jfhghghbg

”Smart people learn from their mistakes. but the real sharp ones learn from the mistakes of others” -Brandon Mull

fhfhhfhbhbf

After 50+ years of investing, I’ve learned that there are money missteps that cost time and money. Many of these missteps have been learned the hard way through experience. This blog is being written in hopes that readers can avoid some of the annoyance and discomfort associated with these missteps. Most of these missteps seem innocuous at the time, but over time even small mistakes can multiply and grow in significance, ultimately costing a lot of money.

hghghhg

What are Some of These Common Mistakes and What Can be Done to Correct or Avoid Them?

hfhhhfbh

Too Little Planning– The biggest and most consequential omission is inadequate planning. It has been said that people do more advanced planning for summer vacation than for their retirement lifetime. Both Retirement plans and Financial plans provide a roadmap designed to transport a person from where they are at present to their destination. Several blog posts have been written on the importance of planning: MAPPING YOUR FUTURE: DO YOU HAVE A SOLID PLAN?, OVERCOMING THIS PLANNING PITFALL: TACKLING TEMPORAL DISCOUNTING #1, OVERCOMING THIS PLANNING PITFALL: TACKLING TEMPORAL DISCOUNTING #2, AVOIDING A FINANCIAL HURRICANE BY CREATING AND UNDERSTANDING A FINANCIAL PLAN.

hfghhhgg

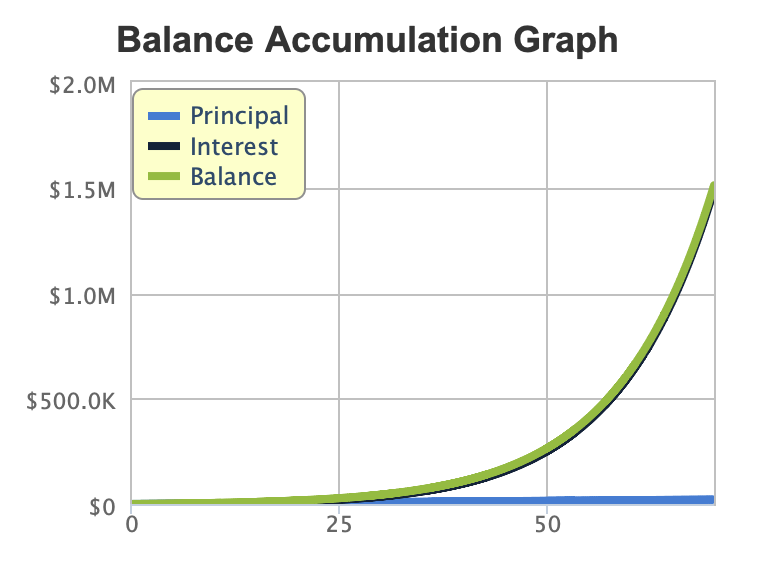

Starting Too Late– another common mistake is not beginning an investment program as soon as possible. Time is one of your best friends when investing (See: COMPOUNDING MAGIC: HARNESSING THE EIGHTH WONDER IN YOUR FINANCES.) When workers are starting a career, it’s normal to have limited funds for investment purposes. Time and compounding allow these limited funds, and the money that these funds generate, to both grow and compound over time. For example: starting with a zero balance in a tax-deferred account and adding $300 semi-annually (compounded semi-annually) with a 9% interest rate yields a final balance of a little over $1.5 million after 35 years. This works out to a monthly investment of only $50 dollars!

But, the key is starting early. When observing the effects of compounding it’s important to note that, almost nothing appears to be happening in the first 25 years. It is only after that period that the combined value of investments and investment growth can really grow and compound.

hfhhfhhf

Too Much Risk– A very common misconception is that it is both recommended and permissible to take greater risk early in your investing career. Risk is an integral part of investing, and investors are normally rewarded for taking more risks. But, excessively risky investments can be harmful in the short run, and excessive risk provides a basis for future failure.

My experience with high-risk investments left me with little satisfaction and less money. The dollar amounts that were lost early in my investing career were not large, but even the small amounts lost were dollars unavailable to invest for long-term growth and compounding. Risky investments have a low probability of long-term success, and these early investment failures create increased stress as time progresses. As investment failures mount over time and account balances fail to grow, investors feel that increased risk is needed later in life to “catch up” for earlier losses and missed opportunities. A never-ending circle of excessively risky investments and investment losses that create the need for even riskier investments and losses is ultimately created. Instead of reaching investment goals, these goals move further and further away and are never reached.

fhghfggfg

Too Conservative– Almost as bad as taking too much risk, is taking two little risk. Early in my investing career, I would compare notes at the end of each year with a friend who invested very conservatively. He invested only in CDs because he felt investing in the Stock Market was too risky. We did this for several years and initially he did better in some years while I did better in other years. After a few years it became obvious to both of us that his strategy was leaving him further and further behind.

In most cases, a 100% investment in CDs does not even keep pace with inflation. Even retirees, who are considered the most conservative investors, should have a percentage of their assets invested in stocks. It is generally agreed that stocks provide the best long-term protection against inflation. The normal stock percentage recommended for retirees who wish to invest in the Stock Market is generally between 40% and 60%. Not all retirees feel comfortable investing in the stock market during retirement. There are well-known ways to provide an income stream in retirement. Regardless of the strategy applied, some form of inflation protection will be needed. It will be up to the individual retiree whether this means a percentage of assets invested in the stock market or some percentage of assets used to purchase an annuity with an inflation protection rider which provides a certain percentage increase annually.

fhhfhhfh

Too Little Invested– One of the big decisions each investor must make is how much money Present You is willing to give up to build retirement funds for Future You. It’s hard to give up money that could be used for present needs, wants, or wishes. It’s also hard to visualize the Future You that Present You will become in 40+ years. What percentage of your paycheck you decide to save is directly correlated to how long you will need to work to replace current income (See: BUILDING A RETIREMENT PIE: ONE SLICE AT A TIME.) There is a significant difference in how long a person needs to work to replace current income when saving 5% of income versus a savings rate of 20%. Saving an extra 15% of income decreases the time needed to replace the current income from 66 years to 37 years. If you have no savings, then you are never able to quit working, and a 5% savings rate means that you must work for 66 years. If starting work at age 18, this means working until age 84 to replace current income!

fgjhghhg

Too Few Investments– diversification decreases risk. It’s just that simple! Having assets invested in 100% company stock is not recommended! Even though you feel you know and understand your company, workers are not always privy to information that could adversely affect a company’s stock price, and ability to retire. Wisdom dictates that no more than 10% of your portfolio be invested in any single stock. Recent research indicates that the vast majority of 401(k) assets are invested in a single target date retirement fund. Is this a bad strategy? It’s important to understand that target date retirement funds are a fund of funds. This means that a target date fund is a mixture of other types of funds available through that company that are allocated based on portfolio asset allocation at any given period. This means that even if a 401(k) plan’s assets are invested in a single target date fund, that fund is comprised of thousands of different stocks and will provide some or all needed diversification.

jhfhhfhf

Too Many Investments– diversification decreases risk. Diversification also means that a portfolio will become more complex and harder to manage. So, there is a constant struggle between how many stocks or mutual funds are needed to provide adequate diversification without significantly increasing portfolio complexity. Some investors become collectors. I have seen portfolios comprised of between 50 and 60 mutual funds and stocks. Unfortunately, when an investor reaches this number of investments in a portfolio, complexity and duplication, become a major issue. Even a portfolio of 15 different mutual funds will have a tendency to have significant overlap. By that I mean, the different mutual funds in the portfolio may all contain a significant percentage of the same stocks.

hfhhhfr

Too Little Knowledge– Even a portfolio adequately, funded and diversified may not be sufficient for someone without proper financial education and understanding. Knowledge is power! It is incumbent on everyone to gain sufficient knowledge to understand their investment needs, goals, and financial pathway. Investors who are unwilling to invest adequate time to gain basic financial knowledge are better served by engaging a financial advisor to manage retirement funds. Engaging a financial advisor does not remove the need for basic financial knowledge, it only lessens that need.

kghgjjjg

Too Much Advice– I can almost guarantee that at some point everyone reading this blog has heard someone speaking about a company or a company stock that has outperformed the market significantly. FOMO (fear of missing out) is a misstep that can have severe implications with money that is invested without adequate research in a particular stock or mutual fund. I have lost money in almost 100% of the stock recommendations that I invested in based on information received in a social setting. Too much advice or advice from financially questionable sources leads to impulse purchases of stocks that are unnecessary or too risky. One of the hardest skills to learn is the ability to ignore the little voice inside that tells you that you are missing out when not purchasing a certain stock or mutual fund.

ghghhgh

This is an abbreviated list, as there are numerous other missteps that can cost both time and money. These are some of the missteps that have caused me pain over the years. Becoming aware of and avoiding these missteps can save each person significant time and money. As the opening quote stated, ”Smart people learn from their mistakes. but the real sharp ones learn from the mistakes of others”.

jfhhhfg

Final Thoughts

ghghhghhg

- Better than making mistakes is learning from the mistakes of others!

- A lifetime of investing has taught me that avoiding small missteps can generate large dividends over time.

- Comprehensive planning and thoughtful execution over a lifetime create the framework for a successful retirement.

jhghhghhhg

fhhhfhf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS