FHFHGFHGFV

JGHGHHGHG

If you rent, the rent goes up every year. But if you buy a 30-year mortgage, the cost is fixed- John Paulson

hghghhg

Recently, I had a conversation with a young homeowner. The homeowner had reviewed mortgage loan documents and couldn’t understand why the mortgage loan balance had only decreased a few thousand dollars after paying a monthly mortgage note of over $1,500.00 for five years.

Is this confusion a common problem? I think so!

The reason I’m pretty certain that confusion is a common relates to the fact that many years ago I felt the same way when reviewing loan documents for the mortgage on my first home. After about nine years in our first home, we had the opportunity to upgrade and buy a home we desired. I thought I would be pretty pleased with the remaining balance on the original mortgage, as I had been paying the mortgage note diligently and was certain I had made real progress in reducing the principal.

I was unpleasantly surprised when I reviewed the loan balance documents and realized that the principal had been minimally reduced. Like many homeowners, I didn’t understand the functional operation of a home mortgage!

Using my personal experience as a guide, I think home mortgages are a necessary and confusing problem for many homeowners. Many homeowners, to their financial detriment, don’t fully understand the terms and conditions of their mortgage.

ghhghg

What Exactly is a Home Mortgage?

Investopedia explains that a mortgage is a type of loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. The property then serves as collateral to secure the loan.

Types of mortgages

- Conventional loan: good for borrowers who want a more traditional mortgage and have good credit scores.

- Jumbo loan: usually borrowers of larger mortgage amounts with excellent credit.

- Government-backed loan: good for first-time homebuyers who have lower credit scores and less cash for a down payment.

- Fixed-rate mortgage: Best for borrowers who prefer a predictable, set monthly payment for the duration of the loan

- Adjustable-rate mortgage: good for short-term borrowers who prefer lower payments in the short term and are comfortable with possibly having to pay more in the future

- Reverse mortgages– are designed for older homeowners (age 62 or older) who want to convert the equity in their homes into cash. These homeowners borrow against the value of their home and receive the money as a lump sum, fixed monthly payment, or line of credit. The entire loan balance becomes due when the borrower dies, moves away permanently, or sells the home.

- Interest-Only Mortgages– interest-only mortgages and payment-option ARMs, can involve complex repayment schedules and are best used by sophisticated borrowers. These types of loans may feature a large balloon payment at its end.

hhhjhh

How Exactly Does a Mortgage Function?

Like most potential homeowners (especially young potential homeowners,) I didn’t have adequate free cash available to make an all-cash purchase of a home. When a person or couple doesn’t have adequate funds for an all-cash home purchase, the next logical step is to contact a mortgage lender in hopes that the mortgage lender can provide the needed funds for the home purchase. If the lending and underwriting requirements are satisfied the lender will provide funds for the home purchase. In return, the borrower agrees to pay back the original loan amount, plus interest, over an extended period. The home that is purchased serves as collateral for the loan until the loan is fully repaid.

Almost everyone can understand everything so far. At some point or another everyone has had to borrow a little money and then pay it back. In most cases, these loans are non-interest-bearing loans that are repaid quickly. In the case of a home purchase the borrower is asking someone (a mortgage lender) for a loan, but it’s not interest-free, nor is it quickly repaid.

Because most new homeowners don’t fully understand the mortgage process and are confused, they excitedly tell all their friends and relatives that they just bought their first home. That’s not a true statement! The mortgage lending company has purchased a home and is allowing the borrowers to live in the home in return for paying back the principal with interest.

hjhghhg

Mortgages and Amortization Schedules

Home Mortgage loan repayment creates the most confusion. Let’s use an example of a simple personal loan. A simple personal loan of $20 can be paid back with a $20 bill, or in the worst case with a $10 bill each week for two weeks. $20 loans are usually not paid back at $1 per week for 20 weeks, and these personal loans normally are interest-free. Mortgage loans, unlike personal loans, are interest-bearing, long-term, and in many cases levy penalties and fees for early payment.

Mortgage loan payments follow a set schedule called an Amortization table. An Amortization table usually provides a monthly (or annual) schedule of principal, interest, and annual payments.

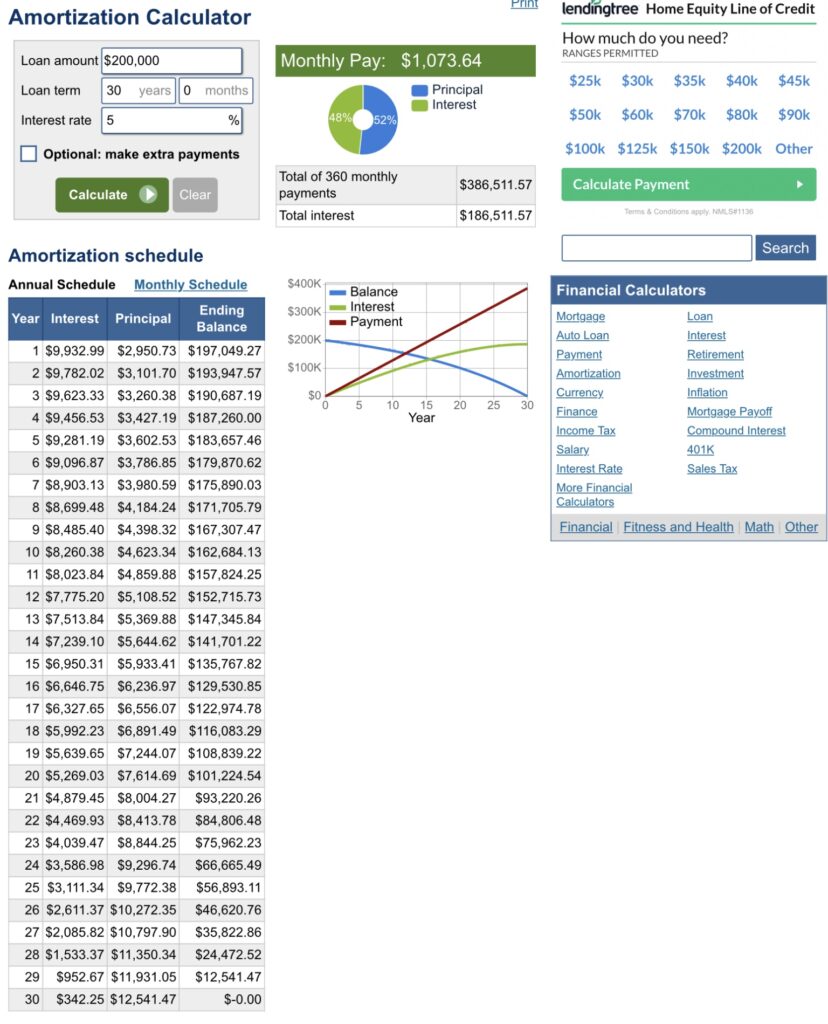

Below is an Amortization table for a 30-year fixed loan of $200,000 with monthly payments and an interest rate of 5%:

Even though the numbers are more dramatic when visualized monthly, annual numbers are provided here for a big-picture view.

hfhhf

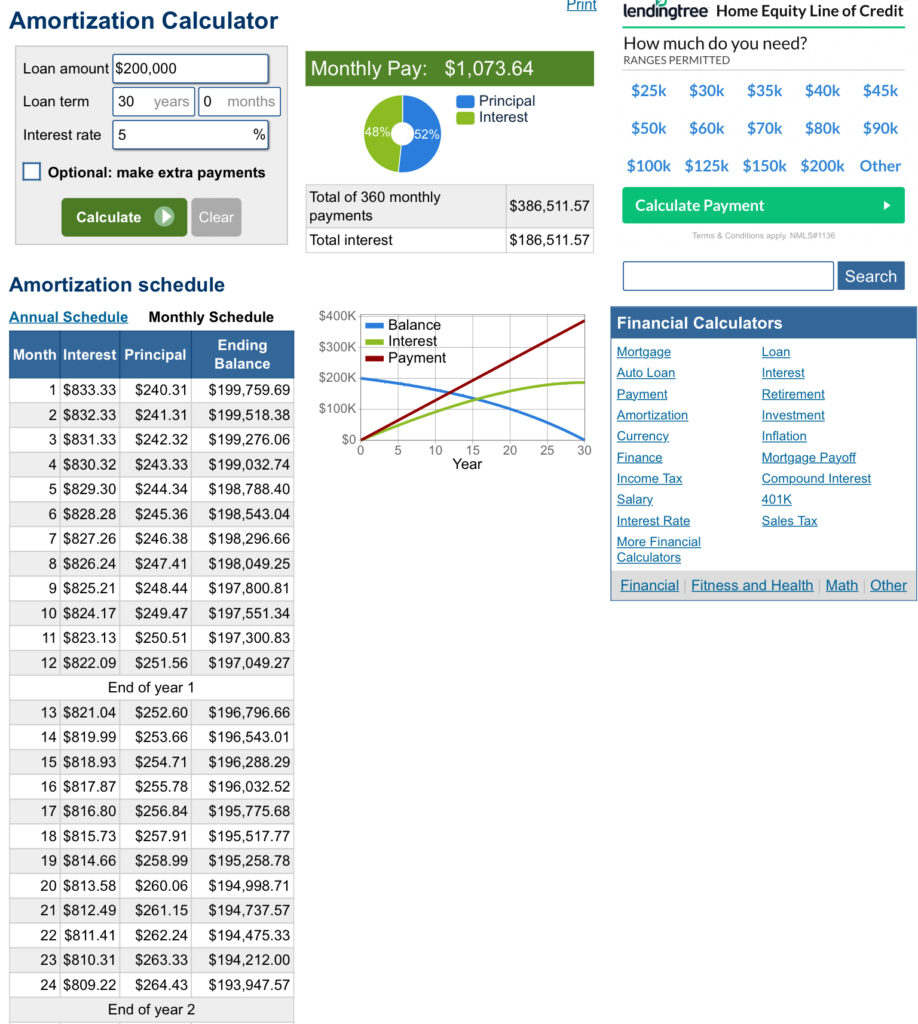

The monthly notes for the first two years look like this:

In this chart, it’s easier to see that the majority of the early loan payments are used to satisfy interest charges rather than reducing the principal balance. After making loan payments of approximately $1,075 per month for a whole year (12 loan payments) the principal has been reduced by only about $2,950. This occurs after paying approximately $12,900 in loan payments. It’s usually at this point in the discussion that the client would say: “What do you mean? I’ve paid almost $13,000 and my loan has only been reduced by $3000.” Because of how mortgage loans are crafted, the early years of loan repayments are primarily directed to interest payment, and not principal reduction.

hjghghg

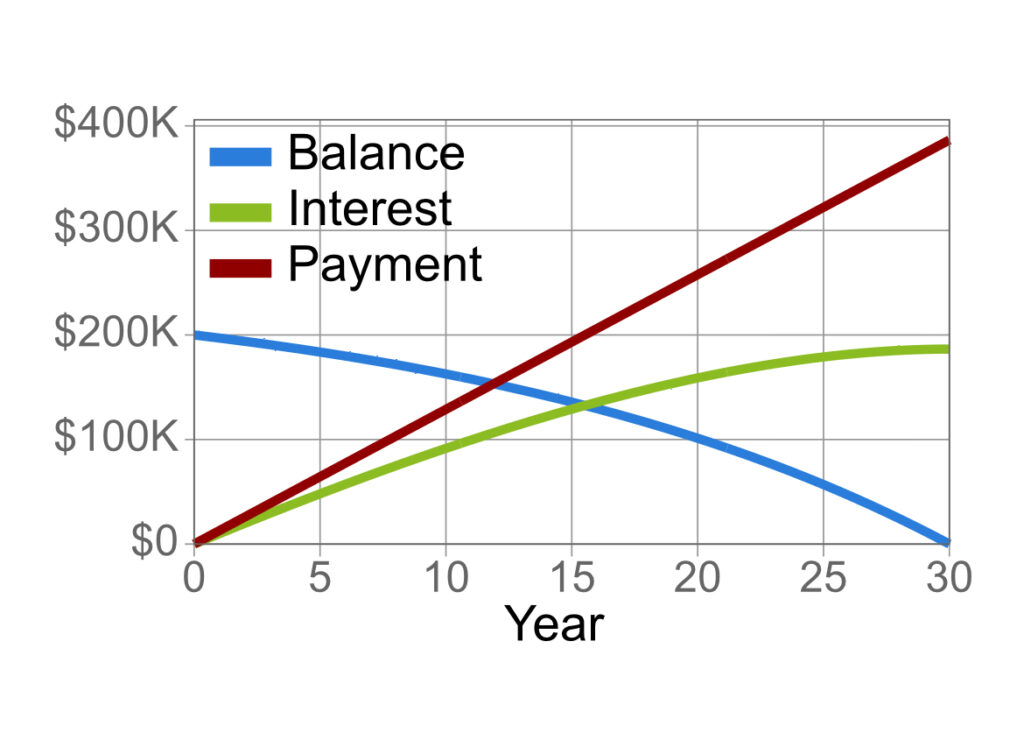

The following chart shows the relationship between balance, interest, and payments:

This graph shows pictorially that the total amount of dollars paid towards principal reduction doesn’t overtake the amount of interest paid until after year 15 of the loan (the monthly amount paid towards principal reduction doesn’t overtake interest payment until payment number 195 in year 17 of the loan.)

uurufu

It’s also important to note the total amount and interest paid during the loan period:

The total of all payments made is $386,511.57. The total interest payments made is $186,511.57. The $200K loan over 30 years of repayment has a total cost of over $386K.

kkhkkh

It’s at about this point that most people’s head wants to explode! Most people tend to focus on monthly payments and how much they can afford monthly, and not the total amount of payments over thirty years.

jhjjjh

Mortgage amounts, Interest Rates, and Time Periods.

Mortgages consist of the three main parts. Mortgage terms are determined by the mortgage amount, the interest rate charged, and the length of the mortgage term. Each of these parts is integral to the mortgage and each part helps to determine how long the mortgage will exist and how much the mortgagee will pay monthly and in total.

The easiest way to think about this is to imagine a large water line with three smaller water lines that feed into the larger line. Each smaller line has a graduated shutoff valve that can let in more or less water depending on how much the valve is opened. How little or how much each of the smaller water lines is opened will contribute to the flow of the larger water line. The combination of all three smaller lines feeding into the larger line will determine the total flow. In much the same way, a greater or lesser loan amount, interest rate, or mortgage length will determine the flow rate (monthly note) of a home mortgage.

Although, this analogy is not correct because the mortgage amount can affect the interest rate that will be attached to the mortgage. For instance, a jumbo loan (which has a larger loan amount) will typically have a higher interest rate with stricter underwriting rules. Jumbo loans usually require a larger down payment than a standard mortgage.

Interest rates are affected by market forces and nationwide inflation rates. Periods of high inflation normally result in corresponding increases in interest rates charged to borrowers. Interest rates can also be affected by the creditworthiness of the borrower. Lower credit scores equal more risk for lenders. To offset increased risk, lenders charge higher interest rates.

The length of time the mortgage is in force will affect both monthly and terminal payments. With other things equal, the longer the term of the mortgage equals more total dollars paid. A shorter-termed mortgage means fewer payments and less total monetary outlay. A shorter mortgage term also means monthly payments must be higher to pay off the loan in a shorter period.

So, if we look back at our analogy, not only can each water line affect the total water flow (monthly note), but each water line can potentially be connected to the other water lines and modify the water flow of the other pipes (loan amount, loan interest rate, and length of mortgage.) What could be confusing about that scenario? After looking at and understanding the water pipe analogy, it’s easy to understand the confusion of most homeowners!

jgjjg

PMI (Private Mortgage Insurance)

Investopedia explains that Private mortgage insurance (PMI) is a type of insurance that a borrower might be required to buy as a condition of a conventional mortgage loan. Most lenders require PMI when a homebuyer makes a down payment of less than 20% of the home’s purchase price. When a borrower makes a down payment of less than 20% of the property’s value, the mortgage’s loan-to-value (LTV) ratio is over 80% (the higher the LTV ratio, the higher the risk profile of the mortgage for the lender). Unlike most types of insurance, the policy protects the lender’s investment in the home, not the individual purchasing the insurance (the borrower). However, PMI makes it possible for some people to become homeowners sooner. For individuals who elect to put down between 5% to 19.99% of the residence’s cost, PMI allows them the possibility of obtaining financing. While PMI is an added expense, so is continuing to spend money on rent and possibly missing out on market appreciation as you wait to save up a larger down payment. However, there’s no guarantee you’ll come out ahead buying a home later rather than sooner, so the value of paying PMI is worth considering.

jgjjjg

When Does it Make Sense to Refinance?

One of the great things about mortgages, in general, is the ability to refinance under certain conditions, which usually results in more favorable mortgage, terms or payments.

- Interest rates have dropped– With corresponding decreasing interest rates, refinancing starts making more sense.

- You want to extend the term of the loan– there are several reasons why it may make sense to extend the term of the loan with refinancing. It is important to understand that extending the term of the loan will also extend and increase the total amount of interest paid.

- Time of ownership– The main idea of refinancing is usually to decrease monthly notes. There is a certain period needed after refinancing to recover the cost of refinancing with decreased monthly payments. This crossover point where the financing costs are recovered and the refinancing savings start occurring is usually around three years (just like the original loan, it depends on the refinancing amount, interest rate, and time.)

- Your credit score has risen– mortgage rates are normally tied to an individual’s credit score. A decrease in credit score usually signals that refinancing interest rates may not be optimal. The best refinancing interest rates are usually reserved for borrowers with the highest credit scores.

Going through the paperwork and expense of refinancing makes sense if interest rates have dropped at least 1.5%, if for some reason you want or need to extend the time of the loan, if you will remain in the home long enough to recover the cost of financing, and if your credit score has not fallen.

high

My Personal Best Strategy for Accelerating Loan Payoff.

My strategy for home mortgage financing has been to finance at a fixed rate for the longest time available at the lowest interest rate possible. This meant that notes were fixed and stable and that monthly payments were most affordable. Using this strategy created the greatest amount of security in knowing the note would not change throughout the mortgage and monthly payments were the smallest amount possible. The security of a fixed rate with the smallest monthly note created the least amount of financial pressure in terms of loan repayment.

It’s true that using this strategy and paying the mortgage for the full term would mean a longer mortgage term with the greatest total interest paid. But, it also meant that anytime we had extra money, we could direct those extra dollars to principal reduction. (any extra dollars added to a monthly note are used to reduce principal.) Those months where money was tight, there was no pressure to pay anything over the required monthly note.

In this manner, we were able to add extra dollars that went directly to principal reduction without the pressure of a higher monthly note. Even the addition of $100- $200 extra dollars per month used to reduce principal can significantly decrease the mortgage time frame.

By adding $100 to $200 each month we were able to effectively reduce our mortgage time frame from thirty years to less than fifteen years. So, we paid the amount necessary each month to pay off the mortgage at approximately year fifteen, yet we were only “on the hook” each month for the lesser amount of a thirty-year mortgage note.

Using an online mortgage calculator or online amortization table can make calculations of monthly payment additions and mortgage time frame reductions easier.

jfjhfhfhf

Final Thoughts

jfhjfhfhhf

- In most cases, a home purchase will create greater value over the long run.

- Most consumers consider home mortgages to be confusing and hard to understand.

- Mortgage borrowers agree to pay a series of regular payments divided into principal and interest over a set period.

- There are many different mortgage types, with the fixed mortgage being the most suitable for most potential homeowners.

- Mortgage terms will be determined by the mortgage amount, the interest rate charged, and the length of the mortgage term.

- Most lenders require PMI when a homebuyer makes a down payment of less than 20% of the home’s purchase price.

- One of the great things about mortgages, in general, is the ability to refinance under certain conditions, which usually results in more favorable mortgage, terms or payments.

- My strategy for home mortgage financing has been to finance at a fixed rate for the longest time available at the lowest interest rate possible. Combining this strategy with accelerated principal payments has allowed me to pay off 30-year mortgages in about half that time frame with less stress and more security.

GHHGHHG

HGHHGHGHG

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS