HFDHHFHHF

ghhghhgh

Recently, I had a conversation with a friend who questioned the validity of owning a Roth IRA account. He had a traditional IRA account and questioned the need for a Roth IRA account. He also questioned whether starting a Roth IRA Account was worth the time and effort.

He feels that paying taxes before it is necessary is unwise. He also feels Roth IRA accounts add complexity and create an additional account to monitor and maintain.

He liked the idea of having a traditional IRA account where money is contributed into the IRA, the account grows tax-deferred, and then money is distributed when the account holder retires or when required by RMDs.

His understanding of traditional IRA accounts is correct. But, traditional IRA accounts are not the only type of IRA account available.

ffjjfjjf

IRA accounts fall under two general headings.

- IRA accounts are classified as tax-deferred accounts. Examples of IRA account types are Traditional IRAs, SEP IRAs, rollover IRAs, and simple IRAs.

- Roth IRA accounts are classified as tax-free accounts. Examples of Roth IRA accounts include the Roth IRA and Roth 401(k).

dhhdhhdh

His question is simple. Are Roth accounts worth the time and effort?

The answer is complex and more nuanced. Many things determine the validity of a Roth account including age, tax rate, income, retirement planning, and estate planning.

fgfyufyyf

Let’s look at the history of the Roth IRA:

The Roth IRA, a popular retirement savings account, was established by the Taxpayer Relief Act of 1997 (Public Law 105-34) and became available to investors in 1998. It is named after its chief legislative sponsor, Senator William V. Roth Jr. of Delaware.

The concept of a Roth IRA was initially proposed in 1989 as the “IRA Plus” by Senators William V. Roth Jr. and Bob Packwood. This early version would have allowed tax-free earnings withdrawals in retirement. To aid its passage, the 1997 Taxpayer Relief Act limited tax-deductible traditional IRA contributions for higher earners and expanded the availability of Roth IRAs, although initially with income limits.

A core feature of the Roth IRA is that contributions are made with after-tax dollars, unlike traditional IRAs. Qualified withdrawals in retirement are tax-free. Roth IRAs offer flexibility, allowing contributions to be withdrawn penalty-free at any time, although earnings may be penalized if withdrawn before age 59½. They are also beneficial for estate planning, as funds left to heirs are tax-free. The Roth IRA has seen significant growth in popularity since its introduction.

fhhhjjfjjf

This blog discusses Roth IRA accounts and their effects on individuals and families. First, it’s necessary to have a basic understanding of the differences between Traditional and Roth IRA accounts.

The easiest way to differentiate between the two types of accounts is by how they are taxed.

Money placed in IRA accounts is tax-deferred. Both contributions and investment income are tax-deferred until money is removed from the account. Taxable income in the year of the contribution is reduced by the IRA contribution amount. If either contributions or investment income are distributed before age 59 1/2, these distributions are subject to taxation and penalties (There are exceptions to this rule that would allow early penalty-free distributions that will not be covered here.)

Money placed in Roth IRA accounts is tax-free. Both contributions and investment income within Roth IRA accounts are exempt from taxation. Contributions in Roth accounts do not reduce taxable income and are taxed in the year of the contribution. For the purposes of this Blog, the term contributions includes basic contributions, Rollover IRA conversions, backdoor Roth conversions (taxed when contributed into an after-tax traditional IRA), and Roth conversions.

jfjfjjfjjf

As of mid-2024, 44% of US households owned IRAs, an increase from 34% a decade ago. The Investment Company Institute (ICI) reported that 57.9 million U.S. households had IRAs in mid-2024.

- Overall IRA ownership is increasing: Ownership increased from 34% a decade ago to 44% in mid-2024.

- Traditional IRAs are the most common type: Owned by 33% of US households in mid-2024.

- Roth IRAs are also popular: Owned by 26% of US households in mid-2024.

- According to Investment News: Younger households prefer Roth IRAs while older households prefer Traditional IRAs. The percentage of households headed by someone in their 20s with a Roth IRA has significantly increased, tripling from 6.6% in 2016 to 19.2% in 2022.

- Households with IRAs have other retirement savings: Nearly 9-in-10 IRA-owning households also have employer-sponsored retirement plans or defined benefit plan coverage.

hfhhhfh

The most common type of IRA is the traditional IRA. The Traditional IRA was created by the Employee Retirement Income Security Act of 1974 (ERISA). The second most common type is the Roth IRA, which was created by the Taxpayer Relief Act of 1997.

Forty-four percent of Roth IRA-owning households in 2023 indicated their Roth IRA was their first IRA account.

Households often invest in both traditional and Roth IRAs.

In 2023, 60 percent of households that owned Roth IRAs also owned traditional IRAs.

ffhhhfhf

According to the IRA investor database:

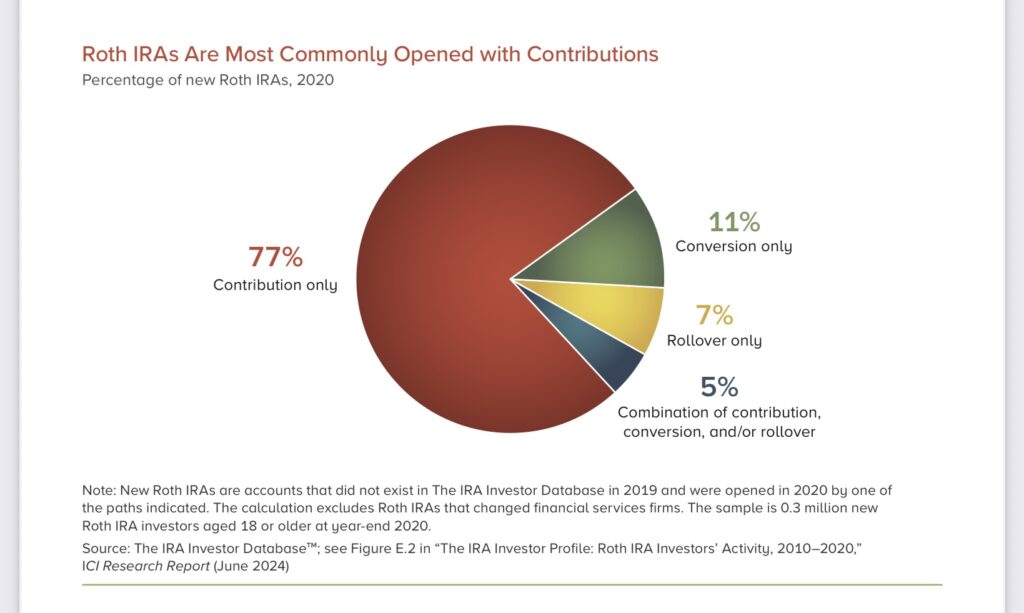

Roth IRAs can be opened with contributions (subject to income limits), conversions, or rollovers. In a typical year, the most common path to Roth IRA ownership is through contributions.

In tax year 2020: 77 percent of new Roth IRAs were opened only with contributions. In contrast, 11 percent were opened only with conversions. 7 percent were opened only with rollovers. 5% were a combination of contribution, conversion, and/or rollover.

jgfjjgjjgjg

Key Features of a Roth IRA:

- After-tax contributions: You contribute money after it has been taxed, meaning you won’t get a tax deduction for your contributions in the current year.

- Tax-free growth: Investments within the Roth IRA grow tax-free, and the earnings are not taxed while they remain in the account.

- Tax-free withdrawal of contributions: Unlike traditional IRA accounts where all distributions are taxable and may be subject to penalties, contributions to Roth IRAs are made with after-tax dollars and contributions can be distributed at any time without taxation or penalties. This only applies to Roth IRA contributions, as there are rules concerning the distribution of Roth IRA investment income.

- Tax-free withdrawals (qualified): When you take withdrawals in retirement, provided you meet certain requirements (typically age 59 1/2 and having held the account for at least five years), the withdrawals, including earnings, are tax-free.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, you are not required to take distributions from a Roth IRA or Roth 401(k) after a certain age (though you may have to if you inherit one).

- Contribution Limits: There are annual limits on how much you can contribute to all your IRAs (traditional and Roth combined). For 2024 and 2025, the limit is $7,000 if under age 50 and $8,000 if 50 or older.

- Income Limits: There are income limits for contributing to a Roth IRA. For 2025, single filers with a modified adjusted gross income (MAGI) below $150,000 can make full contributions. For those filing jointly, the limit is $236,000.

- Income requirements: IRAs (Roth and Traditional) require contributions from work-related income. Passive income sources such as investment income or real estate income are not qualified income sources, and cannot be used to make IRA contributions.

djfjhfjhhjf

Benefits of a Roth IRA:

- Tax-free retirement income: The primary advantage is the potential for tax-free retirement income, which can be especially beneficial if you anticipate being in a higher tax bracket during retirement.

- Flexibility: You can withdraw your contributions at any time without penalty, although withdrawals of earnings may be subject to taxes and penalties if not qualified.

- Estate Planning: Roth IRAs can be advantageous for estate planning purposes, as they can be passed on to beneficiaries with potential tax advantages.

- Favorable tax treatment: Once money is contributed into a Roth IRA account, principal and earnings are tax-free for the remainder of the holder’s life.

hghhghg

Who Benefits Most From Roth IRA Accounts?

Younger and lower-income workers benefit most from Roth IRA account ownership.

Younger workers benefit from having longer periods for Roth IRA growth and compounding.

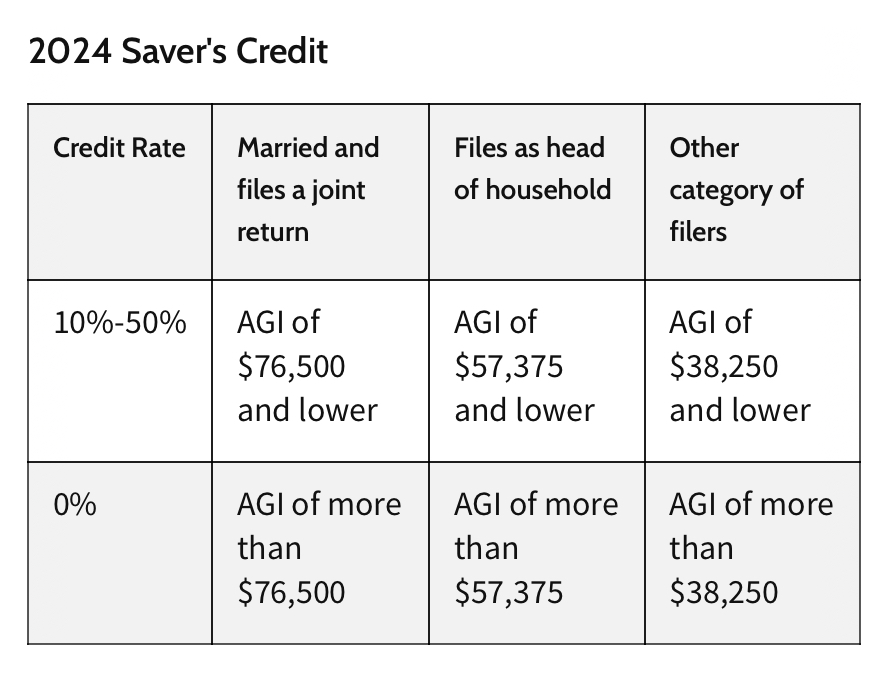

Lower-income workers benefit from the favorable tax treatment of Roth IRA contributions. Low-income workers are in the lowest tax brackets. This means that Roth contributions will receive the best tax treatment. Lower-income workers may also be eligible for an IRS Saver’s Credit.

You qualify if you meet the following criteria:

- You’re 18 years old or older

- You aren’t claimed as a dependent on someone else’s tax return

- You aren’t a student

You may be eligible for a nonrefundable tax credit of up to 50% of your IRA contribution, not exceeding $1,000 ($2,000 if married filing jointly), depending on your adjusted gross income (AGI). Below are the 2024 tax credits that are allowed for combinations of particular income ranges and tax-filing statuses

fhhgfghhfhhf

All workers can benefit from Roth IRA accounts, but the obvious benefits of lower taxation and maximum compounding decrease or disappear as a worker ages and moves into higher tax brackets.

One of the biggest benefits of Roth account ownership concerns legacy giving and estate planning.

Unlike traditional IRA accounts, Roth accounts can be passed to heirs income tax-free.

Additionally, the Roth account can be maintained as an Inherited Roth IRA for 10 years after the original owner’s death. The account must be liquidated before the end of the tenth year after the original account owner’s death (this is not true, as a Roth IRA can be transferred to a spouse with no lifetime limitations. (There are relatively complex considerations that will not be addressed here.)

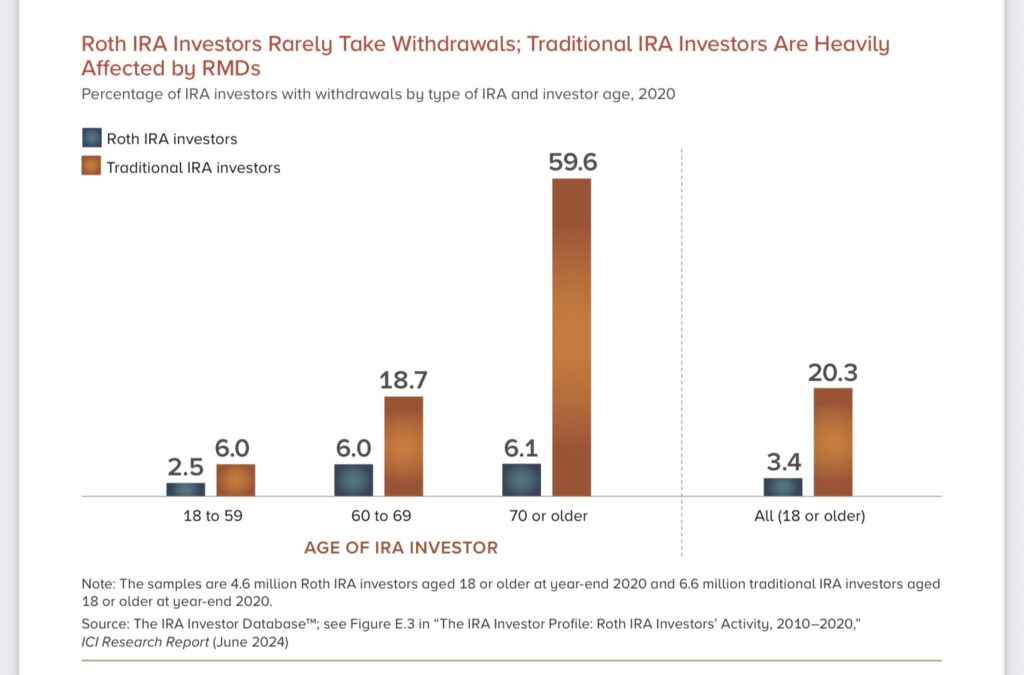

The following chart outlines the withdrawal frequency of Roth IRA account holders compared to Traditional IRA account holders. I detailed my own hesitancy to withdraw Roth IRA funds in the Blog titled: MY ROTH IRA (UN)SPENDING.

dhfhhhhfh

dhdghghdhhd

Final Thoughts

I agree with my friend who is now retired. The advantages of starting a Roth account are minimized as a person ages. His age dictates that his time horizon is short and the advantage of compound growth is diminished. Compounding takes time, and time is what he lacks.

Roth accounts are advantageous for young workers and low-income workers. Roth accounts may be the best retirement account for younger workers.

Younger and low-income workers may also be able to take advantage of the IRS Saver’s Credit.

Roth Accounts afford many benefits, including tax-free growth, tax-free retirement income, estate planning benefits, and retirement planning flexibility.

gjfgjjjjf

kkgkkgkg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS