JFHGHGHG

“Bigger the risk, bigger the reward. But the higher the climb the harder the fall.”— Greyson Chance

jhhfhfhfhf

In a recent conversation with a younger investor, it became painfully obvious throughout the discussion that this person was invested in several deferred types of accounts, and didn’t understand what those investments encompassed. The longer the discussion continued, the more frustrated each of us became!

My frustration originated from the fact that although I explained each account in several different ways, the investor could never reach a true understanding of what each account accomplished.

The investor was frustrated because even after receiving multiple explanations there was no true understanding of the function and benefits of each investment. More importantly, the investor didn’t understand why they were invested in those accounts.

ghghghghghg

At that point, the problem became: “Why am I invested in all these things I don’t understand?”

This is a common problem! This particular person is self-employed, is very successful, and has been in business for over a decade. The investment accounts are the result of recommendations by professionals such as attorneys, CPAs, and advisors, and were initiated as part of an overall tax reduction and retirement plan. All these accounts were opened in an appropriate and timely fashion! But, after approximately a decade of investing, this person still doesn’t understand the function and importance of these accounts.

This is a big problem! It’s similar to having a brand-new Lamborghini, and not understanding it’s true value!

fhhfhghfhfhg

Why not Invest in Real Estate?

ghghghhg

After my long and thoughtful discussion of each of the investment accounts, the question to me was: “Why can’t I invest in something that I understand, like real estate? I understand how the process of real estate functions, and I feel comfortable with real estate investments. Why wouldn’t I invest in real estate, which I understand, rather than these retirement accounts, which I don’t understand? Also, these retirement accounts don’t seem to produce great short-term results, and I feel like I could generate much higher returns with real estate.”

jfjfjhfjhfj

Is Real Estate the Right Investment Vehicle?

jghghhg

My initial reaction was to discount the idea of real estate investment. I am a long-term investor in the stock market and have invested in several different types of retirement accounts for long periods. I Have a high level of understanding and feel very comfortable investing in the stock market. I know from research and experience that the stock market has the best long-term return potential (See: BEST LONG-TERM INVESTMENT -FACT OR OPINION?) I’ve also been involved in investment properties and have met with both great and limited success. So, I fundamentally feel that the stock market is the best place for long-term investments (See: INVESTMENTS AND COMPOUND INTEREST.)

The problem with my initial reaction was that it discounted the feelings and understanding level of this person, who did not have the same understanding and comfort level with investing in stocks.

So now, there is a quandary! Do I continue to make the stock investment recommendation even though this person does not have a full understanding of stock investments? Or, do I agree with this person’s personal preference for investing in real estate, even though I know that investing in real estate has less long-term return potential than stocks and a higher risk profile? And worse, with the lack of financial education is it advisable to continue to recommend stock purchases, even if I feel that it is in their best interests?

hfhfhfhf

Fiduciary Responsibility

fhjfhhfhgfghf

After leaving this conversation several weeks ago I have put a lot of thought into our conversation. Over the last several weeks I have realized that this person’s decision is truly not stock versus real estate investments. The decision is instead one of risk versus reward.

No one, including me, can say that for this particular person, a long-term investment in real estate would be better or worse than a long-term investment in stocks. As stated previously, I have generated both great and poor investment returns with past real estate investments.

Real estate is an integral part of most portfolios and provides needed diversification. However, commercial real estate investments (normally REITs- Real Estate Investment Trusts) normally have an asset allocation of 5% to 10% of total assets (some professionals feel this could rise to approximately 25%.) Even having a twenty-five percent allocation in real estate is a far cry from being 100% invested in real estate!

I feel it is my fiduciary responsibility to make this person, aware of the benefits and risks associated with real estate investing. In our conversation, I questioned this person about the type and scope of potential real estate investment properties. This person was interested in single-family, or smaller multi-family dwellings for rental purposes. Potential properties would not be focused in one location, but interest was expressed in investment real estate located in the same city of this person’s primary residence.

The biggest problem for this investor is the same problem faced by all real estate investors with limited portfolios. Having five or fewer real estate investment properties in the same geographic location is similar to having all of your invested money in five or fewer stocks. In both of these examples, the potential return is much greater because investment dollars are concentrated. But, The potential loss is also greater because of the same concentration. Real Estate investment entails certain risks not associated with other investments.

hfhfhf

Risks with Real Estate Investments

hghhhghhg

According to David Scherer of Origin Investments, there are eight major risks associated with real estate investing:

1. General Market Risk. All markets have ups and downs tied to the economy, interest rates, inflation, or other market trends. Investors can’t eliminate market shocks, but they can hedge their bets against booms and busts with a diversified portfolio and strategy based on general market conditions.

2. Asset-Level Risk. Some risks are shared by every investment in an asset class. In real estate investing, there’s always demand for apartments in good and bad economies, so multifamily real estate is considered low-risk and therefore often yields lower returns. Office buildings are less sensitive to consumer demand than shopping malls, while hotels, with their short, seasonal stays and reliance on business and tourism travel, pose far more risk than either apartments or offices.

3. Idiosyncratic Risk. Idiosyncratic risk is specific to a particular property. The more risk, the more return. Construction, for example, will add risk to a project because it limits the capacity for collecting rent during this time. There’s also entitlement risk – the chance that government agencies with jurisdiction over a project won’t issue the required approvals to allow the project to proceed; environmental risks that range from soil contamination to pollution; budget overruns and more, such as political and workforce risks. Location is another idiosyncratic risk factor. For example, values can change when views once present from the property are altered or obstructed.

4. Liquidity Risk. Taking into consideration the depth of the market and how one will exit the investment needs to be considered before buying. Sometimes it’s easy to get into the investment, but difficult to get out.

5. Credit Risk. The length and stability of the property’s income stream are what drive value. A property leased to Apple for 30 years will command a much higher price than a multi-tenant office building with similar rents. The huge market in so-called triple-net leases, which are often said to be as safe as U.S. Treasury bonds and require tenants to pay taxes, insurance, and improvements, can fool property investors. The more stability in a property’s income stream, the more investors are willing to pay because it behaves more like a bond with predictable income streams. However, the triple-net lease landlord is taking a risk that the tenant will stay in business for the length of the lease and that there will be a waiting buyer.

6. Replacement cost risk. As demand for space in the market drives lease rates higher in older properties, it’s only a matter of time before those lease rates justify new construction and increase supply risk. What if a new property makes your investment property obsolete because there’s a better facility with comparable rents? It may not be possible for an investor to raise rents, or even attain decent occupancy rates. Evaluating this situation calls for understanding a property’s replacement cost to know if it’s economically feasible for a new property to come along and steal away those tenants. To figure out replacement cost, consider a property’s asset class, location, and sub-market in that location.

7. Structural Risk. This has nothing to do with the structure of a building; it relates to the investment’s financial structure and the rights it provides to individual participants.

8. Leverage Risk. The more debt on an investment, the riskier it is and the more investors should demand in return. Leverage is a force multiplier: It can move a project along quickly and increase returns if things are going well, but if a project’s loans are under stress – typically when its return on assets isn’t enough to cover interest payments – investors tend to lose quickly and a lot.

djdjdjdjjd

Risk Concentration

hghghhgg

With fewer properties, just like fewer stocks, these risks are concentrated because there are fewer properties. And, if all of the properties are located in the same geographic area, then these risks become even more concentrated.

What happens if all properties are simultaneously destroyed or damaged by a severe weather event like a hurricane, flood, earthquake, or tornado? What happens in an economic downturn when rent levels can’t be maintained, or even worse rental properties become vacant for long periods? What happens if an investment property is used for short-term rentals and short-term rental contract details become unfavorable? The municipality in which the rental properties are located may terminate or change short-term rental policies in a way that renting becomes unfavorable or illegal for the property owner. If the property is no longer rentable, can it be sold quickly, and can it be sold at a profit? This doesn’t include the expense, time, and effort expended in purchasing, renovating, and managing real estate investment property.

jfhfhhf

So, Where Does That Leave Us?

hghhhhg

- Real Estate investment can be reasonable under certain limited conditions.

- Real Estate entails unique risks.

- Unlike stocks, which can grow exponentially, real estate normally has a linear growth pattern.

- Real estate investment is much more active than long-term stock purchases which are more passive.

gjgjjg

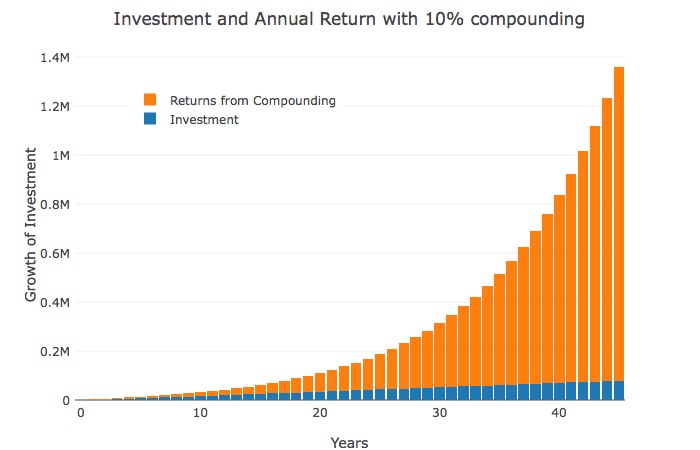

In the blogs BEST LONG-TERM INVESTMENT -FACT OR OPINION? and INVESTMENTS AND COMPOUND INTEREST the subject of compounding of long-term investments was discussed. One of the greatest benefits of long-term stock investing is compound growth. When I spoke with the investor, one of the biggest concerns that was stated, was that very little growth was seen in the investment accounts. Compound growth is one of the biggest factors in the long-term success of investments. But, the effects of compounding are normally greatest after long periods. The following chart gives a good example of the long-term effects of compounding. It should be noted that the vertical rise and greatest growth occur in later years.

This is dramatically illustrated in the following chart from Exploring Finance:

hghghghgh

Almost nothing changes between dollars invested and return for the First 10 years. But after the first 10 years, dollars that are reinvested also make money, and compounding starts to take effect.

The ultimate choice is always with the investor. Everyone must feel comfortable with investments and understand what benefits their investments will ultimately provide. But, it is also up to the investor to either get professional, help or educate themselves about the best investments and investing techniques.

Anyone who can read between the lines in this blog, and also reads BEST LONG-TERM INVESTMENT -FACT OR OPINION? and INVESTMENTS AND COMPOUND INTEREST will see that my heart and long-term research both indicate stock investing, will provide the best and safest long-term returns.

ghhghg

fjfjfjfjf

Final Thoughts

- There are multiple investment vehicles available for dollars dedicated to retirement. The common Real Estate investment allocation is in the range of 5% to 10% of investable assets.

- It is up to each investor to decide what the appropriate asset mix is for their individual investment needs and portfolio.

- And this blog we discussed the relative merits of stock investing versus real estate investing.

- Real estate entails risks not found in other types of investments. Unlike stock investments, which can be diversified through the use of different asset classes and mutual funds to mediate risk, real estate investments are much more concentrated in fewer assets, and therefore, involve much higher risk.

- Unlike stocks, which compound exponentially over long periods, real estate investments are more linear and normally do not compound exponentially.

- Real estate investing (outside of REITs) involves much more time to manage assets, and more dollars after purchase for renovations and maintenance.

- Real estate, unlike stocks, is more illiquid. Stocks can generally be bought and sold daily, with proceeds available within a day or two. Capturing profits from a real estate investment may take months or years.

- This author believes that stock investing is the best and safest, long-term investment vehicle for the average investor.

fjjfjfjf

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS