jgjyyvchgv

I recently reviewed the original blog titled CRAFTING A STRATEGIC INVESTMENT ROADMAP, and realized that the material was comprehensive, but also complex. I’ve said before that I am a visual learner, but this blog seemed to lack simplicity.

All of the information presented was thoroughly researched, well-prepared, and organized. But, as I was reading the material I felt that it was not readily understandable. As I read through the blog I felt I had not fulfilled one of the principles of the Retiring With Enough website, which is to clarify and simplify complex financial concepts.

Many of the principles of investing are complex and are made more confusing by the fact that these basic principles need to be modified to fit into individual investment plans for maximum efficiency and performance.

So, I am going to try again!

In speaking with people over the years I realized that there are two parts to the investment roadmap equation. The first part revolves around, trying to understand how much, and how to best save for retirement. The second part revolves around where to place those investment dollars, and how to put them to best use.

The simplified version of crafting a strategic Investment roadmap utilizes only two principles:

- **Spend less than you make**

- **Invest the difference in long-term investment vehicles**

fhjhhfhfh

It can’t get much simpler than this! But, simple doesn’t always mean easy! Even though they are simple, it doesn’t mean that these two principles are easy to apply!

fhhfg

**Spend Less Than You Make**

I think this is a pretty simple concept to understand.

If you earn $10, then you must spend less than $10. The problem is not one of understanding the principle but is more of a problem of implementation. How is this best accomplished, and will it really lead to financial independence?

For the vast majority of salaried workers, the paycheck that each worker receives is usually net of anticipated taxes. By that, I mean that usually Social Security, Medicare, and anticipated Income Tax amounts are withdrawn prior to issuing paychecks to employees. The dollars received can be used for discretionary spending on items such as food, clothing, healthcare, education, etc. (A person’s gross salary may be $36,000 per year, but the monthly amount received will be less than $3000 per month because of the removal of applicable taxes and surcharges.)

But, this also means that each employee has a much clearer picture of how many dollars are available to spend each month. This amount represents your net monthly income, or net spendable income.

According to principal number one, you must spend less than the amount you receive each month to have dollars to save. By spending less than the total earned income, these extra dollars become available to invest for future investment income generation.

What Percentage to Save

The next question is how much, or what percentage of available dollars should you save each month. This is a personal choice, but the percentage of income saved is important and has a huge impact on the time needed to create necessary retirement savings.

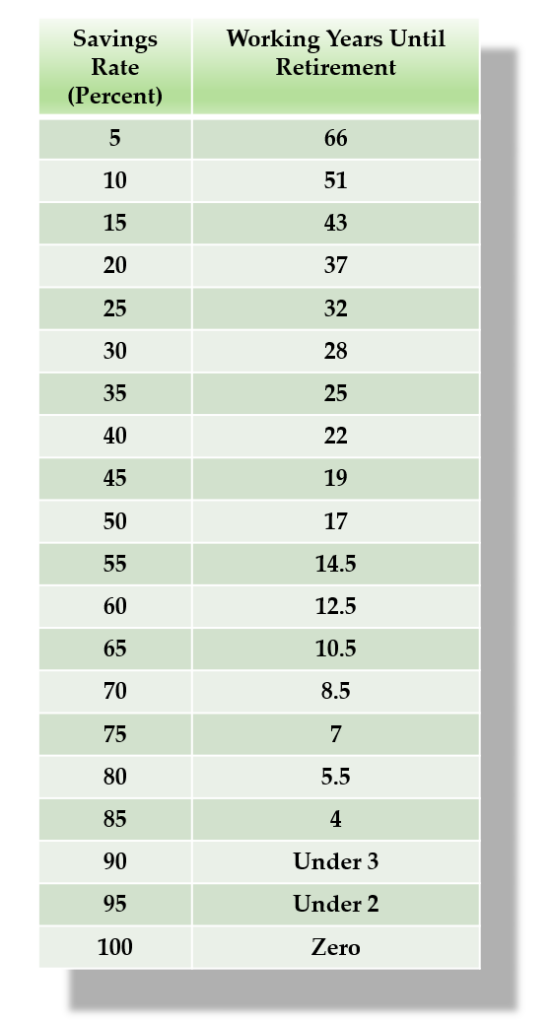

The larger the percentage of income saved each month, the shorter the period until someone can replace earned income with income derived from investments. I am re-posting a chart from Mr. Money Mustache that I feel is very simple and easy to understand:

First, each person must understand that if you don’t save any of your spendable income, then you will never build retirement savings or generate retirement income. You will never be able to retire! With no retirement income, being generated from savings, you will have to continue working to generate earned income to live on for the rest of your life.

Saving 5% of discretionary income means that someone will have to work approximately 66 years to generate enough retirement income to replace earned income.

If someone moves up the savings ladder and saves 20% of his income versus 5% of the income that decreases the time needed to replace earned income with investment income from a period of 66 years to 37 years.

If someone moves further up the savings ladder and saves 40% of disposable income, the time needed to replace, earned income with investment income decreases to 22 years.

If someone is willing to save 65% of their income then they would be in a position to retire in approximately 10 1/2 years.

How to Save

One of the best and most effective techniques for long-term savings programs is to automate the investment process. It has been shown that automatic enrollment and automatic investing increase participation. (Plan participation for T. Rowe Price‑recordkept plans that have adopted auto-enrollment is 85% compared with just 39% for those who had not implemented it.)

Money automatically deducted from discretionary income periodically is consistently and painlessly invested. People are less likely to be tempted to spend money they don’t see and is that automatically removed before monthly discretionary spending.

Virtually all retirement plan accounts and brokerage accounts can be directed by the account holder to automatically withdraw money from a personal account periodically. This withdrawal can occur weekly, monthly, bi-monthly, quarterly, annually, or at any other time frame the account holder dictates.

There are myriad ways to invest using money from a personal checking account. Using automatic, periodic drafts is one of the simplest and easiest ways to save for retirement.

hfhhfhhgf

**Invest the Difference in Long-Term Investment Vehicles **

jjghjghhng

All of the subject matter discussed in the previous blog is correct and relevant. If someone is engaging a certified financial planner, a comprehensive investment plan is an integral part of the retirement planning process.

The problem for a novice, or do-it-yourself investor is that this same material is very comprehensive and can be confusing to the uninitiated investor.

So, just like with principal one, I am going to give a very simple and easy solution. For someone who is not well-versed in stock investing, the best investment may be a Target Date Fund. A Target Date Fund combines all of the beneficial aspects of comprehensive portfolio composition in one fund. The fund starts more aggressively for young investors who have a long timeline and becomes more conservative as the investor approaches retirement. The investor picks the fund that corresponds most closely with their target (anticipated) date for retirement.

The fund manager gradually reduces stock exposure over time which also decreases market risk over time. The fund is designed to become safer and more conservative as the investor approaches retirement.

Most Target Date Funds are a fund of funds, comprise of several different types of stock or bond mutual funds. With one fund the investor receives management, portfolio diversification, and risk management.

Is the Target Date Fund as beneficial as a self-directed diversified portfolio or a professionally managed portfolio? There is normally some slight additional drag that comes from the higher management fees associated with Target Date Funds. But, returns for Target Date Funds are very competitive. Ease of use and the efficiency of one fund goes a long way to balance any discrepancies.

fhhhht

So, there you have it!

hgdhgdfhffghghf

Two very easy principles get you down the path toward retirement most easily and simply.

Is this the best and most cost-effective method?

The correct answer is that it is dependent on each person.

The investment plan described above would be best for someone who desires to create and manage their retirement plan while spending the least amount of time managing that plan.

Someone seeking the highest return, or someone seeking the greatest amount of flexibility in their plan would not be happy with a Target Date Fund.

Anyone seeking variability in funding their retirement plan, or the ability to deposit larger amounts under certain conditions may not be happy with periodic automatic drafting of specific amounts.

Investors seeking the lowest cost plan may not care for the slightly higher fees of Target Date Funds, or possibly would rather use ETF (Exchange Traded Funds) which also provide a lower cost profile.

So, even the easiest and simplest Investment Plan still has some degree of complexity. There will always be choices and options that are investor dependent.

The function of this addendum was to clarify and simplify what I felt was the more comprehensive, and possibly confusing, Investment Plan style I presented in the previous blog. Even though the previous Investment Plan follows the format used by financial planning professionals, it may be more complex than necessary for many individual investors.

gjjhghgh

Final Thoughts

gjjgjjgjg

- An Investment Plan is an integral part of Financial Planning.

- Investment Plans have the potential to be as simple or comprehensive as each person desires.

- The Investment Plan presented above is one of the simplest to fund and easiest to manage.

- Individuals who are not comfortable creating and managing their plans have the option to work with a certified financial planner to create the best plan for their individual needs.

- Complexity, costs, and returns will vary among plans depending on the type of plan chosen, the amount of risk taken, and the investing horizon.

fjhhjhghg

If you’d like to be a part of a free online retirement community, join us on Facebook:

COMMENTS