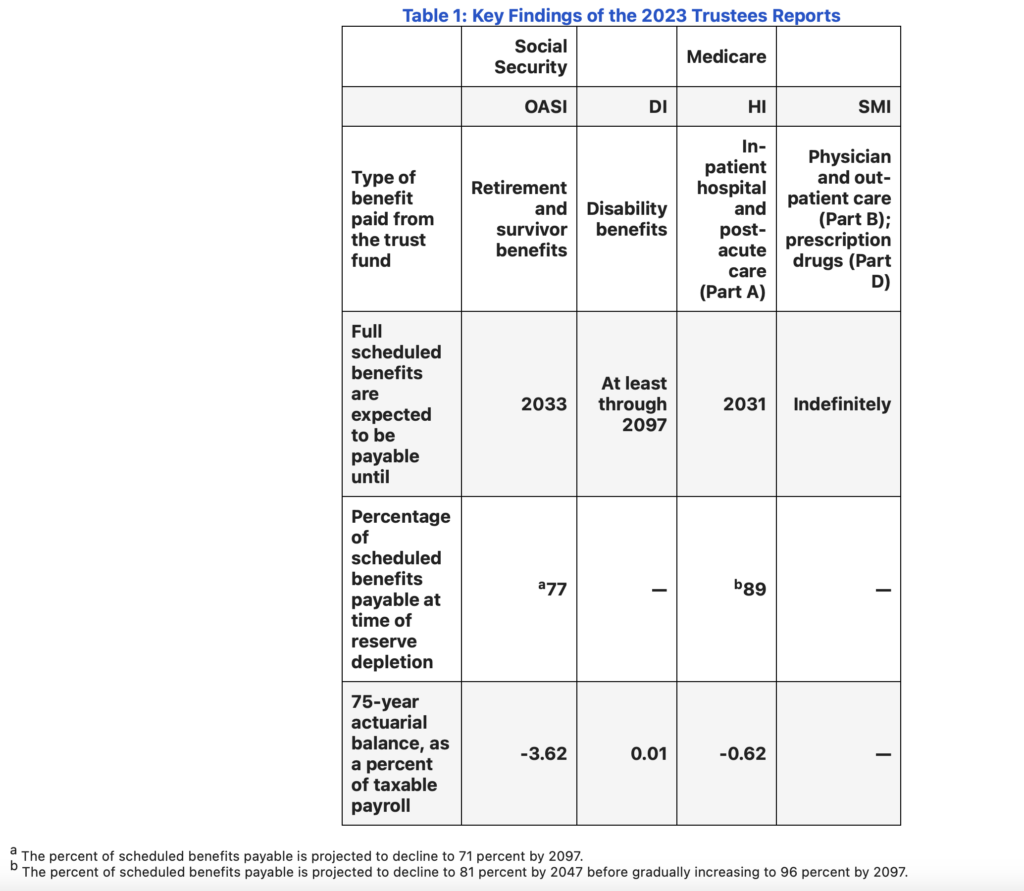

USA– In the USA the Social Security Administration just released a 2023 report titled:

A Summary of the 2023 Annual Social Security and Medicare Trust Fund Reports. Below is a chart representing a summary of the information provided:

gfgfgfgf

It is often useful to consider the findings for the two Social Security trust funds (OASI and DI) on a combined basis. The actuarial deficit for Social Security as a whole – called OASDI – is 3.61 percent of taxable payroll. If these two legally separate trust funds were combined, then the hypothetical OASDI asset reserves would be projected to become depleted in 2034 and 80 percent of scheduled Social Security benefits would be payable at that time, declining to 74 percent by 2097.

So, it’s obvious that the US Social Security system is also experiencing considerable strain and is only projected to pay full benefits until 2033.

jghhghng

Canada– Canada’s retirement system is the (CPP) Canada Pension Plan. According to Investopedia: The Canada Pension Plan (CPP) is one of three levels of the Canadian retirement income system. It was established in 1966 to provide retirement, survivor, and disability benefits.

Almost everyone who works in Canada, outside of Quebec, contributes to the CPP.

Canada’s retirement system is not as stressed as the USA Social Security System. However, changing birth rates and Canadian worker profiles are a concern for future viability.

As seen in the three examples above, even developed countries are beginning to feel stress in fulfilling promises made to workers many years ago.

jfhhggf

Is Social Security a Right?

jfhhghfghhfg

Historically, Social Security benefits have been regarded as a right of workers who reach retirement age. Is it a true statement that long-term workers who have worked the necessary period (40 quarters of coverage, or have received 40 credits) and had their wages reduced by the mandatory employment taxes are entitled to Social Security benefits at a future date?

This may come as a HUGE surprise to most people, but Social Security benefits are NOT guaranteed by the US government. So, what most Americans consider a guaranteed right to receive Social Security benefits at retirement is actually not guaranteed.

But, how can this be true? Most people believe that Social Security is guaranteed for qualified workers at retirement.

There are two relevant US cases related to Social Security that explain the US Social Security system and the benefits accorded to workers who participate in the US Social Security system.

According to Wikipedia:

The first case, Helvering v. Davis, 301 U.S. 619 (1937), was a decision by the U.S. Supreme Court that held that Social Security was constitutionally permissible as an exercise of the federal power to spend for the general welfare and so did not contravene the Tenth Amendment of the U.S. Constitution.[1]

The Court’s 7–2 decision defended the constitutionality of the old-age benefit program of the Social Security Act of 1935 by requiring only welfare spending to be for the common benefit, as distinguished from some mere local purpose. It affirmed a District Court decree that held that the tax upon employees was not properly at issue and that the tax upon employers was constitutional.

This decision confirmed the constitutionality of the US to tax employees and employers for welfare spending for the common benefit.

The second case: Flemming v. Nestor, 363 U.S. 603 (1960), was a United States Supreme Court case in which the Court upheld the constitutionality of Section 1104 of the 1935 Social Security Act. In this Section, Congress reserved to itself the power to amend and revise the schedule of benefits.

The Court ruled that there is no contractual right to receive Social Security payments. Payments due under Social Security are not “property” and are not protected by the Takings Clause of the Fifth Amendment. The interest of a beneficiary of Social Security is protected only by the Due Process Clause.

Under Due Process Clause analysis, government action is valid unless it is patently arbitrary and utterly lacking in rational justification.

In this second court case, the court ruled there is “no contractual right to receive Social Security payments.” It also references the “Takings Clause” of the Fifth Amendment. The Takings Clause allows the federal government to take private property for public use if the government provides “just compensation”.

These two cases in concert give the US government the right to tax employers and employees for the common welfare and ruled that there is no contractual right to receive Social Security payments.

hjdghggvdgggd

So, What Does All This Mean?

dghgdgd

According to Michael Tanner, a former Senior Fellow, CATO Institute Social Security is not an insurance program at all. It is simply a payroll tax on one side and a welfare program on the other. Your Social Security benefits are always subject to the whim of 535 politicians in Washington. Congress has cut Social Security benefits in the past and is likely to do so in the future. In fact, given Social Security’s financial crisis, benefit cuts are almost inevitable. Several proposals to cut benefits, from increasing the retirement age to means testing, are already being debated.

hfhgghghgf

Where Does That Leave American Workers Who Are Counting on Social Security Benefits to Fund Retirement?

hfggggf

If you understand the information provided above you now realize that Social Security benefits are not guaranteed, and benefits are subject to the whims of Congress.

What citizens understand as a right to retirement benefits is not truly a right at all!

Americans counting on Social Security must understand that Social Security is a PRIVILEGE afforded by the US Congress and that Social Security benefits can be modified or reversed at any given moment by the same US Congress.

nhfhhfhhhf

Social Security Benefits

ghhghghg

I’ve never counted on Social Security benefits to fund my retirement. (If someone considers Social Security a privilege that can be reduced or removed, then it’s not counted as a guaranteed income funding source.) Unfortunately, retirement plans for most Americans include Social Security benefits as a major component of retirement funding. According to SSA.gov Social Security is the major source of income for most of the elderly:

—-Nearly nine out of ten people age 65 and older were receiving a Social Security benefit as of December 31, 2022.

—Social Security benefits represent about 30% of the income of the elderly. *

—Among elderly Social Security beneficiaries, 37% of men and 42% of women receive 50% or more of their income from Social Security. *

—Among elderly Social Security beneficiaries, 12% of men and 15% of women rely on Social Security for 90% or more of their income. *

*This information is from research released in 2021 using 2015 data.

fghghghgh

Does This Mean Social Security Will Eventually Become Insolvent?

ghghhghgh

No!

Social Security as we know it today cannot continue unchanged and remain solvent. Presently, changes to the Social Security system need to be implemented prior to 2033 to insure the solvency and continuity of the Social Security system. Social Security will most likely continue into the foreseeable future in some altered form with changed provisions.

hfhhfhfhf

Is Retirement a Right or a Privilege?

hfhhfhf

The information provided in this blog should help each person come to their own conclusion about the rights and privileges of retirement and retirement funding through Social Security. My feelings are that Retirement is a privilege afforded to all Americans who save and plan beforehand. But, as with most things in life, there are no free lunches!

jfjfhjhfh

Final Thoughts

hjghhgf

- The Social Security Act was signed into law by President Roosevelt on August 14, 1935.

- The Social Security program has undergone numerous changes and modifications since its enactment in 1935.

- Social Security will need continued modifications to remain solvent for the foreseeable future.

- Needed Social Security program changes may include additional taxes, an increased retirement age, or decreased benefits for present and future Social Security recipients.

- It is this author’s opinion that Social Security is a privilege afforded the American workers by Congress.

- Retirement should be considered a privilege for those who have worked, saved, and planned for retirement during their working years.

fjfhfhfhf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS