HFHHF

FHHFGH

A listener who recently contacted me asked a question about the validity of removing funds from a Roth IRA account. I answered that accessing a Roth account to withdraw funds, especially for non-emergency reasons, is generally a hard “NO!”

In the past, I have posted several articles about Roth and Traditional IRAs. These posts provide background information not addressed in this post. To access the most recent post please see: WEIGHING THE PROS AND CONS: ROTH IRA VERSUS TRADITIONAL IRA.

ruuruurr

fjghjg

Disclaimer

Before I answer the Roth withdrawal question, let me first state that I am a huge fan of Roth IRAs. When managing taxes, Roth IRAs can bestow many tax planning advantages on an account holder!

Roth IRAs are still drastically underutilized, holding only about 1/10 of the funds invested in traditional IRA accounts.

Roth IRAs have many advantages, both short-term and long-term. Roth IRAs also have the potential for substantial legacy advantages in that funds can be transferred to heirs tax-free and have a potential 10-year distribution period after the death of the primary account holder.

fghghg

Roth IRA Benefits

- Tax-free withdrawals– dollars contributed to Roth IRA accounts have been previously taxed and can be withdrawn from the Roth IRA account at any time without penalty (this is not the case for earnings generated within the IRA account.)

- Money grows tax-free– dollars contributed to Roth IRA accounts and earnings generated in the Roth IRA account both grow tax-free.

- There are no required minimum distribution (RMD) requirements– Roth accounts do not require RMDs for the original account holder.

- Legacy and estate planning benefits– Roth IRA account balances are normally transferred tax-free to heirs, and distributions are generally tax-free and can occur over 10 years.

- Enhanced tax planning– Roth IRA contributions are funded with after-tax dollars, and qualified distributions are tax-free. These benefits provide the potential for tax planning enhancements.

- Avoidance of Medicare surcharges– Qualified withdrawals from a Roth IRA account don’t count towards the modified adjusted gross income (MAGI) threshold, which determines Medicare surcharges. Qualified distributions can provide non-taxable income that will not increase MAGI.

- Roth IRA and future taxes– Roth IRA accounts can act as a hedge against future taxes, as taxes are paid in the year of the Roth contribution. Roth IRA accounts are protected from future taxes and any future tax increases.

- Paying taxes at a lower rate– Roth IRA contributions made by young workers are generally taxed at a lower rate because of the lower income of younger workers. This may mean that more dollars can be contributed to the Roth IRA at an early age with little or no tax consequences.

- Roth IRA and income– after-tax dollars can be contributed to a Roth IRA at any age as long as a person has earned income and meets contribution requirements.

ghhhg

jghjhhg

How are contributions and earnings distributed tax and penalty-free?

You can generally withdraw your earnings without owing any taxes or penalties if:

- You’re at least 59½ years old

- It’s been at least five years since you first contributed to any Roth IRA. This is called the five-year rule.

gfghfgf

hfgghfghf

Pros and Cons of Early Roth IRA Withdrawals

Pros

- Roth IRA contributions can be distributed tax-free.

- In some cases, Roth IRA earnings can be distributed tax-free without incurring early withdrawal penalties.

- Dollars contributed to a Roth IRA can be used as an emergency fund and distributed if needed tax-free.

- Roth IRA distributions can help to avoid taking out a regular commercial loan.

Cons

- Earnings withdrawn from a Roth IRA account early may incur both taxes and penalties.

- Qualified withdrawals of earnings will be taxed, but not penalized.

- Once dollars are withdrawn from a Roth IRA account, those dollars cannot be repaid.

- Money removed from a Roth IRA account misses out on all future earnings.

jthhht

My biggest concerns with Roth IRA withdrawals are not the potential tax implications, as dollars contributed to Roth IRAs can always be removed tax-free.

The two biggest concerns with Roth IRA withdrawals are once the money is removed from a Roth IRA account it cannot be repaid, and that dollars withdrawn from a Roth IRA account miss out on all future tax-free earnings.

The Roth IRA is one of the last tax-advantaged deals available for everyday workers. The Health Savings Account (HSA), which is triple tax-advantaged, and the Roth IRA, with tax-free growth of earnings, are the last types of accounts that offer tax-free growth.

It is also my opinion that the tax advantages of the Roth IRA will be minimized or lost in the future due to the US Government’s ever-increasing need for additional government income.

hhghhg

ghjjghjghjjgh

Roth Accounts and Compounding

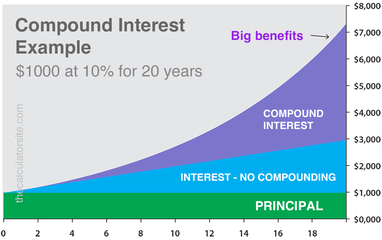

Once dollars are removed from a Roth IRA account, those dollars can never be replaced, and all future earnings from those dollars are lost! Compound interest is an amazing process. The problem with compound interest is that the effects of compounding are very hard to discern in the early compounding stages. Let’s look at a graph of compounding:

hjhghhg

jhghhhg

$1000 invested at 10% interest for 20 years will yield approximately $3000 without compounding (simple interest.) The same $1000 invested at 10% interest for 20 years with interest compounded will yield over $7000 (compound interest.) Compounding over 20 years more than doubles the terminal value of a $1000 investment.

It’s also important to note on the graph the effects of compounding are very minimal initially, but the effect of compounding multiplies over time (exponential growth versus linear growth.) For more information on compounding see: COMPOUNDING MAGIC: HARNESSING THE EIGHTH WONDER IN YOUR FINANCES.

Stated differently, each $1000 withdrawn from a Roth IRA account will cost the account holder approximately $7000 in terminal value in 20 years.

Using the same example, $10,000 removed from a Roth IRA account by a 30 year old account holder will result in a loss of $70,000 in terminal value at age 50. The same $10,000 removed from a Roth IRA at age 30, after 40 years of compounding at 10%, would result in a loss of approximately $520,000 at age 70.

It’s easy to miss the significance of the removal of $10,000 from a Roth IRA at age 30, especially if the account holder feels the money is needed elsewhere. But, that same $10,000 has an opportunity cost of $520,000 if not left in the Roth IRA to compound for 40 years (See: FUTURES IN FOCUS: OPPORTUNITY COST AND TIME VALUE IN RETIREMENT PLANNING.)

ffjhghgh

The hard part about answering many questions concerning finance is that the future result of present decisions is not felt and seen for many years. It’s easy to make a decision that resolves a current problem, without truly understanding the long-term impact of that present decision. There are limited cases where a distribution from a Roth IRA is necessary to resolve an emergency. In my estimation, those instances are very limited. My answer to the question of removing funds from an IRA, either Traditional or Roth, is normally “NO!”

I have personally seen the results of removing retirement funds early to pay for current obligations. In almost every case, the individual or couple reaches Retirement with a very constricted financial situation. I know cases where couples have to live on Social Security benefits solely. It’s tragic, especially knowing their initial financial situation and the value of possible Retirement funds versus knowing the result of removing retirement funds early in their working career and the resulting precarious financial position in retirement.

I answered the listener’s question about Roth IRA withdrawals by listing the short-term and long-term disadvantages of removing funds that can grow and compound tax-free for many years.

gjhhghg

jghhhg

Final Thoughts

- Roth accounts hold about 10% of dollars invested in Traditional IRAs.

- There are multiple benefits to holding a Roth IRA account. Nine benefits of Roth IRA accounts were listed in this post.

- One of the advantages of Roth IRA accounts is that contributions are made with after-tax dollars, and can be distributed at any point without tax or penalty.

- One of the biggest disadvantages of removing money from an IRA is that those dollars miss out on all future compounding in a tax-free environment.

- The effects of compounding are less obvious during the early periods of compounding. The effects of compounding become more pronounced over longer periods.

ghhghghg

ghhghghg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS