Plans are nothing; planning is everything. – Dwight D. Eisenhower

Planning is everything! But, planning that doesn’t result in the formulation of a plan is an exercise in futility. A written plan should be the ultimate goal of extensive planning (See: HAVING A “PLAN”.) The plan discussed in the blog HAVING A PLAN addressed the need of having a written retirement plan. The same need for a written plan holds for an Investment Plan.

hfhfhfhfhfhfh

This blog concentrates on investment planning; the blog’s information concerns investors of all ages and outlines the process of creating a formal Investment Plan.

hfjfkfkfdkkfkkf

Most of the blog titled HAVING A PLAN concerned formulating a retirement plan more than an investment plan.

A retirement plan is a map to direct a person to a certain destination in life. And investment plan is a map to direct a person to a certain financial destination.

An Investment Plan involves the process of aligning financial goals (where you want to go- your destination) with investment resources (what you currently own to help get you there- WHAT’S YOUR NET WORTH?) An Investment Plan is a component of financial planning which utilizes savings to ensure the greatest return through targeted investments.

An investment plan is an integral part of retirement planning.

hjgjjdkfkgjgkgjkkkgkg

What does an investment plan include ?

The components of a formal Investment plan include:

Current financial situation-

Current financial situation consists primarily of two sets of information:

*The first piece of information is a net worth statement. A Net worth statement lists assets, investments, and the current location of assets. Net Worth represents money already invested, or available to invest (WHAT’S YOUR NET WORTH?) This is your nest egg!

*The second piece of information needed is the amount of new money available to invest (ANNUAL SPENDING- DID I SPEND THAT MUCH ?)

With these two pieces of information, a person can derive total assets and new money available for investing. It’s also important to consider both accessibility and liquidity. Accessibility relates to how readily assets can be accessed and used. Liquidity relates to how quickly an asset can be converted into cash. Net Worth is a listing of all assets, both liquid (readily available cash), and illiquid (assets not easily converted to cash.) A cash asset in a bank is accessible because it is immediately available for use on any business day. The same cash asset in a brokerage account may require two to five business days before it can be transferred and used outside the brokerage firm, and is therefore, less accessible, even though it is liquid.

Define Goals-

Begin with the end in mind.

*Investment categories: safety, income, and growth. The Safety category attempts to maintain your current level of wealth (Net Worth.) The Income category provides active income. The Growth category attempts to build wealth over long periods. The best investment path will be based on which of these three categories is most appropriate for each individual’s needs.

*Investment objectives– the reason for investing. Is the investment objective saving for retirement? Leaving work early may be a priority. Is leaving legacy funds for heirs a concern? Specific wants such as a second or vacation home, luxury trip, or expensive hobbies will create another objective.

Time horizon-

If you’ll need your money in:

*Less than three years– cash investments like money market funds or CDs are most appropriate. Investment in stocks is not indicated because stocks are very volatile in the short term.

*Three to five years– some of your money may be invested in stocks (depending on your risk tolerance), but the bulk of assets should be invested in short-term bonds, bond funds, or cash equivalents (three years is too short a period to recover from stock market losses.)

*Six to ten years or longer– stocks should be the main investment and a reasonable percentage to invest would be more than half, given the investment time horizon. For most people the investment target is retirement. If this is the case, then investments should be slanted towards growth and a more aggressive stance (based on risk tolerance.) Normally, more risk can be tolerated and accepted when the time horizon is 30+ years.

Risk tolerance-

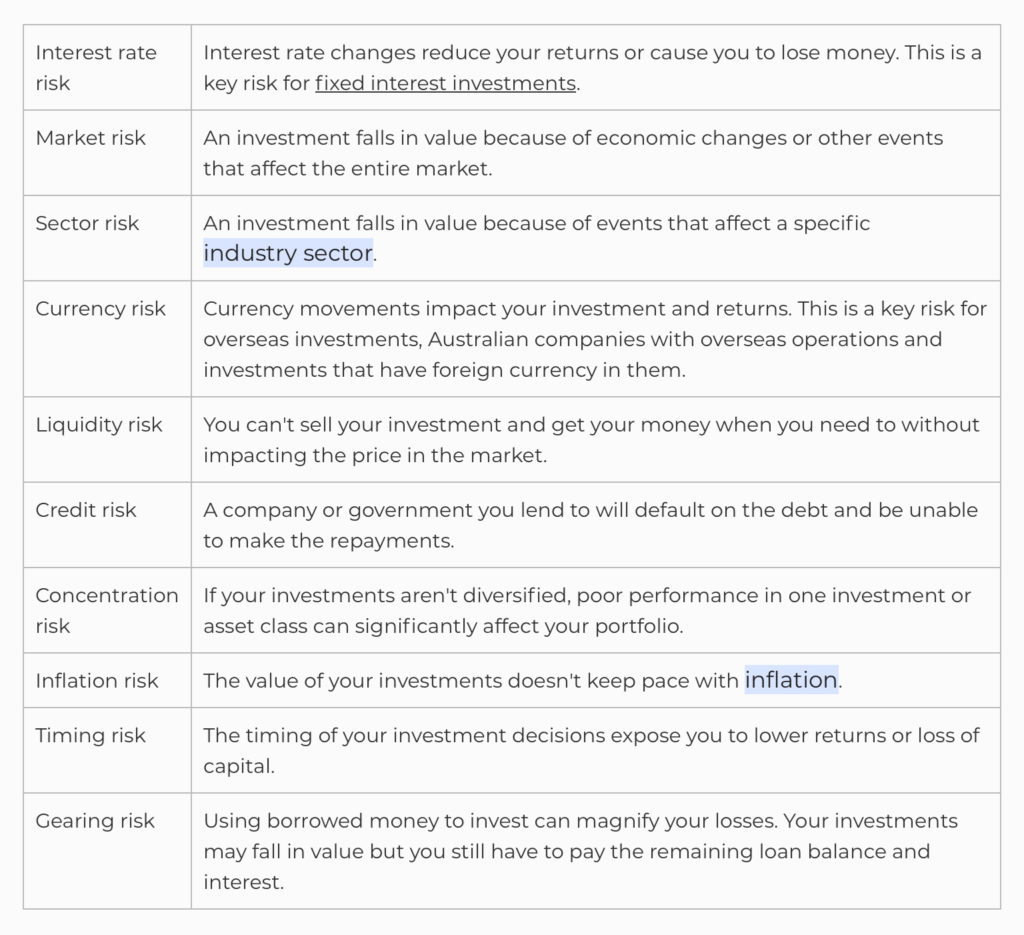

People tend to focus on how much they can make and not on the potential for loss (risk capacity.) Markets go up and down, and almost any investment involves risk. New investors need to understand their risk profile. New investors may want to complete an investor questionnaire such as the one provided by Charles Schwab (investor profile questionnaire ) to figure out personal risk tolerance. The questionnaire normally guides the decision to invest conservatively, moderately, or aggressively. There are many risks beyond whether the markets go up or down. Below are some of the risks associated with investing that may affect market prices and returns.

Risks that can affect the value of your investment include:

Investment vehicle(s)-

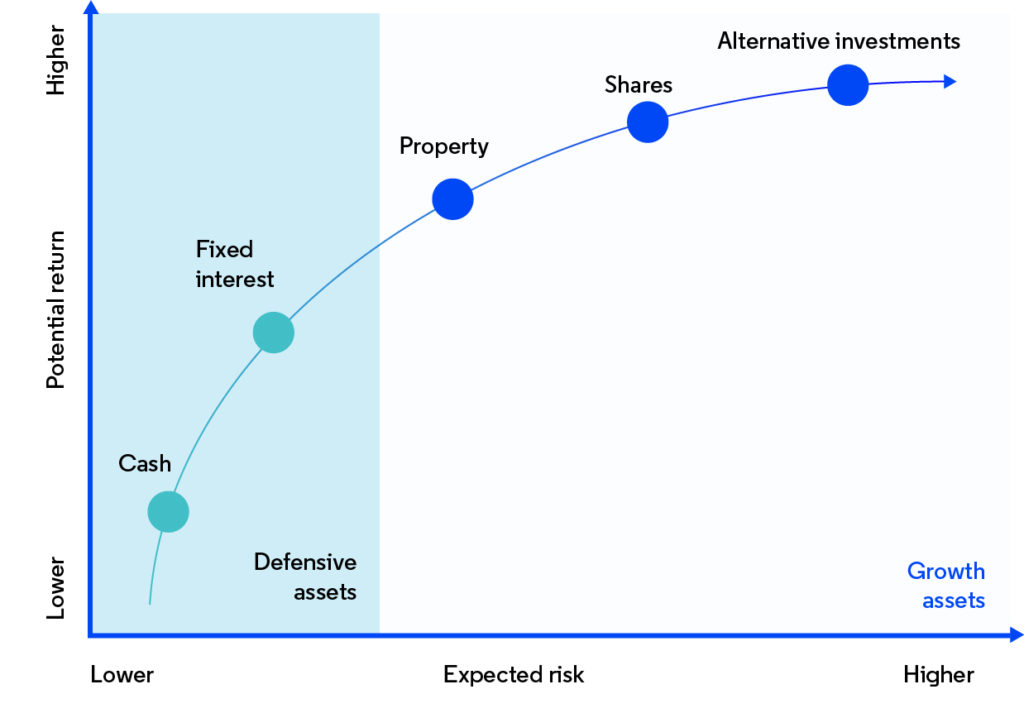

Securities like stocks, bonds, mutual funds, 401(k) plans, 403(b) plans, IRAs, bank savings accounts, CDs, 529 plans for education savings, real estate, art, gold, digital currencies, and commodities can all be used for investment. Not all are appropriate for every investor or portfolio and investment vehicles must consider time horizon, risk, and goals. Generally, the lower the risk, the lower the return and the higher the risk, the higher the return.

The graph below shows the risk and return relationship for different asset classes:

Portfolio diversification-

Allocates assets to different investment types that fit goals and risk tolerance. Proper diversification will maximize growth and stability.

Start early-

Start investing as soon as possible to maximize the effects of compound growth and a longer time horizon. (Don’t forget to create an emergency fund and get debts under control.) An investor starting early can withstand more risk and can afford to focus on growth.

Minimize fees and taxes-

Take steps to minimize both fees and taxes. How much you make and keep are both important. Use low-cost investments and brokerages (where accounts are held.) Take advantage of tax-smart strategies like IRAs, Roth IRAs, and company-sponsored retirement plans to minimize taxes during the investing period.

Monitor and reconfigure-

One of the most important and least utilized weapons is the ability to monitor and reconfigure. Monitoring Can uncover the fact that you are not investing enough money and you aren’t on track to reach your goals, or maybe you’re ahead of schedule. Reconfiguring portfolios may involve moving money to more stable investments over time, or if investments are performing well an investor may want to increase or de-risk a portfolio.

Rebalancing-

Rebalancing involves selling assets that have over-performed and buying assets that have underperformed to re-establish optimal target asset allocation. A major consideration is rebalancing frequency (quarterly, semi-annually, or annually.) Rebalancing occurs when a portfolio drifts from ideal asset allocation, periodically, or when plans change. Other considerations include the rebalancing threshold, costs of rebalancing, and tax considerations.

Plan document-

This statement provides the general investment goals and objectives of a client and describes the strategies that the manager should employ to meet these objectives. A plan document contains the nitty-gritty of plan execution and allows for easier monitoring and modification of the plan.

jdjdjdjdjdjd

Investors who engage an advisor benefit from the creation of an investment plan as a part of the provided advisory services. For DIY investors the process is more self-involved but is still a necessary part of retirement planning.

fjghgjhgkgjkd

Final Thoughts

- An investment plan should be an integral part of retirement planning.

- A formal Investment Plan considers the current financial situation, goals, time horizon, risk tolerance, investment vehicles, and portfolio diversification.

- Early implementation of an investment plan maximizes the effects of time and compounding on portfolio growth.

- Fees and taxes during the investing stage can be minimized through the use of tax-advantaged accounts.

- Monitoring, rebalancing, and reconfiguring the Plan will maintain the desired portfolio composition.

- A written Plan Document contains the nitty-gritty of plan execution and allows for easier monitoring and modification of the plan.

jdhdhdgdhdhjdhd

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS