ghghghgh

“The important thing is not to stop questioning. Curiosity has its own reason for existing.”– Albert Einstein

I love questions submitted by readers and listeners! Recently someone questioned whether being 100% invested in and S&P 500 index was the best investment strategy. This person had read several articles that recommended placing all investable funds in an S&P 500 index fund.

jghghghhgh

So, is a 100% Asset Allocation to the S&P 500 Index a Valid Investment Strategy?

fjjkfjfjhfjh

The correct answer to this question involves looking at the question from two different perspectives- technically (mathematically) and behaviorally (emotionally.)

dfkfjjjfkf

Technical Aspects of a 100% Investment in an S&P 500 Index Fund.

dldjfhghf

The S&P 500 is one of the best known indexes. It is comprised of large, US stocks, and includes about 75% of the market capitalization of all publicly traded US stocks. (Market capitalization is the value of companies that are traded on a stock market, and market capitalization is calculated by multiplying the total number of shares by the present share price.)

kdjjhdhhdhhd

However, the S&P 500 index has no exposure to the better performing small-cap stock sector, and no exposure to international stocks.

According to Investopedia: The average annualized return since adopting 500 stocks into the index in 1957 through Dec. 31, 2022, is 10.15%.

The average annual return of the S & P 500 index over the last 15 years has been 8.81%. Over this same 15 year period the S&P 500 index performed better than small cap stocks (7.16%), international developed stocks (2.29%), emerging market stocks (0.99%), REITs (6.64%), high grade bonds (2.57%), high yield bonds (6.02%), and US treasury bills (0.62%.)

So, with an annualized return of 10.15% since 1957, and an annualized return of 8.81% for the last 15 years (which beat all other major asset classes), a 100% investment in the S&P 500 index. Seems like a slam dunk!

dkldjdjjdj

Are There any Technical (Mathematical) Problems with a 100% Investment in the S&P 500 Index?

hdhdhghfhdfhd

The short answer is YES, there are technical problems! The two biggest technical problems with a 100% investment in the S&P 500 Index are: Lack of Diversification, and Underperformance for Long Periods.

*Lack of Diversification–

I’ve already stated above that even though the S&P 500 index incorporates the 500 biggest large cap stocks in the US stock market, it doesn’t include any exposure to small cap, stocks, or international stocks.

This lack of diversification has benefited the S&P 500 during the United States explosive growth from 1957 to date. But, it’s always important to remember that past performance is not a guarantee of future returns. (It would be almost impossible for me to invest my entire retirement portfolio in the S&P 500 Index based on past performance data.) No one can predict how the S&P 500 index will perform in the future.

Diversification decreases risk (See: PORTFOLIO NUTS AND BOLTS and INVESTMENT PLAN BASICS.) Even though the S&P 500 is comprised of 500 US large-cap stocks, it is still narrowly focused when considering the whole universe of world-wide stocks. When viewed in the context of all available worldwide stocks, a 100% Investment in the S&P 500 index increases risk because it excludes all other stocks in the US stock market, and all international stocks.

gjgjjhg

*Prolonged Periods of Underperformance–

The S&P 500 index is also subject to prolonged periods of under performance. The S&P 500 index funds have the ability to match, but not beat the US stock market, and the S&P 500 weighting system increases risk by giving a small number of companies a major influence in the index.

Let’s look at the period between 2000 and 2010. This period has often been referred to as “The lost decade for stocks.”

For the period between 2000 and 2010 a $10,000 investment in the S&P 500 US large cap stocks would have yielded a final balance of $9017. This means that over a period of 10 years that your investment would have lost approximately $1000 or 10% of its value.

During this same 10 year period a $10,000 investment in emerging markets equities would have generated a $25,520 final balance. This would represent in approximate 150% increase in value! Similarly, a $10,000 investment in US small cap value stocks would have generated a final balance of approximately $21,000. International ex-US small cap stocks returned a final balance of $30,764 which represents more than a 200% increase in value.

Almost all major asset classes handily beat the S&P 500 index over this ten year period. This means that if you had invested all your money in the S&P 500 index in 2000 that over the next 10 year period you would have watched your investment decline by 10% while US small cap stocks, which are not included in the S&P 500 index, would have increased by over 200%.

This long-term under performance of the S&P 500 index brings us to the second perspective of a 100% investment in the S&P 500 index. This second perspective is the behavioral (emotional) aspect of a 100% S&P 500 index investment.

jfjhhhf

Behavioral (Emotional) Aspects of a 100% S&P 500 Index Investment.

fkfkkjjkf

According to Investopedia: Risk is defined in financial terms as the chance that an outcome or investments, actual gains will differ from an expected outcome or return. Risk includes the possibility of losing some or all of an original investment. Each investor has a unique risk profile that determines their willingness and ability to withstand risk. (One of the initial tasks of a financial planner is to determine a client’s risk tolerance. There are several different types of risk assessment evaluation programs to help determine personal risk tolerance. In general, investors with a higher risk tolerance expect higher returns to compensate for taking higher risks.)

Most people understand the concept of risk. The problem with risk is that most people overestimate their ability to tolerate risk.

In a 2016 article by Russell Poldrack of Stanford University titled “What is loss aversion?” Professor Poldrack states that losses generally have a much larger psychological impact than gains of the same size. He stated that more recently, psychologists and neuroscientist have uncovered a phenomenon that they termed neural loss aversion. And their studies individuals displayed enhanced brain activity in certain brain areas as the amount of reward increased and decreased activity as the potential losses accrued. But, brain reactions were stronger in response to possible losses than to perceived gains.

jfjjfkkjf

So, if Emotional and Neural Perception of Losses are Felt More Intensely, How Does This Affect our Ability to Tolerate Prolonged Periods of Underperformance of Investments?

fjjhfhhf

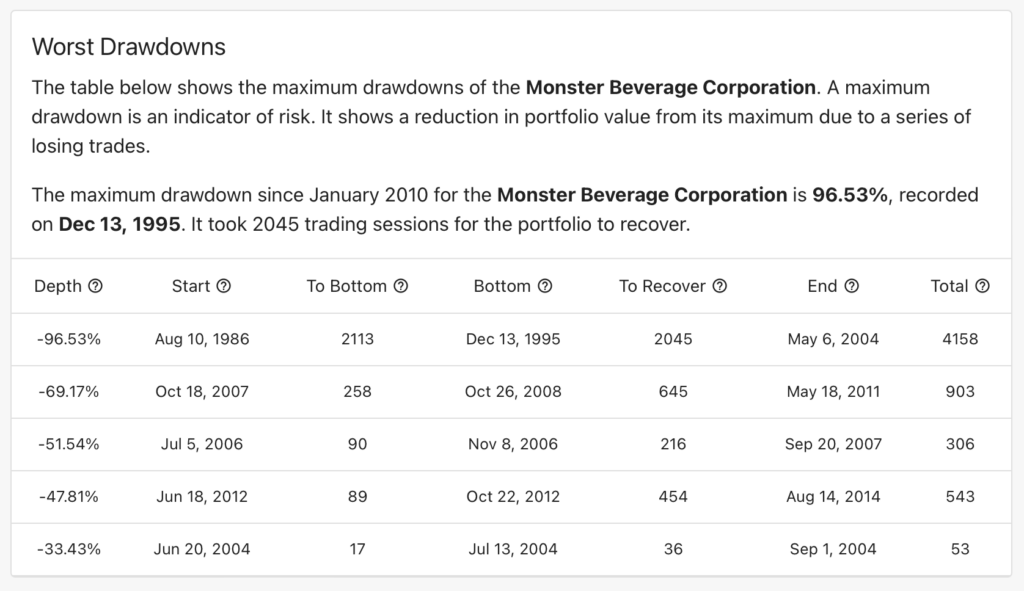

Let’s look at Monster Beverage Corporation (MNST) which is the best performing stock of the past 20 years. The company was formally known as Hanson natural corporation and changed its name to monster beverage corporation in January 2012. Monster beverage corporation was founded in 1985.

Monster beverage corporation has a 20 year trailing positive total return of 87,560% and a total return to date of 135,316%. A $10,000 investment in monster beverage corporation in January 2014 would be worth nearly $7,034,230 or roughly a 70,242% increase (adjusted for splits and dividends).

hhgjfkkkf

Who Wouldn’t Want to Make That Investment and Become a Multimillionaire?

dldkdkkd

But, in order to generate that maximum return, you would have had to tolerate losses of -96 1/2%, -69%, -51 1/2%, -47.81%, and -33.4% while staying invested for the life of the stock without selling at any point (At the point of the -96.53% loss on August 10 of 1986, it took 4158 trading sessions, or until May 6, 2004 [almost 18 years] to recover the loss.)

Graph by PortfoliosLab.

gjjgjhjg

Loss aversion dictates that very few people could stomach a -96 1/2% loss that extends over a period of 18 years.

I know that I couldn’t tolerate that magnitude of a loss for that period of time, and the vast majority of investors couldn’t either. So, turning a $10,000 investment into $7+ million is not easy or comfortable to accomplish.

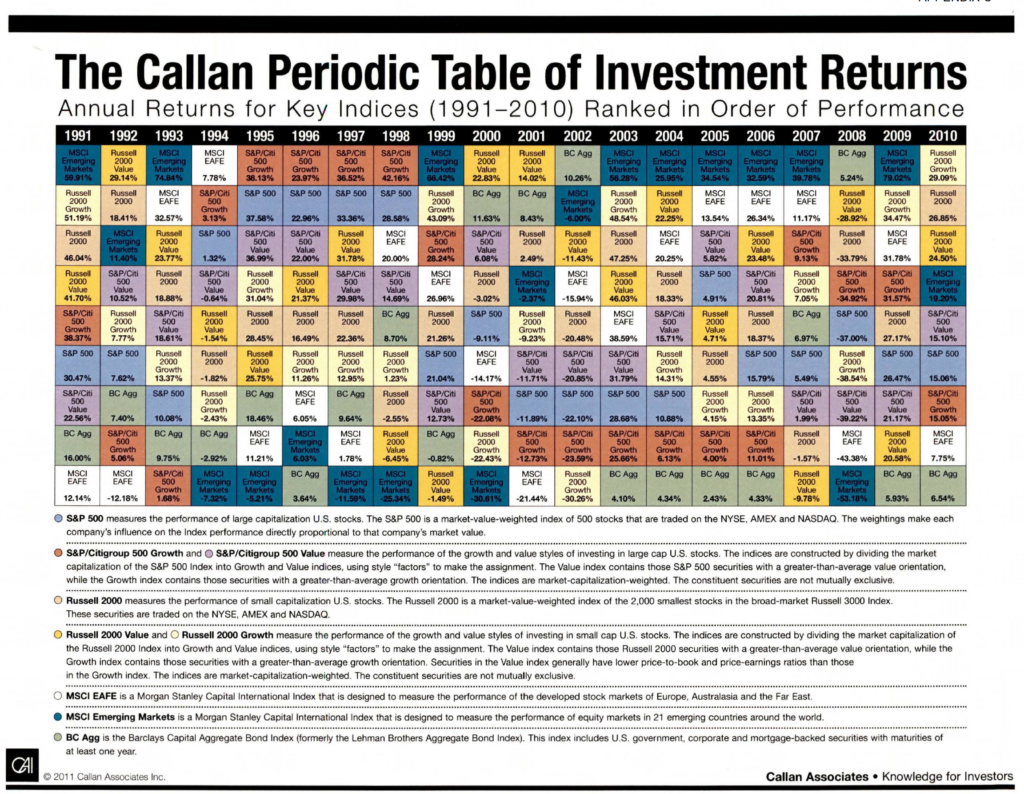

Now, let’s switch over to the S&P 500 Index. The potential for loss is not as extreme and the time period of loss is normally not as long. But, the effects of loss aversion are still present regardless of the magnitude of the loss. Below is a chart called the Callan Periodic Table for the years 1991 through 2010:

ghghfjfkkf

The chart indicates that the performance for the S&P 500 index was strong for the period between 1991 and 1999 followed by negative or weak returns for the period between 2000 and 2010. (The trend again is a period of strong performance, followed by a 10 year period of under performance.) It is also important to note that in the Callan periodic table an individual asset class that is a top performer of one year becomes the worst performer in following years, and vice versa.

Loss aversion, rears it’s head when a top performing asset class cycles to underperformance and several years of imbedded gains evaporate and become current losses. Loss aversion and the emotional turmoil it produces are risks inherent to investment in a single asset class such as the S&P 500 Index.

jfhfhhf

And the Ultimate Answer is:

jdfjjjjf

Technically, the S&P 500 index has outperformed most other asset classes over long periods. This has been established by historical research over many years and is not disputed. The more problematic aspects of investing in a single asset class are the emotional and behavioral problems associated with loss aversion. Because losses are felt more intensely than gains, otherwise rational investors sell funds during the height of a drawdown to avoid the emotional pain of a losing position.

With an investment in a single asset class not only must an investor rely on unreliable historical data to guide future investment decisions, they must also effectively ignore the strong emotional desire to avoid additional losses by selling at an inappropriate point in the investment cycle.

Both of these considerations can be avoided and mediated by investing in a balanced portfolio that diversifies risk over multiple asset classes and countries. Multiple asset classes mediate risk, create more consistent returns, and normally have one or more asset classes that will outperform in any given year (See: INVESTMENT PLAN BASICS and PORTFOLIO NUTS AND BOLTS.)

ghhhgghg

Final Thoughts

mjfnnnbfbf

- The S&P 500 index has provided excellent long term returns, but with long periods of intermediate underperformance.

- And investment in any single asset class must consider both technical and psychological perspectives.

- Single asset classes normally lack adequate diversification, and are subject to long periods of under performance.

- Loss aversion can lead to poor investment decisions at the worst possible time.

- To successfully invest in a single asset class, an investor must rely on historical data as a guide to future performance and additionally, must be able to suppress loss aversion.

- Investing in a properly constructed portfolio will help to mediate risk, smooth returns, and have some asset classes that will outperform each year.

- A properly administered risk assessment evaluation will help an investor to determine personal risk tolerance.

- An investor’s perceived risk tolerance is usually much higher than actual risk tolerance.

kjfgjjhhjjhg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS