JFHJFHFHHF

I’m pretty sure everyone can close their eyes for a second and imagine the smell of their favorite pie as it comes out of the oven freshly baked, and to imagine the taste of that same imaginary pie once it’s cooled a bit.

But before you get to taste a real pie you must first gather ingredients, mix the right amounts in the right ratios, layer the ingredients in the right order, and cook the pie for the right period until perfectly cooked.

For me, that special favorite pie was always a toss-up between my Mom’s homemade Cherry or Apple pies. Cherry pies were seasonal, so Cherry pies usually got the nod because Cherries weren’t available year-round.

Just like a real pie, a Retirement Pie is the combination of many different ingredients that are mixed a certain way, layered in a pan (retirement account), and then allowed to cook (mature) for a period of time.

Building a retirement pie normally involves building and combining several different funding sources over a long period. Account types and account funding vary from person to person.

For many retirement pie investors, this process can be complex and is usually implemented over a long period. This is a problem for many investors because they want to create the framework for a retirement pie as quickly as possible and have it as easily implemented as possible. But, just like great pies, great retirement pies need time, care, and love to reach their full potential.

Many investors want to complete everything quickly and painlessly. It’s this need to do everything at once that causes many future problems.

nnfbfbbngf

What Can Be Done to Avoid Retirement Pie Problems?

gnnhgnhgn

Trying to build word pictures has always been a part of my dental practice. Most people have a very general knowledge of Dentistry but are not well-versed in the particulars of treatment and treatment protocol. I found early in my career that building word pictures helped to explain more complex, dental problems, and treatments.

In trying to create the best explanation (word picture) for a complex restorative case; I spoke to a patient about breaking down treatment into smaller and more manageable phases. The patient sat and listened quietly to my explanation. At the completion of my explanation, I inquired about his level of understanding of the proposed treatment. He looked me straight in the eyes and said “Sure Doc I get it! You can eat a whole pie if you eat it a piece at a time.”

If you imagine your Retirement Pie as being a real pie then your retirement pie is best eaten (or built) a piece at a time. Trying to eat a whole pie in one sitting usually ends with a lot of wasted pie, an upset stomach, or both! Just like eating a real pie, your Retirement Pie should be built slowly and thoughtfully, one piece at a time. Just like trying to eat a whole pie in one sitting, trying to build your retirement pie in one sitting will create wasted time, assets, and an upset stomach!

hghhgghghg

What Are Some Things to Do?

fbfgfhhf

I’ve heard of “Dump Cakes” but not “Dump Pie.” A pie’s ingredients must be placed into the pie pan in the correct order: crust, filling, and pastry strips. In much the same way, a Retirement Pie’s ingredients (though not quite as critical) need to be placed in a certain general order:

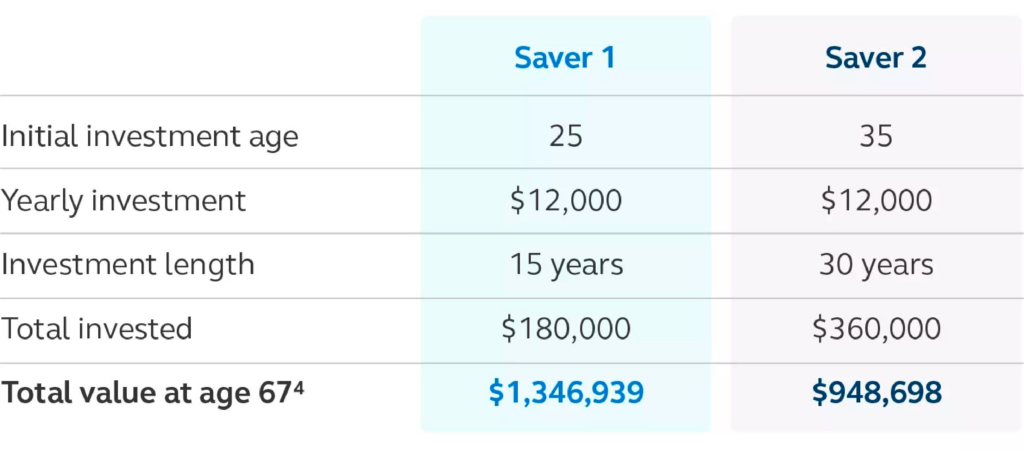

- Start early with planning and saving– time can be your best friend or your worst enemy. This chart from Principal Financial Group illustrates the benefit of starting a savings plan early:

By starting 10 years earlier Saver 1 invests for 15 years with a total investment of $180K, yet still has a final balance of almost $400K greater than Saver 2 which has invested twice as much. Saver 1 benefits with a $400K higher terminal balance by starting early!

Starting a comprehensive and coordinated retirement plan early means less lost time and effort by creating a targeted approach. Early planning reduces errors and continual changes cost time and money to resolve.

- Account type for retirement funds– workplace retirement plans, IRAs, or a combination. Workplace retirement plans come in a variety of flavors, with the 401(k) plans currently dominant. 401(k) plans can be both traditional and 401(k) Roth plans. With these plans, a portion of each paycheck is automatically sent to your personal account within the retirement plan. An added benefit is a 50% employer match up to 6% of the employee’s salary (employers will provide a 50% matching contribution, or 3%, of salary up to a 6% cap.) IRAs (Individual Retirement Arrangement)- Everyone who has earned income is eligible to open an IRA account. IRA accounts can also be opened for eligible spouses if earned income is sufficient. Most major investment companies and brokerages offer IRA accounts. Most of these accounts can be set up to accommodate periodic automatic investment plans. In many cases, investors are able to use a combination of company retirement plans, IRAs, Roth IRAs, and nondeductible IRAs in concert to plan for retirement. There are rules concerning eligibility and feasibility for combining these different types of plans, so proper planning is essential. But, combining different types of retirement plans, when possible, can supercharge retirement funding in amazing ways!

- Tax, deferred, or after-tax accounts– tax deferral and deductibility can have huge tax implications when the contributions are made and when taxable distributions occur. Contributions made into a tax-deferred account are not taxed and contribution amounts are deducted from taxable income in the year the contributions are made. When distributions occur, distributions are normally taxed at ordinary income tax rates. IRAs and 401(k) are types of tax-deferred retirement accounts. Contributions made into non-deductible, or after-tax accounts, and Roth IRAs receive no favorable tax treatment at the time of contribution as dollars contributed have already been taxed. The main benefit occurs when Roth IRA accounts are accessed in retirement as both contributions and earnings are tax-free win properly distributed. With non-deductible IRAs only earnings are taxed upon distribution.

- What percentage to save– along with starting early, the percentage saved has a major impact on how long a person will have to work before retiring. First, each person must understand that if you don’t save any of your spendable income, then you will never build retirement savings or generate retirement income. You will never be able to retire! With no retirement income, being generated from savings, you will have to continue working to generate earned income to live on for the rest of your life. Saving 5% of discretionary income means that someone will have to work approximately 66 years to generate enough retirement income to replace earned income. If someone moves up the savings ladder and saves 20% of his income versus 5% of the income that decreases the time needed to replace earned income with investment income from a period of 66 years to 37 years. If someone moves further up the savings ladder and saves 40% of disposable income, the time needed to replace, earned income with investment income decreases to 22 years. If someone is willing to save 65% of their income then they would be in a position to retire in approximately 10 1/2 years.

- Age vs risk– A longer time frame before retirement means more risk can be tolerated. This means that younger investors have a much longer time frame, and as such should be invested more aggressively to maximize return potential with passing time, portfolios should become less aggressive and less risky.

- Fund type and diversification– it’s important to have funds properly invested in a mixture of funds that are appropriate to the age and risk tolerance of each investor. Diversification of assets across many types of funds helps to reduce overall risk. Portfolio composition was discussed in detail in the blog titled: MASTERING THE PORTFOLIO: UNDERSTANDING THE NUTS AND BOLTS.

- Find out how much you need to retire– How much you will need in retirement normally is an estimate based on current income. The general rule is that in order to retire, someone should have savings equal to 25 times annual income (For a person earning $100,000 per year this means total savings should equal $2.5 million.) Another less common approach is to determine annual spending and use a figure of 75% to 80% of annual spending as a guide to annual spending in retirement (someone with a current annual spending of $100,000 would need approximately 25 times $80,000= $2 million.) it should be noted that using annual spending to approximate retirement funding needs results in a smaller net worth amount needed, which may be more accurate, but also allows for less flexibility and variability with a smaller Net Worth amount.

- Automate saving– Automating retirement contributions means you’d don’t have to remember to contribute on a regular basis. It’s all done for you automatically!

- Evaluate annually– getting your plan in place is the first and most important step. But continued monitoring and rebalancing of portfolio assets is equally important. Over time assets drift upward or downward. Periodically assets must be realigned to the desired asset allocations. For a more detailed explanation of portfolio rebalancing see: STRIKING THE PERFECT BALANCE: THE ART OF PORTFOLIO REBALANCING.

- Estimate SS benefits– for people Born in 1960 or later, the full retirement age (which is the age when you can begin to receive Full Social Security benefits) Is age 67. The earliest age a person can start claiming Social Security benefits is age 62. However, receiving benefits at age 62 means that benefits will be reduced from full retirement age benefits. For those people who wait until age 70, retirement benefits will increase each year from full retirement age until age 70. After age 70, no further increases in benefits occur, and there is no reason to delay Claiming Social Security benefits, after age 70. The social security administration website has abbreviated and comprehensive Social Security benefits calculators. The Social Security Administration site states: Your Social Security Statement (Statement) is available to view online by opening a My Social Security account. It is useful for people of all ages who want to learn about their future Social Security benefits and current earnings history. For workers age 60 and older who do not have a My Social Security account, we currently mail Social Security Statements three months prior to your birthday.

hghghhg

When to Retire?

fjfgjgfghj

Some people may retire early because they want to or have to, and many may delay retirement for long periods after they are financially able to retire. The choice of when to retire is personal and individual to each worker. It is becoming increasingly popular for workers to slowly ease out of the workforce rather than retire abruptly.

Becoming financially independent provides flexibility by allowing a worker to retire at the time they desire (regardless of work income) because work income will be replaced by investment income.

When all of these ingredients are properly mixed and placed, and given time to cook (mature), you will end up with a wonderful retirement pie built one piece at a time.

hjhjh

Final Thoughts

- A retirement pie, just like a real pie, is formed by gathering ingredients, mixing the right amounts in the right ratios, layering the ingredients in the right order, and cooking the pie for the right period until perfectly cooked.

- Just like trying to eat a whole pie in one sitting, trying to build your retirement pie in one sitting will create wasted time, assets, and an upset stomach!

- There are a wide array of components necessary in creating a retirement pie, and these must be properly placed, applied, and continually managed over time.

- The choice of when to retire is personal and individual to each worker.

- Becoming financially independent provides flexibility by allowing a worker to retire at the time they desire (regardless of work income) because work income will be replaced by investment income.

hmhnnmhmnh

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS